1815Views 0Comments

Monthly News Recap: November 2021 Quwa Premium

This week’s Quwa Premium article is a recap of some defence news items from around the world. Besides a basic overview of the news item, this article also offers short-form analysis of each topic.

Kazakhstan to Reportedly Buy 3 Anka UAVs

Turkish news outlet HaberTürk reported that Kazakhstan ordered three Anka unmanned aerial vehicles (UAV) from Turkish Aerospace Industries (TAI). If accurate, this would be TAI’s second Anka sale. The first was the sale of three Anka-S UAVs to Tunisia for $80 million U.S.

The TAI Anka is a medium-altitude, long-endurance (MALE) UAV. It has a maximum takeoff weight of 1,700 kg and offers a payload of 250 kg, which it can utilize for surveillance equipment and precision-guided air-to-surface munitions. TAI offers multiple variants of the Anka UAV, but the mainstay variant seems to be the Anka-S, a satellite-communications (SATCOM)-equipped system. The Anka-S can operate at beyond-line-of-sight (BLoS) ranges. Without SATCOM, the standard Anka-S can operate at a range of over 250 km.

Turkey’s drone industry is in the upswing. Certainly, its recent export successes have drawn attention. But it is worth noting that TAI, despite being the largest aerospace supplier in Turkey, is not the leading driver of drone sales. Turkey’s top drone exporter is Baykar, which manufacturers the Bayraktar TB2, a smaller UAV that garnered a positive reputation from its combat usage in the Middle East.

Though a private sector company, Baykar led Turkey’s entry in the global drone market and, in turn, made it one of the world’s top UAV suppliers. In key markets such as the Middle East and Africa, Turkey seems to be second-only to China, but in others, like Central Europe, Turkey is the top supplier.

That said, it seems that the Anka-series is poised to enter new markets. In August 2021, TAI had signed an agreement with Pakistan’s National Engineering and Science Commission (NESCOM) to both co-produce and continue co-develop the Anka. TAI could be sensing a sales opportunity in Pakistan.

Besides exports, Turkey’s drone development is advancing. Both Baykar and TAI are flying larger designs – i.e. Akıncı and Aksungur, respectively. Baykar is also developing a jet-powered unmanned combat aerial vehicle (UCAV) for carrier operations and loyal wingman applications, the MIUS.

Images Suggest Pakistan’s Type 054A/Ps Will Use CM-302s

New close-up images of the Pakistan Navy’s (PN) new Type 054A/P frigate, PNS Tughril, indicate that the new warships are coming equipped with the CM-302 supersonic anti-ship cruising missile (ASCM). It was evident that the Tughril-class was not configured with the standard 2×4 C-802 ASCM load-out, but it was not clear what type of missile the PN chosen (i.e. CM-302 or CM-401).

China has been marketing the CM-302 ASCM since at least 2016. Equipped with a ramjet engine, the CM-302 is capable of low-altitude cruising at Mach 2 and high-altitude cruising at Mach 3. It has a stated range of 290 km and, likely, using an active radar-homing (ARH) terminal-stage seeker.

By seemingly fitting the Tughril-class frigate with the CM-302, the PN is countering the Indian Navy’s (IN) BrahMos by emulating the capability. The BrahMos is a challenge for the PN because it aggressively closes the response time PN ships have in stopping the missile. Moreover, stopping the missile does not mitigate the threat as the BrahMos’ high speed could result in highly damaging shrapnel towards ships that manage to intercept it. The PN is looking to present a similar challenge to the IN, but through the CM-302.

However, an anti-ship ballistic missile (ASBM) is still on the cards (i.e. P282). Thus, the PN is working on a varied anti-ship attack capability through different types of missiles. Combined with a growing submarine fleet of both large and shallow-water attack boats, new maritime patrol aircraft, and investment in various intelligence, surveillance and reconnaissance (ISR) assets and unmanned surface and underwater vehicles, the PN is building a robust anti-access and area-denial (A2/AD) capability.

Is Pakistan Inducting the TPS-77 MRR?

During the 2021 Dubai Air Show, Pakistan Aeronautical Complex (PAC) indicated that it is overhauling the Lockheed Martin TPS-77 MRR (Multirole Radar). In March 2020, the Directorate of Procurement (Air) had issued a tender for radomes for TPS-77 MRR, suggesting that the Pakistan Air Force (PAF) was procuring the radar. In 2017-2018, the PAF disclosed that it ordered 10 low-level radars for $130 million U.S.

Quwa learned from a correspondent who spoke to PAC that PAC was referring to the TPS-77 MRR, not the AN/TPS-77 radars that the PAF is already using. If accurate, this information would indicate that the PAF settled its gap-filler radar requirements with both the TPS-77 MRR and Chinese YLC-18A.

The TPR-77 MRR uses gallium nitride (GaN)-based transmit/receive modules. It is an active electronically-scanned array (AESA) radar capable of both long-range and low-level coverages. The PAF likely sought it for the latter role. In its low-level mission mode, the TPS-77 MRR offers a range of 150 km.

By this stage, the ‘last leg’ of the PAF’s air defence modernization efforts would involve new surface-to-air missile (SAM) systems. The Spada-2000 Plus offers a credible capability at up to 20-25 km range, but a more capable longer-ranged SAM could be of interest as well. In fact, the MBDA CAMM-ER (which the PN chose for its Babur-class corvette and Jinnah-class frigate programs) could be a candidate.

Analysis: Are Sub-1,000 kg UAVs a Distinct Class of Drone?

