6262Views

Munitions Could Boost Pakistani Defence Exports Quwa Premium

Bilal Khan

Founder of Quwa, Bilal has been researching Pakistani defence industry and security issues for over 15 years. His work has been cited by Pakistan's National Defence University (NDU), the Council of Foreign Relations, Bulletin of Atomic Scientists, Centre of Airpower Studies and many others. He has a Hons. B.A in Political Science and Masters of Interntional Public Policy from Wilfrid Laurier University in Waterloo, Ontario, Canada.

In the 1990s, the Pakistani military began leveraging its defence industry entities to drive arms exports, albeit, as a secondary goal behind the primary objective of supporting domestic requirements.

Nonetheless, by setting up recurring events like the International Defence Exhibition and Seminar (IDEAS) and organizations like Global Industrial & Defence Solutions (GIDS), Pakistan built the commercial venues and infrastructure for marketing and selling arms.

To date, these efforts have not generated the export volumes Pakistan initially anticipated, and big-ticket orders were few and far between. However, despite the lack of traction up to this point, wider shifts across military technology and doctrine could create lucrative niches for the Pakistani defence industry.

These potential niches include, among others, the rise of loitering munitions, precision-guided bombs and missiles, and custom integration services. While these niches may not draw the attention a fighter aircraft or surface warship sale would, they are in wide demand globally and, if Pakistan executes well, can drive hundreds of millions of dollars in defence exports annually.

Pakistan’s Competitive Advantage

Big-Ticket Items Don’t Sell

Unlike the world’s top defence exporters, Pakistan lacks a credible industrial and technological base. It cannot manufacture gas turbines, advanced composite materials, and other critical inputs necessary for independently building fighter aircraft, ships, and armoured vehicles.

While its product portfolio includes big-ticket platforms like the JF-17 Thunder multirole fighter aircraft and al-Khalid main battle tank (MBT), Pakistan must import critical inputs like powerplants and electronics from China and other sources to produce these systems.

When the most valuable inputs are imported, Pakistan’s ability to influence the cost of its platforms as well as guarantee its supply and support is limited. This arrangement works for Pakistan’s domestic needs, but it is difficult to leverage for driving exports.

First, buyers will generally prefer sellers that will guarantee the supply and support of the critical inputs. It is easier to deal with one stakeholder, especially over the long-term, than multiple parties. For example, if the engine comes from China, then the customer will need to worry about its long-term relationships with both China and Pakistan (if not others).

Second, an external supplier could wield influence over a potential deal. This is a common blocker for a great many big-ticket sales, such as Pakistan’s attempts to procure the T129 ATAK attack helicopter from Turkiye, or Argentina’s push to buy F/A-50s from South Korea. Those deals were scuttled because of the influence wielded by the United States and United Kingdom, respectively, as a result of the technologies they supplied for those platforms, such as engines, ejection seats, and other inputs.

Third, big-ticket items are higher in price, and in many cases (especially with markets Pakistan tends to engage) support mechanisms like loans and credit are also necessary. Otherwise, the buyer is forced to procure Pakistan’s goods in small numbers (as was the case with Nigeria’s purchase of three JF-17s) on cash availability rather than commit to a larger upfront order.

Therefore, continued reliance on big-ticket items will not help Pakistan’s defence industry increase sales or drive larger volumes of exports. It must focus on solutions it can independently produce through local inputs, which (in light of Pakistan’s weaker industrial and technical capacity) must be less complex than those involved in fighter aircraft, surface warships, or submarines.

Focus on 'Smaller' Goods

Compared to a big-ticket platform, it is easier for Pakistan to independently manufacture smaller systems, such as loitering munitions and precision-guided munitions (PGM). They are simpler designs wherein the inputs are much lower in cost, more accessible from a sourcing standpoint, or easier to produce locally.

