2184Views 0Comments

Can Offsets Work in Pakistan? (Quwa Premium Sample) Quwa Premium

Report Summary

This Quwa Premium report (now a freely accessible resource) examines the viability of commercial offsets (tied to big-ticket defence purchases) in Pakistan. In this report, we briefly review the checkered history of offset packages, especially in the developing world. However, in contrast to many economic discussions of offsets – which assessed viability of such deals against the buyer and seller’s claims of development and savings – we benchmark offsets against resource optimization.

Unlike many countries, Pakistan’s defence or security establishment seldom requires public approval (in the mainstream democratic sense) to push defence purchases, but rather, they are constrained by fiscal resources. In effect, the discussion of offsets would, at least partly, revolve on the subject of return-on-investment (ROI) in that the results of offsets – such as new manufacturing entities, supply-chain contracts, foreign direct investment (FDI) or partnerships – must, ideally, reverse those constraints.

In other words, the purported economic benefits of offsets would have to be realized in order to fulfill the Armed Forces of Pakistan’s own strategic objectives, i.e. to secure long-term funding mechanisms to support ongoing and future big-ticket procurement.

Introduction

In its simplest sense, an “offset” is a counterweight. In defence procurement, an ‘offset’ serves to counter the expenditure of fiscal resources by the buyer with fiscal resources from the seller. For example, a fighter aircraft deal could be priced at $10 billion US. Under an offset package of 50% the contract price, the seller of that fighter aircraft would in some form return $5 billion US to the buyer’s economy. This return could take the form of investment in the buyer’s economy, countertrade or bartering by buying goods from the buyer or the buyer’s marketplace or a mix of the aforementioned methods.

In defence procurement, there are two forms of offsets: direct offsets and indirect offsets. Direct offsets involve the inputs necessary to bring a defence contract to fruition. For example, under an offset package, the seller could subcontract 10% of the value of the deal to suppliers in the buying country. Indirect offsets are transfers unrelated to the original contract: for example, the seller could invest in a kitchen appliance manufacturer in the customer’s market. Indirect offsets need not be outside of the defence industry. For example, the seller could connect a defence manufacturer in the customer’s market to produce parts for a defence system that the customer did not procure. This would be a form of countertrade.

Offsets are a recurring topic, especially in relation to the defence procurement dynamics of developing or low-income states where there are both fiscal constraints and macro-economic pressures. On the surface, offsets promise to manage – if not improve – macro-economic pressures by enabling the customer-state to control its balance-of-payments (BoP) by countering costly arms imports with exports and FDI resulting or borne from the arms contract. For Pakistan, offsets could be viewed as a means to remediate its macro-economic challenges while also procuring new armaments. In this sense, Pakistan could optimize its fiscal resources to multiple objectives – i.e. procurement, productive macro-economic activity and potentially transfer-of-technology (ToT) – through commercial offsets integrated to its arms imports.

The Challenge with Assessing Offsets

Though the backers of offsets – generally the governments buying arms and their suppliers – purport the value of offsets in retaining foreign or hard-currency for BoP, facilitating ToT, supporting exports by linking domestic industries to foreign supply chains and other means of productive economic activity. However, offsets are a contentious issue, especially from the standpoint of the purported benefits. In general, those skeptical of offsets – notably economists – cite the inherently costly, inefficient and opaque nature of the national security space as cause for doubting the utility of offsets, at least as a rule.

The inefficiency of the defence industry stems from the fact that countries maintain parallel platforms for each of their applications. For example, the US, Russia, France, China and Western Europe each maintain their own engine development and manufacturing programs. The national security reasons are rational as each (capable) country has no intention of being reliant on outsiders for critical systems. However, these are parallel and – economically speaking – redundant efforts. Those countries that are not effective at engines (e.g. China) are burning resources they could otherwise use to excel in areas they are best at, such as aerostructure manufacturing, electronics or munitions. The result are products (from all countries) that are overlapping and non-optimal designs (i.e. best possible performance at lowest possible cost).

