3289Views 0Comments

How Saab is looking to thrive in the global ISR market

18 February 2016

By Bilal Khan

The Swedish defence vendor Saab recently announced that its aerial surveillance systems, the GlobalEye and Swordfish, are now available as complete off-the-shelf solutions. The GlobalEye is an airborne early warning and control (AEW&C) system based on the proven Erieye, and the Swordfish is a maritime patrol aircraft (MPA) solution. The GlobalEye AEW&C and Swordfish MPA are being offered with the Global 6000 executive jet, which is produced by the Canadian aircraft manufacturer Bombardier.

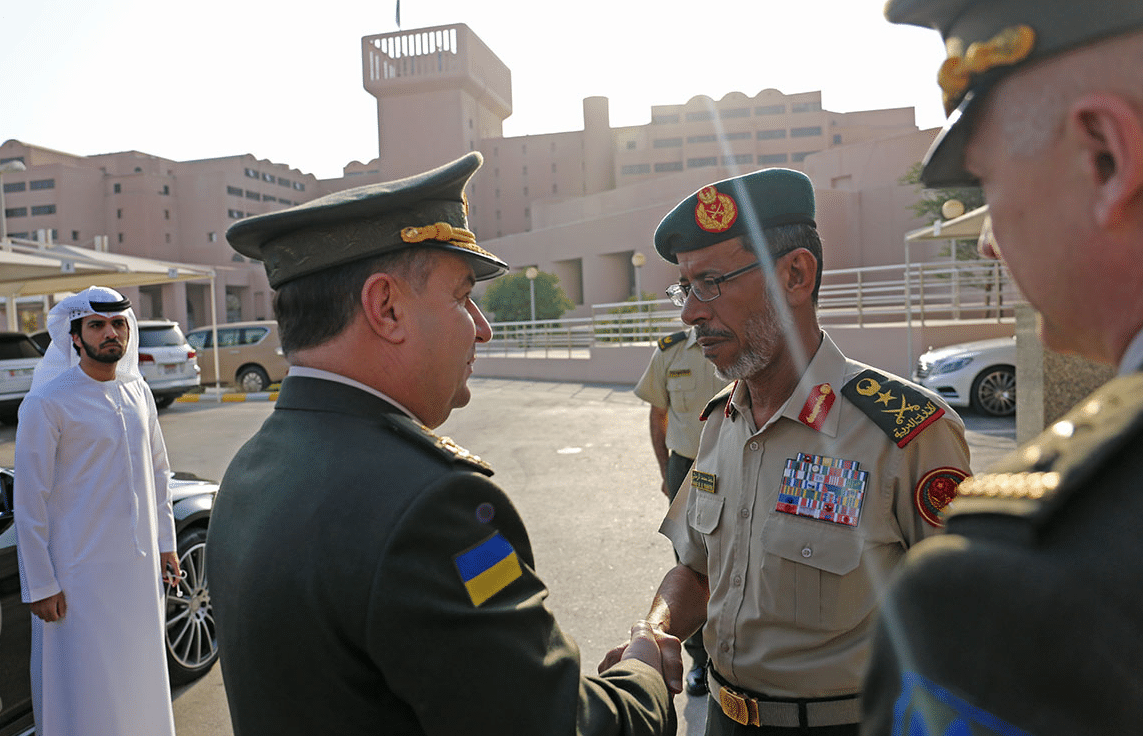

Saab’s announcements are interesting on multiple levels. First, the GlobalEye and Swordfish are being marketed as highly versatile and capable platforms. Second, Saab’s partnership with Bombardier has enabled both vendors to enter the global ISR [intelligence, surveillance, and reconnaissance] space with a set of cohesive and relatively cost-sensitive solutions. Third, Saab’s existing user base of armed forces clients, such as the United Arab Emirates, gives it a comfortable point-of-entry in terms of the market.

The GlobalEye AEW&C uses the Erieye Extended Range (ER) radar, which is billed by Saab as a new-generation active electronically-scanned array (AESA) radar built upon the company’s gallium nitride (GaN) technology. Aviation Week has an excellent overview of the technology and its applications, but the short of it is that GaN-based TRMs [transmit/receive modules] help the Erieye ER detect targets with very small RCS [radar cross-section] signatures, such as stealth fighters and unmanned aerial vehicles.

The end-user also has the option to equip the GlobalEye with a ground-facing X-band radar, which enables the GlobalEye to track moving targets on the ground as well as acquire an image of the area using a synthetic aperture radar (SAR). In a sense, the GlobalEye could serve as a JSTARS-like platform. This is an important addition in that it enables the GlobalEye to support ground operations. This scalability could position the GlobalEye as a value-added solution in the eyes of cost-sensitive countries.

While new-built GlobalEye systems could be acquired using Bombardier’s Global 6000 jet, which offers an endurance time of over 11 hours, existing customers can opt to upgrade their Saab 340 or Saab 2000-based systems to the GlobalEye standard. In November 2015, the UAE signed a $1.27 billion U.S. deal to acquire two new GlobalEye systems as well as upgrade its existing Saab-340-based Erieye AEW&C to the standard. In other words, the GlobalEye could easily be marketed by Saab as a ‘mid-life update’ to existing Erieye users, such as Pakistan. In any case, the approximate $300 million U.S. unit cost of a complete GlobalEye system is expensive, but for prospective users seeking dual-AEW&C/JSTARS-like capabilities as well as the latest radar technology, there may be enough value in justifying the cost.

The Swordfish MPA is a very interesting system. Before looking at the Swordfish specifically, it is worth noting that the space for next-generation MPAs has not seen significant movement. Yes, the Boeing P-8 Poseidon is leading the space, but while that platform is very advanced and highly capable, it is also a very expensive system. With the Swordfish, Saab has the opportunity to corner the potentially large of market of cost-sensitive buyers looking to gradually replace ageing platforms, such as the P-3 Orion, without compromising on key maritime mission requirements.

The Global 6000-based Swordfish MPA will be equipped with a 360° AESA multi-mode radar, electro-optical and infrared (EO/IR) sensors, as well as four weapon hard-points, which could be used for anti-ship missiles (AShM) and anti-submarine warfare (ASW) torpedoes. It is clear that the Swordfish is a fully-equipped maritime platform capable of combat as well as standard ISR roles. Granted, the Swordfish cannot carry as much payload as the P-3C, but unlike the Orion’s direct successor (the Poseidon), the Swordfish is more affordable.

Although Bombardier is the default platform provider of each of Saab’s solutions, it would be interesting to see if Saab would offer the GlobalEye and Swordfish suites on other aircraft. For example, a navy might look for an MPA that is more directly comparable to the P-8 Poseidon, and as a result, it may be interested in the Airbus A320. Could Saab scale the Swordfish to a larger platform? Would Airbus be willing to work with Saab in offering a P-8 Poseidon-class solution? Alternatively, in light of Saab’s growing partnership with the Brazilian armed forces, could Embraer be an alternative platform provider for Saab’s ISR solutions?

Saab already has a lineup of existing customers using its Erieye AEW&C, it would be natural to expect the company to follow-up with those countries in regards to these new systems. However, to Saab’s credit, the GlobalEye and Swordfish are markedly differentiated solutions from what is currently on offer, especially to cost-sensitive countries. With this in mind, it would not be surprising to see Saab expand its customer base.