In the 1990s, the Pakistani military began leveraging its defence industry entities to drive arms exports, albeit, as a secondary goal behind the primary objective of supporting domestic requirements.

Nonetheless, by setting up recurring events like the International Defence Exhibition and Seminar (IDEAS) and organizations like Global Industrial & Defence Solutions (GIDS), Pakistan built the commercial venues and infrastructure for marketing and selling arms.

To date, these efforts have not generated the export volumes Pakistan initially anticipated, and big-ticket orders were few and far between. However, despite the lack of traction up to this point, wider shifts across military technology and doctrine could create lucrative niches for the Pakistani defence industry.

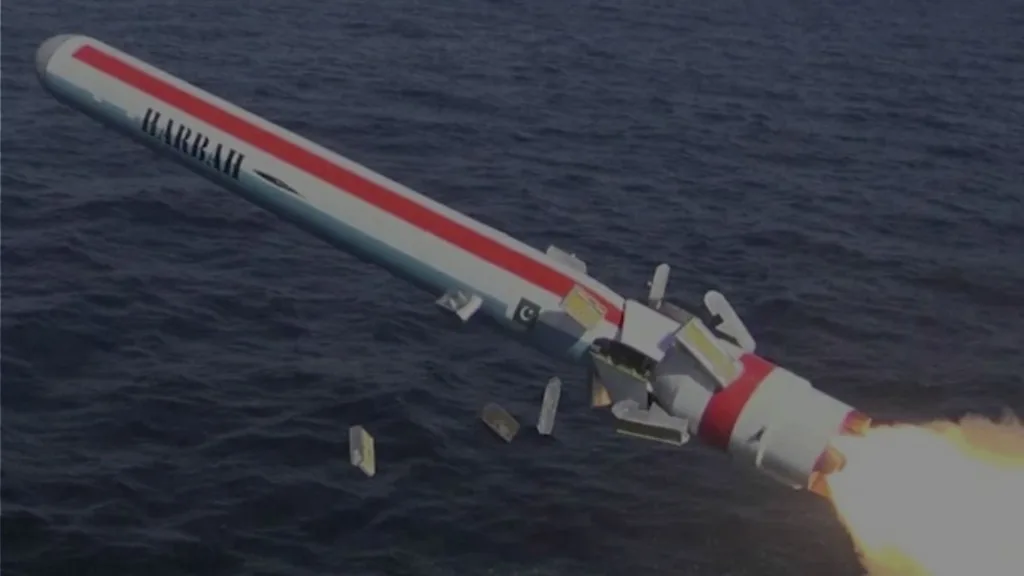

These potential niches include, among others, the rise of loitering munitions, precision-guided bombs and missiles, and custom integration services. While these niches may not draw the attention a fighter aircraft or surface warship sale would, they are in wide demand globally and, if Pakistan executes well, can drive hundreds of millions of dollars in defence exports annually.

Stay up to date with the latest Pakistani defence news with reliable research and accurate forecasting

Click Here

Granted, Pakistan is not sourcing every critical input indigenously. However, the nature of cruise missiles and other guided munitions is that the inputs are, by design, meant to be low-cost and disposable. Thus, even if Pakistan is importing them, it still has significant pricing room to charge for value-added services, such as the munition design and manufacturing stages. Moreover, because countries need munitions in large numbers and (when engaged in conflict) frequently, there are more opportunities for contracts.

Finally, a munition is a lower-risk purchase compared to a fighter aircraft. Thus, there is less of a delta or gap for Pakistan to overcome to pursue such sales, even from non-traditional buyers. Interestingly, this is also a case where diversification is necessary; thus, countries looking to secure multiple supply chains for munitions could be willing to involve Pakistan, even if they themselves already buy from the West.

Get Timely Pakistani Defence News

Unmatched depth on the JF-17, Project Azm, Hangor submarine, Babur, Fatah, and more. Be the first to know about Pakistan's next-gen UAVs, USVs, and emerging platforms.