However, a defence policymaker will not subordinate national security needs to economic efficiency. Yes, those economic efficiencies that can fit within national security boundaries could work. For example, the UK, Germany, Spain and Italy decided to pool their respective resources towards common systems, such as the Eurofighter Typhoon. Granted, to what extent this was an economically efficient exercise (wherein each partner took on tasks it was best equipped to undertake) is unclear. Nonetheless, the main point for consideration is that defence as a whole is not economically cost-effective; in fact, some economists will simply view defence as a waste of resources if not for its national security necessity.

Pakistan Makes Progress on its Next Generation Fighter Program (Project Azm) | Read Now

This consideration is important because if defence as a whole is economically inefficient, then how could one expect additional contracts (built on that basis) to be macro-economically prudent for others? While the stated goals of the offsets could, in theory at least, be achieved, the buyer is buying a non-optimal system that is neither ‘the best’ in performance nor the most cost-effective in the absolute sense. Instead, the economic consequence is like that of selecting the ‘least worst’ of available options.

Besides the inherent inefficiency of defence, commercial defence transactions are opaque, particularly in developing countries such as Pakistan. As a result, observers will seldom know of every fact contributing to the final outcome of the deal. In turn, observers cannot make concrete judgments about the facts, such as the actual cost of the goods involved versus the stated price (which could be inflated), and other potential factors (such as corruption). It is also unclear if the ones benefitting from offsets were selected based on performance or other reasons, such as political connections. Finally, there are also cases of where offsets have failed to even achieve their stated aims, notably in South Africa and Saudi Arabia.

How are Offsets Relevant to Pakistan?

Though it has not figured prominently, Pakistan has an official offset policy wherein contracts valued over $15 million US must involve offsets of 30% the contract price.[1]

Today, principally justifying defence expenditure is not a challenge for Pakistan’s defence establishment. Be it a national acceptance of the military as the most credible Pakistani institution or its preeminent role in defining national security imperatives, there is no need to argue a macro-economic case in Pakistan. This would only occur if defence procurement comes under external scrutiny and is threatened, either from within the armed forces or from a strong political government. Rather, we are shifting the focus from justifying the economic value of offsets to determining if the offsets contribute to the armed forces’ resource-optimization efforts – i.e. the adage of ‘getting the biggest bang for the buck’.

For Pakistan, resource constraints are its main roadblock to sustainable defence procurement, especially of big-ticket weapon systems. Thus, the question of offsets would revolve on whether the purported gains of offsets enable Pakistan to extract savings and support its macro-economic productivity. The latter can contribute to Pakistan’s fiscal exchequer and, in turn, sustain national security interests directly through future purchases and indirectly by alleviating debt and contributing to other sectors (e.g. education). Thus, the resource optimization question requires offsets to demonstrate national security value.

Through the defence-centric resource optimization framework, one would assess the viability of an offset-based import against alternatives fulfilling the original requirement. These alternatives could include the domestic development of a solution, co-development of a solution, importing from another party – with or without offsets – or altering the requirement itself and trying to solve the problem through a different means. This is a difficult study to undertake without a tangible and real-world example. Thus, we selected the Pakistan Army’s program for new attack helicopters as our case-study.

