10482Views

Pakistan’s GIDS Eyes Munitions & Drones Sales in Latin America Quwa Premium

Pakistan’s Global Industrial and Defence Solutions (GIDS) was present at the 2025 Latin America Aerospace & Defence (LAAD) exhibition, which ran from April 01 to April 04, 2025, at the Riocentro Exhibition & Convention Center in Rio de Janeiro, Brazil.

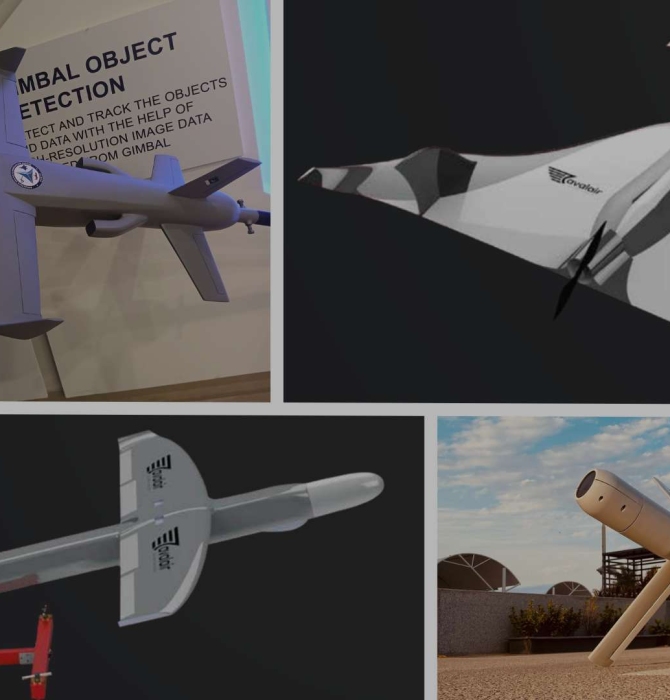

At LAAD 2025, GIDS showcased its growing product portfolio, including:

Latin America: A Growing Market

Latin America has historically been an active defence market, but recent years have seen key regional powers initiate a series of major procurement programs across various domains.

Current procurement programs span the entire spectrum of military hardware, from small arms to strategic platforms, including (in Brazil’s case) a nuclear-powered submarine.

Reports indicate that Brazil alone earmarked $6.5 billion USD for procurement between 2016 and 2023, with a potential for an additional $10.46 billion USD in purchases from 2024 to 2027. Brazil’s arms import contracts for 2016-2023 amounted to $3.043 billion, with forecasts showing imports for 2024-2027 could reach approximately $10.461 billion.

This significant increase compared to the $3.828 billion spent in 2020-2023 was largely driven by Sweden’s supply of Gripen fighters worth $4.2 billion.

Argentina, Colombia, Chile, and Peru – while comparatively smaller arms buyers than Brazil – still represent credible markets in their own right.

These fiscally constrained nations may find GIDS an accessible option for high-impact weapons like SSMs and cruise missiles, particularly due to cost considerations and ITAR-free availability.

Argentina has outlined several major procurement plans in its 2025 budget, including F-16s, transport aircraft, and various helicopter programs totaling $743.55 million.

Colombia’s defence budget for 2023 reached approximately $10.4 billion, with about 4% ($416 million) allocated for equipment purchases, such as weapons and communication upgrades.

A significant recent procurement is the $310 million USD deal with Canada for 55 LAV III light armored vehicles. Additionally, Colombia has recently signed a letter of intent with Sweden to purchase Saab Gripen E/F fighter jets, with the Colombian Aerospace Force planning to order between 16 and 24 aircraft.

GIDS’ Value Proposition

GIDS is positioning itself to enter the Latin American defence market.

Speaking to Quwa, GIDS CEO Asad Kamal said that the company’s presence at LAAD was “primarily a market exploration campaign” aimed at identifying potential buyers and partners in the region.

Kamal highlighted that GIDS’ solutions can resonate with certain markets, noting in particular Peru and Argentina, which “appear to be attractive markets for [GIDS] products” and will be among those GIDS will “focus fully on” in the coming years.

“It’s a challenging market, but we have made a sale here in 2012 before and I think we can do it again with the right perseverance and partners,” noted Kamal.

Latin America could offer another market for Pakistan’s defence industry to engage with its solutions, especially drones and guided munitions.

The Russia-Ukraine War has given militaries around the world new impetus to heavily invest in their unmanned aerial system (UAS) inventories, counter-UAS systems, and land-based precision-strike elements.

Moreover, militaries now value redundancy in their suppliers more than ever, which, in theory at least, opens the market to Pakistan as a complementary player to bigger vendors.

But the fact that Pakistan also offers original solutions like the Shahpar 2 drone, Fatah-I and Fatah-II SSM, and Taimur/Harbah cruise missiles, also positions it as a source for securing advanced weapon systems without the same cost or export control limits of established Western OEMs.

End of excerpt (596/1,751 words).

Existing Quwa Premium members can log in below

Note: Logged in members may need to refresh the article page to see the article.