4286Views

Pakistan Increasingly Leans on Loitering Munitions Quwa Premium

Bilal Khan

Founder of Quwa, Bilal has been researching Pakistani defence industry and security issues for over 15 years. His work has been cited by Pakistan's National Defence University (NDU), the Council of Foreign Relations, Bulletin of Atomic Scientists, Centre of Airpower Studies and many others. He has a Hons. B.A in Political Science and Masters of Interntional Public Policy from Wilfrid Laurier University in Waterloo, Ontario, Canada.

In 2021, Quwa wrote an article inferring that Pakistan will likely adopt a loitering munitions strategy. Nearly four years later, it is evident that Pakistan is acquiring a wide range of loitering munitions and, that too with a strong emphasis on domestic production through in-house programs and partnerships with a number of foreign original equipment manufacturers (OEM). In other words, Pakistan has a substantive – or perhaps an ambitious – loitering munitions program under way.

The Russia-Ukraine War drew attention to the value of loitering munitions – alongside drones, conventional ballistic missiles, and surface-to-air missiles (SAM). However, the potential utility of loitering munitions was apparent before that conflict. They offered low cost means of undertaking precision strikes, even at longer ranges. For example, the Iranian Shahed-136 may cost around $50,000 USD per unit to manufacture, yet the drone is able to ferry a 50 kg warhead up to a reported range of 2,500 km. It is not as large as Tomahawk- sized cruise missiles, but a 50 kg warhead against the right target (e.g., a radar) can generate a very high return on investment in a conflict. However, the Shahed-136 represents one end of the loitering munitions spectrum, perhaps closer to the middle-to-high-end. There are also a growing array of smaller munitions – some the size of hand-grenades – that can elevate the end-user’s tactical attack capabilities in a myriad of scenarios, be it in conventional conflict or asymmetrical warfare.

That said, irrespective of the formfactor, range, payload, or guidance options, a loitering munition will offer one universally critical benefit – flexibility. A loitering munition does not require a costly or complex launch platform, like an aircraft or surface warship (though it can leverage one if need be). In fact, some loitering munitions can be deployed from the palm of the operator, and some larger munitions can take off from a runway. And where launchers are required, the systems can be relatively simple catapults and multi-tube launchers, which are relatively low cost and scalable to deploy in large numbers.

There are drawbacks, however. Loitering munitions generally lack the range, payload, and speed/cruising combinations of larger cruise missiles and precision-guided bombs (PGB). In addition, loitering munitions could be susceptible to certain countermeasures, such as directed energy weapons (DEW). Some could point to Israel’s effective use of a multi-layered air defence system as proof that a mass loitering munition attack could be thwarted. However, there are caveats with that argument. First, few – if any – countries are equipped with as dense an air defence system as Israel (owing to its relatively tight geography). Pakistan’s principal adversary is India, and it is likely that Pakistan will uncover more vulnerabilities in its neighbour’s coverage to leverage the value of loitering munitions, especially in scenarios like cross-border skirmishes. Second, Pakistan will use loitering munitions in concert with cruise missiles, gliding PGBs, tactical ballistic missiles, and other munitions, hence giving it more options to engage multi-layered air defences.