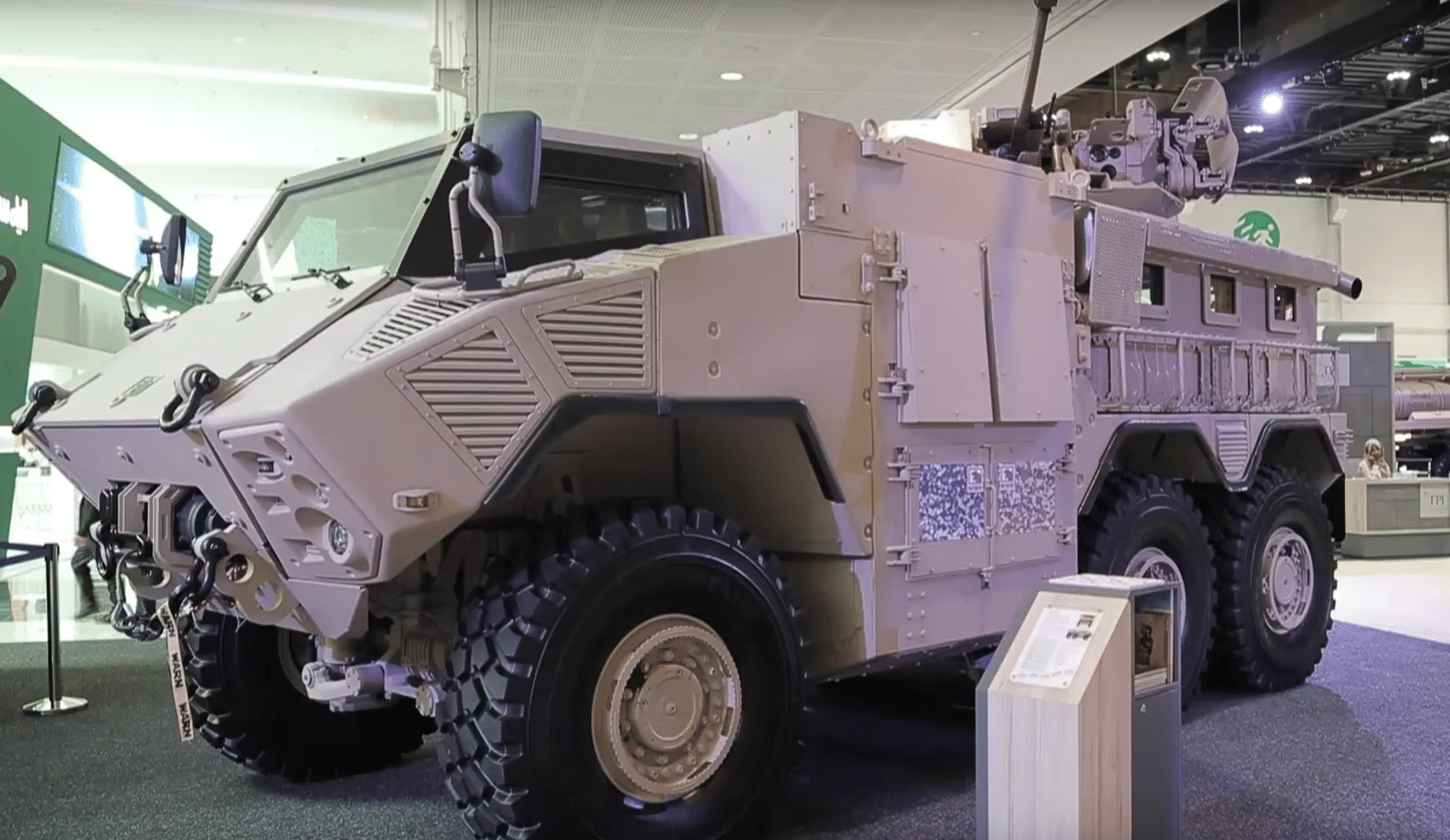

Review: The ‘Plus-One’ Attack Helicopter Program

The Pakistan Army Aviation Corps’ (PAA) ‘plus-one’ attack helicopter program – which is to complement the PAA’s forthcoming Bell Helicopter AH-1Z Viper – is slated to be its most prominent single purchase to-date, at least in the past 30 years. Today, the Turkish Aerospace Industries (TAI) T129 ATAK appears to be the winner with 30 helicopters valued at $1.5 billion US. Pakistan is to ink the T129 contract in 2018 ahead of the 2018 Farnborough Air Show.[2] It is unclear if offsets actually figure in this contract, but depending on how one views the matter, they can come to either conclusion (offset or no offset).

