The MBDA Common Anti-Air Modular Missile (CAMM) program, also designated as the “Sea Ceptor”, was put in the development pipeline in January 2012 under a U.K. Ministry of Defence contract worth £483 million GBP to MBDA. Under the Future Local Area Air Defence System (FLAADS) program, the aim of the CAMM was to provide a new-generation successor to the ageing Sea Wolf SAM system, which was introduced in the late 1970s and through the 1980s.

In September 2013, MBDA had successfully conducted the CAMM’s first launch test. In October 2013, New Zealand selected the CAMM for use on its two ANZAC frigates. The contract was signed in May 2014. Towards the end of 2014 in November, Brazil announced that it would adopt the CAMM for use onboard its next-generation Tamandare light frigates, the first of which is expected to be delivered in 2019. The CAMM is expected to enter British service in 2016.

From a conceptual standpoint, the MBDA CAMM is a versatile system. While it boasts a naval client base, the CAMM can be configured for use from land. The CAMM missile is deployed through vertical-launch system (VLS) cells, and it is compatible with the widely adopted Lockheed Martin Mk.41 VLS system. It can also be deployed using the European SYLVER VLS platform, which is seeing increased naval adoption.

Technology wise, the CAMM utilizes an active radar-homing (ARH) seeker. This is in contrast to many of today’s semi-active radar-homing (SARH) SAM systems, which depend on surface-based radars to ‘paint’ or ‘illuminate’ targets for the missile to follow. Instead, the surface-based radar can provide a location point for the CAMM’s inertial navigation system (INS) to reach, and in the terminal stage – i.e. the point at which the CAMM is triggered to actively engage its target – the ARH seeker will take over the guidance role. This frees the surface radar from further guidance work, i.e. providing it a “fire-and-forget” capability.

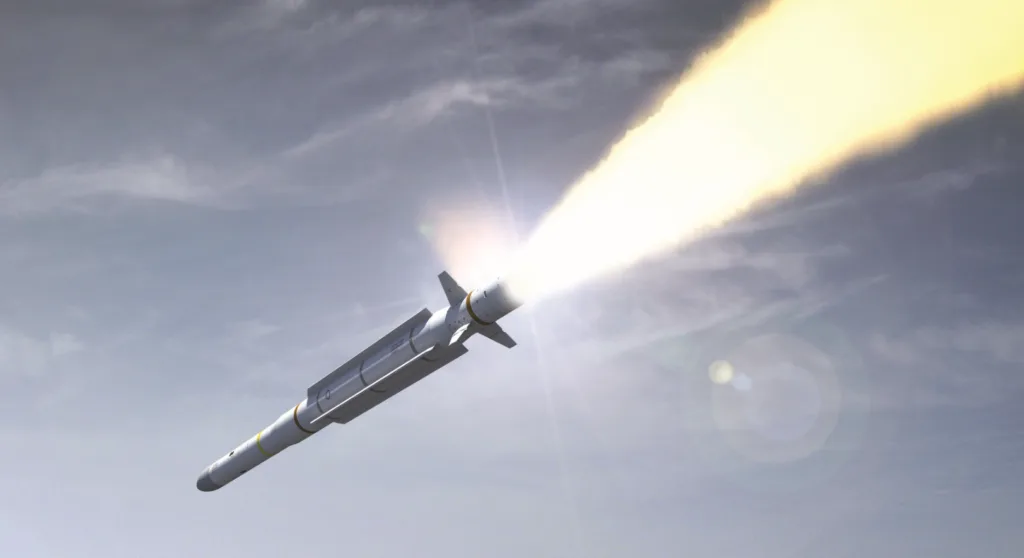

According to MBDA, the CAMM has a range of more than 25 km. The CAMM weighs 99 kg, has a length of 3.2 m, a diameter of 166 mm, and flies at supersonic speed. MBDA is positioning the CAMM’s ARH seeker and compact design as ideal characteristics for fulfilling air defence requirements on small warships such as corvettes and light frigates. In fact, the ARH seeker negates the need for a target-illumination radar, a usually costly addition in monetary terms and space.

The CAMM is also deployable in quad-packed formats (provided a compatible VLS solution is available to the end user). In other words, a small surface combatant could potentially carry at least 32 active CAMM units. This is significant considering that most surface warships capable of boasting such anti-air warfare (AAW) capacity are (today) 3,000+ ton ships, usually larger. MBDA is also touting the CAMM’s “low procurement and through-life costs” as competitive. The 45 km+ CAMM Extended Range (i.e. CAMM-ER) is also in the development pipeline.

The MBDA CAMM is a part of an emerging generation of SAM systems which utilize ARH seekers as well as compact airframes. The latter is achieved through advances in dual pulse solid fuel rocket motors. The CAMM can count its sibling MBDA product the Aster-15, Israeli-Indian Barak-8 and – currently under-development – South African Umkhonto-EIR and Turkish HİSAR-O as its contemporaries. Of course, unlike the latter two, the MBDA CAMM is on the verge of entering service, and in turn, can be marketed as an existing solution. The CAMM is competing with the MBDA Aster-15, which had recently added Qatar to its growing portfolio of end-users.

The MBDA Aster-15 and Rafael/Bharat Dynamics Barak-8 benefit from existing sensor packages. In other words, the likes of Thales and Leonardo and Elta are present to pair their radar and combat management solutions with the Aster-15 and Barak-8, respectively. These attributes enable these effective SAM solutions to be deployable onboard small surface combatants, potentially even fast attack crafts. In effect, navies could potentially begin deploying credible multi-mission solutions at a lower procurement and operational cost.

It is likely that MBDA U.K. (and MBDA Italy in the case of the CAMM-ER) will work with sensor vendors to pair the CAMM, so as to offer complete solutions to respective customers. One can expect Leonardo to play a central part; it is an Italian vendor and its radar work is largely conducted by its Selex ES division in the United Kingdom.