For years, many major militaries have aspired to acquire or develop drones that were similar in capability and size to the American Predator-series. Programs such as the TAI Anka, AVIC Wing Loong, and the PAC MALE UAV point towards a 1,000 kg to 1,500 kg system capable of BLoS ranges (e.g. 1,000+ km).

However, the success of the Bayraktar TB2 shows that smaller – and potentially lower-cost – drones could serve a complementary role. Turkey had used the TB2 for missions against non-state actors and even the air defence assets of organized militaries. It did not worry about losses as, ostensibly, the TB2 is a lower-cost design. It does not need pricier inputs such as SATCOM, a powerful engine, or high-powered mission equipment. Rather, if the focus was kept on low-cost, attritable subsystems, drones with MTOWs of about 500 kg could be effective solutions for directly supporting combat operations.

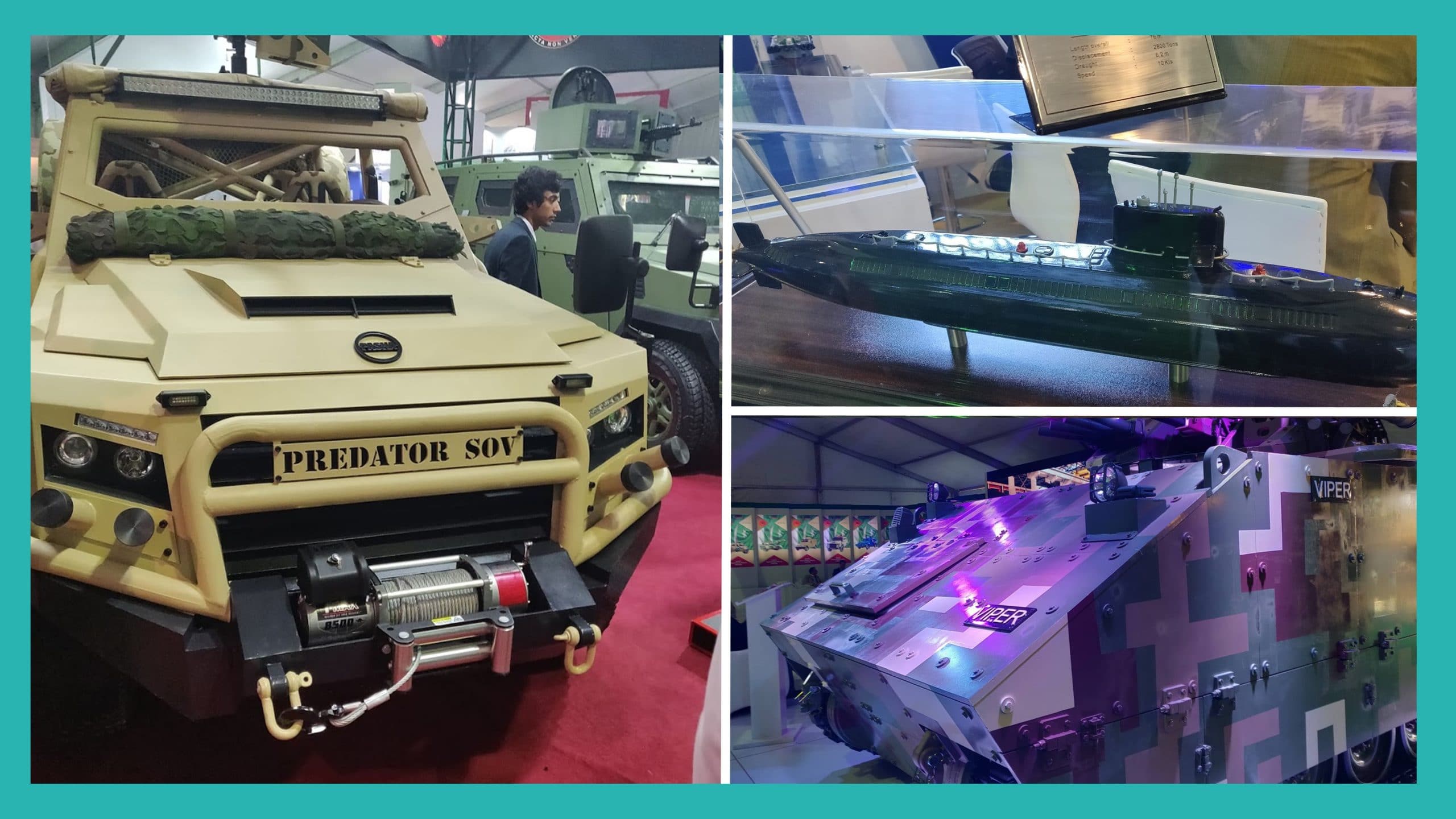

Interestingly, it seems the drone market is starting to cater towards this area as a distinct need. The UAE’s Halcon started marketing its REACH-S platform. The REACH-S is similar in size to the Bayraktar TB2, and it offers similar performance and configurability options. Pakistan’s NESCOM is also offering the Shahpar-2, another drone that is comparable in size and capability to the TB2 and REACH-S.

Granted, the focus could simply be to support a more cost-sensitive market. However, if these drones are an outcome of an operational need, they may evolve into a sub-category. One long-term developmental goal could be to reduce costs even further by refining the manufacturing process or developing even lower cost inputs (especially in terms of electro-optical/infrared sensors). The other focus area could be to make these drones more versatile from a deployment standpoint. So, instead of relying on runways of any type, one could see rocket or catapult-assisted launch (a key feature of some attritable UAV designs).