Updates on Pakistan’s T129 ATAK Program, Straight From Turkish Aerospace | Read Now

Pakistan is not known for emphasizing offsets in its procurement. Rather, its ‘ask’ generally involves ToT in the form of local licensed production and/or depot-level maintenance, repair and overhaul (MRO). Both segments are integrated into the price and supplied to Pakistan, though the extent of ToT (be it partial or a full turnkey solution) varies from program-to-program. However, direct and indirect offsets are typically not factors, though they have occurred outside of defence. For example, Pakistan International Airlines’ purchase of Boeing 777 airliners accompanied an offset involving Pakistan Aeronautical Complex (PAC) as a parts supplier to Boeing until August 2010.[3] In terms of the T129, TAI had offered parts manufacturing work to PAC should the PAA select the T129 for its plus-one requirement.

Of Pakistan’s recent big-ticket procurements, the T129 is arguably the best positioned to facilitate offsets. First, the selling party – i.e. Turkey – is itself experienced in receiving and issuing offsets. Thus, there is a measure of experience at play that can offer a competent offset package. Pakistan’s offset policy requires a minimum 30% in offsets, which would equate to $450 million US in Turkish expenditure in the Pakistani economy. If a direct offset, it would be in relation to the T129 program itself. For example, TAI could sub-contract Pakistani suppliers to help implement the program: this could see TAI award production and/or services contract to a private sector firm for electronics and optronics. Alternatively, TAI could promise to buy $450 million in production work from PAC in the form of spare parts or subassemblies.

In either scenario, ToT aimed at capacity building in Pakistan – be it PAC or the private sector – is required. If TAI (or Aselsan and Havelsan) were to engage the private sector, that ToT would likely need to come by way of investment. For example, a jointly-owned subsidiary for undertaking the production of optronics for the T129 in Pakistan as well as potentially Turkey and third-party customers. In terms of PAC, it could involve Pakistan buying the necessary ToT from TAI and TAI returning with purchases from the plant. An indirect offset would see TAI purchasing non-related goods from Pakistan, be it from the defence industry or textiles, pharmaceuticals, vehicles or other industries. It could also engage in FDI in those areas.

A Spectrum of Results

One challenge with measuring the value of offsets is that the outcomes vary. In fact, in many major cases the stated goals of the offset programs did not come to fruition. Thus, a proper examination of offsets in those cases is not fully tenable; rather, the study must return to other issues related to defence contracts, such as corruption and lack of transparency. For example, in the 1980s Saudi Arabia was promised 75,000 new jobs as part of its offset programs with Boeing, BAE and other US and European suppliers. However, by 1996 those offsets had only created 2,000 jobs.[4] Likewise, the stated job creation goals of South Africa’s offset programs – 15,000 and 60,000 direct and indirect work, respectively – did not materialize.[5]

Even if stated offsets do materialize (such as job creation and supply purchases), the aspirations – such as industry development – are not guaranteed. For example, TAI could simply ask PAC to manufacture simple parts that do not add to the cumulative technology and human capital base in Pakistan. Rather, one could enter a situation similar to the PIA-Boeing deal wherein once the offset commitment is completed, PAC is unable to continue with follow-on exports to Boeing (or Airbus) outside of an aircraft purchase. Thus, an offset might have achieved its stated outcome (e.g. a 30% return on the contract price), but it had failed to achieve the macro-economic aspiration of boosting long-term high-tech exports.

A Look into Why Pakistan’s Defence Industry isn’t Working to its Potential | Read Now

In this spectrum, one can argue that Saudi Arabia has largely failed to accrue the macro-economic benefits of offsets (which are untied to or beyond the original contract). South Africa has had more success in this respect thanks to the fact that it had already possessed an adept technology base that was attractive to the German, Swedish and British suppliers it had bought hardware from in 1999.[6] However, Germany and Turkey can appear to claim complete success in using offsets to propel their respective industries as well as their respective macro-economic aspirations, especially in terms of generating high-tech exports.

In 1986, Turkey ordered 160 F-16C/Ds from General Dynamics (later Lockheed Martin) with an offset deal that involved final assembly and (later) subassemblies manufacturing in Turkey.[7] Offsets – combined with consistent and regular domestic orders – enabled TAI to grow into a robust aviation supplier. Today, TAI is at the cusp of securing its single-largest export order to-date with Pakistan. Granted, it will take several decades of sustained exports to amortize for the total cost of nurturing TAI in the first place, but it seems that TAI is on the correct trajectory to accrue those gains through the long-term.