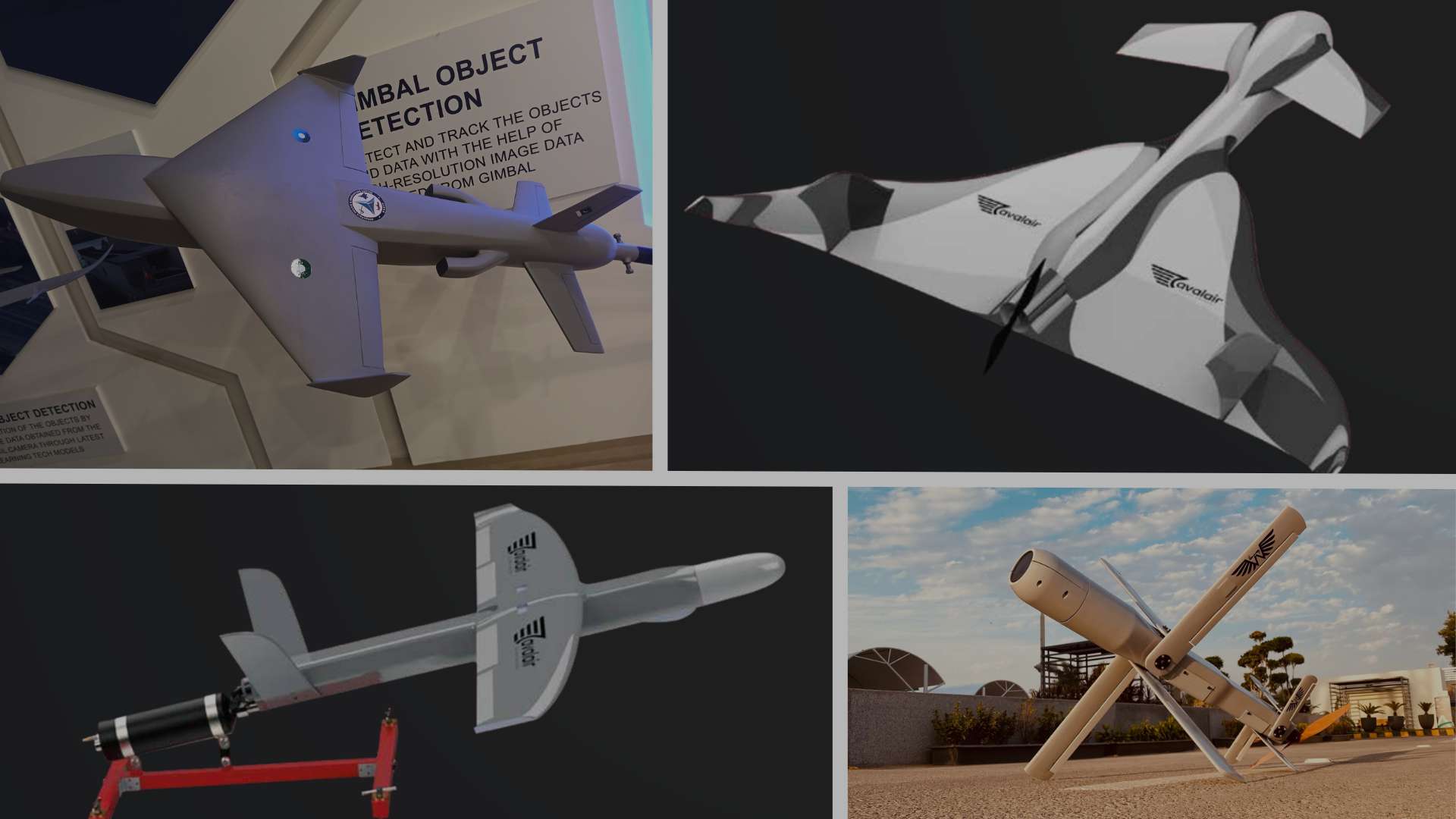

A Growing Loitering Munitions Portfolio

Pakistan’s loitering munitions strategy now functions well beyond off-the-shelf procurement; there is now a strong focus on domestic production via both state-owned entities (SOE) and private companies. Pakistan is carrying out its local production goals through off-the-shelf purchases, transfer-of-technology (ToT), joint ventures with foreign OEMs, and in-house development. Here are 11 notable programs:

1. NASTP KaGeM V3

The KaGeM V3 is a joint-venture between the Pakistan Air Force’s (PAF) National Aerospace Science and Technology Park (NASTP) and Turkiye’s Baykar. From a design standpoint, the KaGeM V3 is a miniature air-launched cruise missile (ALCM) that bears a close resemblance to Baykar’s new KEMANKEŞ 2, which offers a range of 200 km, endurance of 60 minutes, and a 20 kg warhead. The KaGeM V3 may be similar to the KEMANKEŞ 2 in performance, thus giving the PAF a long-range strike capability through its drones, such as the Bayraktar Akıncı high-altitude long-endurance (HALE) unmanned aerial vehicle (UAV), which it inducted in 2023.

End of excerpt (656/1,634 words)

Log in or subscribe to read the rest of the article

Note: Logged in members may need to refresh the article page to see the article.