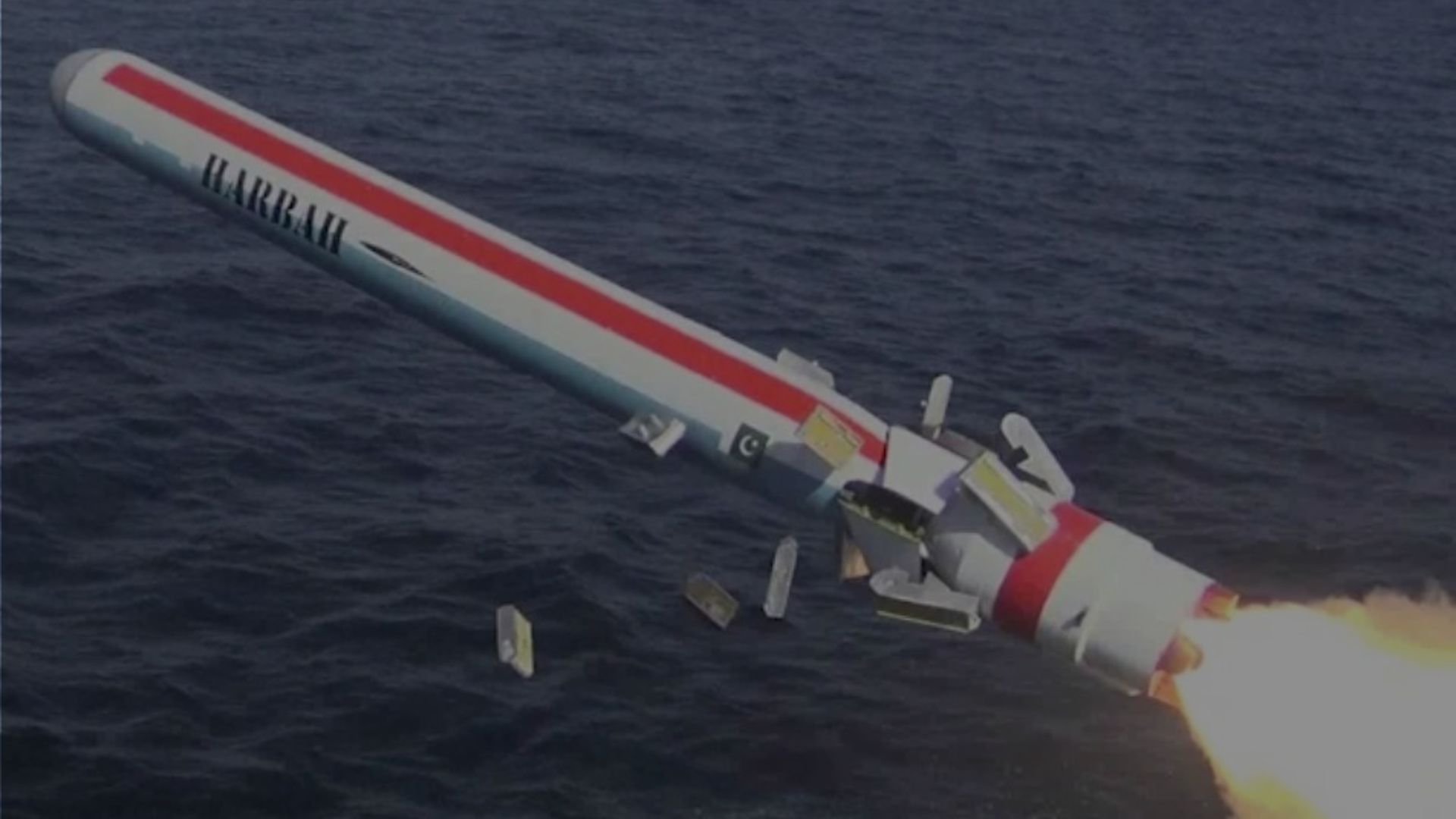

One example of a success story in this regard is Pakistan’s growing cruise missile portfolio. Thanks to an increasing level of localization, Pakistan can market the Harbah anti-ship cruising missile (ASCM) and the Taimur air-launched cruise missile (ALCM) to the world. It is now manufacturing some critical inputs, such as the required miniature turbojet engine for the ALCM, domestically. Other Pakistani companies, such as Solunox, are also producing miniature turbojet engines, albeit for smaller applications, like target drones.

Log in or subscribe to read the rest of the article

End of excerpt (596/1,394 words)

Note: Logged in members may need to refresh the article page to see the article.