Germany is considered a fully-realized example of defence offsets succeeding in both building Germany’s defence industry and enabling it to achieve its macro-economic accomplishments.[8] In fact, the German case is particularly interesting because following the Second World War, the German re-armament process essentially involved rebuilding the country’s defence industry in its entirety. Yes, there was strong human capital already in place, but the industrial and technological growth achieved since the 1950s had drawn significantly from defence imports (especially from the US) tied with offsets and ToT.[9]

However, Germany’s apparent success was contingent in the following key factors:

First, Germany’s offset requirements obliged foreign original equipment manufacturers (OEM) to work through a German partner in order to bid and fulfill a German military requirement.[10] This spurred a combination of ToT and jointly-owned subsidiaries (between foreign and German OEMs). A similar strategy is taking-place in India through New Delhi’s ‘Make in India’ and ‘Strategic Partnership’ programs.

Second, Germany avoided narrowing the ToT and offset work (particularly the indirect offset work) to only defence; instead, it drove activity in dual-use (i.e. and defence and civilian) solutions.[11] For example, its activities in armoured vehicles manufacturing were connected to its automobile industry. The idea was to leverage the economic and development activity in defence to the benefit of the efficient civilian sector.[12] In effect, Germany amortized its ToT costs relatively earlier thanks to the civilian sector, which was much larger in terms of scale, more efficient and not encumbered by the same obstacles or restrictions.

Third, because Germany was integral to NATO’s strategic interests, the US was relatively amenable to the German government’s specific ToT and offset requirements.[13] Finally, Germany also leveraged sustained long-term human capital and infrastructure spending to evolve imported turnkey entities (such as licensed production of foreign designs) into next-generation domestic designs.[14]

In terms of the T129, an offset program must carefully be tuned to generate macro-economic gains in the civilian sector. Thus, the ToT and offset work would revolve on dual-use solutions. However, selecting the right development set is contingent on a coherent and overarching development policy to define exactly where Pakistan should aim to excel in terms of high-tech manufacturing and exports. There is also the lack of an industry-centric education program (designed to create human capital matching to industry needs).

Thus, the long-term macro-economic impact of a T129 offset is likely to be less robust. Yes, we began with the resource-optimization argument, but it need not be confined to immediate gains and losses. If offsets could yield 20 years of sustained and growing high-tech exports, the gains (e.g. public-sector exports and corporate tax on private sector revenue) would return to the exchequer. The resource-optimization effort would have to be more ‘immediate’ by leveraging the industry players and capabilities already present.

Selecting a ‘Winner’

Among the contentions surrounding offsets is how ‘winners’ are selected. In any offset package, the ones receiving contracts in the recipient’s market are going to be the market’s winners. For example, imagine Turkey buying goods from Pakistan, will it choose from agriculture, manufacturing or natural resources? How does it (or Pakistan) decide the winning industry and, in turn, the winning competitors?

Economically, one would want the efficient and truly competitive players to ‘win’, but seldom do offset benefits (in the developing world) result in such winners. Rather, offsets – along with the opaqueness of defence contracts as a whole – create the risk of undeserving winners. For example, the contract to supply T129 components or services could go to a Pakistani company connected to the Army’s leadership. In the case of indirect offsets, Turkish purchases could come from companies tied to certain families.

For Pakistan, mitigating this risk would mean concentrating the offsets to state-owned-enterprises (SOE) such as PAC (in fact, TAI had offered parts manufacturing work to PAC).[15] However, TAI’s offset expenditure would directly return to the exchequer through PAC (a SOE). Granted, capital inflow will not equal direct returns on spending, PAC’s return would be the profit from its activity with TAI (i.e. the cost of PAC manufacturing parts subtracted from the price agreed upon by PAC and TAI).

Narrowing the opportunity to PAC removes the private sector from accruing benefits from the T129. In addition, it also has the risk of narrowing the ToT to only defence solutions, which leaves no opportunity to leverage this expenditure for civilian applications. For example, a dual-use oriented ToT could examine buying a technology base for modern-day dynamic component (e.g. transmission) development which can contribute to domestic automobile, helicopter and other related initiatives.

A Look at How the Pakistan Navy is Pairing Eastern and Western Solutions | Read More

The private sector’s risks (e.g. selecting undeserving winners) notwithstanding, there are fewer potential opportunities for TAI, Aselsan, Havelsan and Roketsan. This is because of a relative lack of capacity for the inputs necessary to manufacture the T129’s aerostructures, electronics and munitions. In Pakistan, PAC – and SOEs in general – are best equipped to receive such work. Turkey would need to invest in Pakistan by bringing the necessary capabilities. This is not unprecedented, Aselsan had done so in Kazakhstan.[16]

But this will open the door to a stronger private sector footprint in Pakistan, one that will be contractually entitled to receiving some of the T129’s workshare. A jointly-owned subsidiary would tie Turkey to Pakistan in terms of ensuring the subsidiary’s long-term profitability. This could generate additional FDI and a growth in technical capacity in Pakistan, though it would need to occur for exports and not cannibalizing or eating-into the SOEs’ activities (such a result would merely shift the existing activity from the SOEs to the private sector, not expand the overall generation of economic activity).

Matching Price to Actual Cost

The issue of matching the price as closely to the cost is in relation to the actual contract. This is a concern because contracts including offsets are at-risk of incurring price mark-ups of 10-30% of the original price, much less the cost of the actual weapon system.[17] It is difficult to mitigate this risk because contractual talks generally occur without transparency and, at least in the developing world, with limited oversight. A mark-up could effectively neutralize the stated benefits of offsets wherein the net-cost of just importing the exact same good could have been less than procuring with offsets.

In February’s Monthly Report, Quwa had done a price analysis (using open source resources) of the PAA T129 contract. On the surface, the T129 is very close in unit-price to the AH-1Z – i.e. $50 m vs. $53.5 m. In order to build a deeper insight of the T129’s costs, we looked into the original Leonardo-Turkish contract.

In 2008, Turkey’s Undersecretariat for Defence Industries signed a $3.2 billion US deal with Leonardo for the A129 with complete transfer-of-technology of the helicopter with its intellectual property and the sole rights to market and sell the platform.[18] Currently, the Turkish T129 requirement sits at 51 helicopters – i.e. $62.7 million US per helicopter. However, this is the total cost. It appears that of the $3.2 billion, $1.2 billion is the sunk cost or overhead (for the ToT et. al).[19]

Thus, the marginal cost of manufacturing one T129 is $39.2 million. Thus, the breakdown for Turkey is $23.53 m (overhead/ToT) + $39.2 m (marginal cost) of each T129. If one accounts for the Pakistani order of 30 T129s, the marginal cost would be $1.18 billion. The remaining $320 million US could include some amortization of the overhead, munitions, ground-support equipment, training and ToT for depot-level MRO and parts manufacturing. The breakdown indicates that there has not been a significant price mark-up (if at all) with regards to the Pakistani contract. In fact, the constraint appears to be the high marginal cost of the T129. Interestingly, involving PAC in the supply-chain could potentially lower that cost (lower labour and currency costs) for the benefit of Turkey, Pakistan and third-party customers.

Getting Benefits to Cross Contract Price

Pakistan’s offset policy would require TAI to spend $500 million US in Pakistan. However, an optimal offset strategy would see the $1.5 billion US contract spur an equal – or greater – net-capital-inflow. This will be contingent on Turkey’s willingness to purchase from Pakistan as a result of the T129 program. Boeing only maintained a temporary offset package. Crossing the $1.5 billion figure would require a long-term offset commitment. PAC emerging as a lower-cost supplier of certain T129 components would be ideal, but this depends on the quality of the ToT PAC is securing and, ultimately, TAI’s willingness to continue buying.

Contributing to Macro-Economic Gains

Ultimately, the offset – and the T129 contract as a whole – should properly contribute to macro-economic activity, if not immediately, then as at least as a basis for another program. This point returns to Germany’s example of pursuing ToT with dual-use value. Unfortunately, Pakistan’s current procurement track seems limited to purely defence applications, which reduces opportunity for civilian industries – and exports – to emerge as a result of defence programs.

This can be corrected through the long-term through future programs, but a strategy that highlights Pakistan’s latent competitive advantages and steers expenditure to achieve them must be in place before selecting ToT. Furthermore, the source of this support is unlikely to come from the West; shared geo-political and security interests could make China the leading source of such ToT for Pakistan. It would be prudent to observe Pakistan’s growing space program, especially the establishment of the Pakistan Space Centre, to see if analogous efforts are being made in the country.

Conclusion

From a cost-optimization standpoint, the simplest way for offsets to help Pakistan would be to enable PAC and other SOEs to profit as a result of the original purchase. For example, if the T129 contract opens PAC et. al to export $1.5 billion US or more in goods and services to Turkey and other customers, and in turn, bring a return-on-investment to Pakistani exchequer, then there could be a case for success. However, a long-term strategy should seek to channel the expenditure to acquire domestic capacities for developing and producing dual-use technologies for macro-economic gains. Offsets can provide partial and near-term remediation of defence expenditure, but they can form a component among many for enabling states to substantively absorb the immense weight of national security.

With Quwa Premium, you will have access to all of our existing research and upcoming research, granting you a comprehensive understanding of Pakistani defence and security issues. Subscribe today!

[1] “Defence Offset Policy.” Directorate General Defence Purchase (DGDP) Pakistan. Accessed: 03 December 2017. URL: http://www.dgdp.gov.pk/documents/defoffsetpolicy.pdf

[2] Alan Warnes. “Pakistan on verge of ordering TAI T129 ATAK.” Mönch Verlagsgesellschaft mbH. 22 June 2017. URL: http://www.monch.com/mpg/news/air/1746-pakatak.html (Last Accessed: 21 December 2017).

[3] “Prime Minister opens Boeing parts facility at PAC”. Business Recorder. 28 February 2006. URL: http://fp.brecorder.com/2006/02/20060228392538/

[4] J.P Dunne and G. Lamb. “Defense Industrial Participation: The South African Experience”. Arms Trade and Economic Development: Theory, Policy, and Cases in Arms Trade Offsets. London. Routledge. 2004.

[5] Ibid.

[6] Ibid.

[7] Ibid.

[8] Jocelyn Mawdsley and Michael Brzoska. “Comparing British and German offset strategies”. Arms Trade and Economic Development: Theory, Policy, and Cases in Arms Trade Offsets. London. Routledge. 2004.

[9] Ibid.

[10] Ibid.

[11] Ibid.

[12] Ibid.

[13] Ibid.

[14] Ibid.

[15] Alan Warnes. 01 June 2017. Twitter. URL: https://twitter.com/warnesyworld/status/870358168710369281 (Last accessed: 21 January 2018).

[16] “Turkey’s Aselsan open defense plant in Kazakhstan”, Hurriyet Daily News. 11 December 2013. URL: http://www.hurriyetdailynews.com/turkeys-aselsan-open-defense-plant-in-kazakhstan-59359 (Last Accessed: 19 May 2018).

[17] Erling Alexander Tenvik. “A study of international trade in defence equipment with a special emphasis on the use and effects of offset arrangements”. Norwegian University of Life Sciences. School of Economics and Business. 2015. p2

[18] Burak Bekdil. “Turkey keen on attack helicopter program despite snags.” Hurriyet Daily News. 14 November 2013. URL: http://www.hurriyetdailynews.com/turkey-keen-on-attack-helicopter-program-despite-snags-57882 (Last Accessed: 21 January 2018).

[19] Alan Warnes. “TAI Exhibits Attack Helicopter and Anka UAV.” Aviation International News (AIN) Online. 13 July 2014. URL: https://www.ainonline.com/aviation-news/aerospace/2014-07-13/tai-exhibits-attack-helicopter-and-anka-uav (Last Accessed: 21 January 2018).