2439Views 1Comment

Profile: Saab Swordfish Maritime Patrol Aircraft (MPA)

In February 2016, Saab unveiled a new set of intelligence, surveillance and reconnaissance (ISR) systems using Bombardier’s Global 6000 business/VIP jet and Q400 turboprop – the GlobalEye and Swordfish.

The GlobalEye was a continuation of Saab’s popular Erieye airborne early warning and control (AEW&C) platform, using a new gallium nitride (GaN)-based active electronically-scanned array (AESA) radar – i.e. Erieye ER – paired with a ground-facing synthetic aperture radar (SAR). Saab positioned the GlobalEye as a comprehensive suite capable of building situational awareness of the air and the ground (via the SAR).

The United Arab Emirates is the GlobalEye (also known as Swing Role Surveillance System)’s launch buyer – it currently has three Bombardier 6000-based systems on order. Abu Dhabi’s recent order indicates that each Saab GlobalEye system costs U.S. $238 million per aircraft.

The Swordfish was revealed as a maritime patrol aircraft (MPA) system, one that can be adapted to either the Bombardier Global 6000 or Q400, depending on customer preference. In broad terms, an MPA is used to monitor a country’s littoral waters and adjoining seas, including its sea-lines-of-communication (SLOC) or sea lanes, which serve as conduits for international trade. Besides patrolling, some MPAs can also serve as anti-ship warfare (AShW) and anti-submarine warfare (ASW) combatants.

Interestingly, the Swordfish appears to utilize a high proportion of hardware from third-party suppliers. For example, the Swordfish uses the Leonardo Seaspray 7500E AESA radar, and its electro-optical and infrared (EO/IR) capability is delivered by a Star SAFIRE system. With the Swordfish, Saab is clearly pitching its system integration – and potentially munitions package (e.g. RBS-15 anti-ship missile) – as a key selling point. Also, commercially-procured off-the-shelf (COTS) hardware also limits cost.

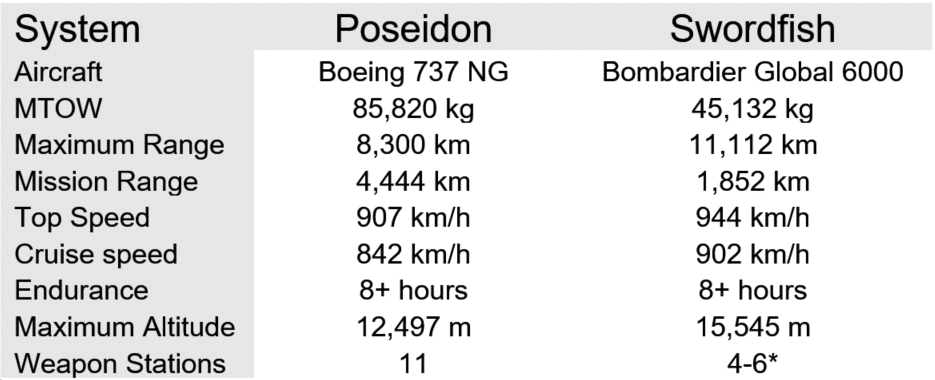

Comparison of the Saab Swordfish and Boeing P-8A Poseidon

Saab is positioning the Swordfish as a AShW and ASW-capable asset, at least in its Global 6000 form. The Bombardier Global 6000 was introduced in 2003 as a long-range and long-endurance executive transport. The Global 6000 has a maximum take-off weight (MTOW) of 45,132 kg. The Boeing P-8 Poseidon, which Saab views as its principal competitor, has a MTOW of 85,820 kg.

Saab claims that the Swordfish is capable of loitering for more than eight hours and to a range of up to 1,852 km. Boeing states that the Poseidon can operate up to 4445 km and loiter an area for over eight hours, though the Royal Australian Air Force (RAAF) states that in ASW missions, the P-8A has a range of over 2,200 km and loitering time of over four hours. The P-8A also has a payload capacity of 10,000 kg via 11 external and internal hard points, while the Swordfish has four NATO-standard hard points. According to Saab, the Swordfish can carry up to six lightweight ASW torpedoes or a mix of ASW torpedoes and anti-ship missiles (AShM).

There are evident performance and capability differences between the Poseidon and Swordfish, but Saab is not aiming to present the Swordfish as the superior system. Rather, Saab is taking aim at cost-conscious markets and is positioning the Swordfish as the more suitable system. For navies seeking MPAs to support their anti-access and area-denial (A2/AD) and littoral security objectives, the Swordfish should more than suffice. However, in contrast to the Poseidon, the Swordfish is – as per Saab – two-thirds the acquisition price and half the through-life cost of the P-8A (Shephard Media).

Note, these are not concrete figures, but a high-level look at the cost-difference between the Swordfish and Poseidon. The flyaway unit-price of a Boeing P-8A is in the range of U.S. $110-125 million per aircraft. However, a logistics, maintenance and training package will push the total cost of each P-8A to roughly $250 million. Saab’s claims would place the Swordfish’s cost to $80 million per aircraft, and with a support package, an approximate price of $140 million per aircraft.

This is a noticeable difference, one that might steer smaller naval air arms to Saab instead of Boeing. The Poseidon was principally designed to fulfill the requirements of the U.S. Navy, which is essentially tasked with a globally-focused maritime security mandate. However, long-range and high-endurance platforms such as the Poseidon may not be the ideal for countries that are primarily focused on A2/AD and guarding nearby maritime interests. Yes, the P-8 will readily fulfil those needs, but the pool of countries capable of readily sustaining the Poseidon’s costs is small. This is true relative to even the legacy Orion user base.

While relatively incremental, an increasing number of countries are beginning to examine potential successors for their respective Lockheed Martin P-3 Orion fleets. To its credit, the Orion has endured (much like the Hercules) thanks to a balanced combination of capability, versatility, upgradeability and affordability (via its scale and widespread adoption). However, as these aircraft age, the prospect of incurring growing maintenance costs and reduced operational efficiency grows. Besides the legacy Orion market, there are countries seeking AShW and ASW-capable MPAs, but the P-8 Poseidon may be priced above many of these countries. Thus, the 2020s could see a large and cost-sensitive MPA market.

Saab is also promising flexibility to how a customer chooses to configure and modernize the Swordfish. While Saab could provide its own AShM and ASW torpedoes, this flexibility is in place to keep a broad potential customer pool. Some Swordfish clients may not have Stockholm’s approval to receive the RBS-15 AShM, or even analogous MBDA weapons.

Besides Boeing, Saab may face competition in the form of similar systems. For example, certain subsystem vendors (e.g. Thales) may collaborate with other business jet manufacturers to develop comparably priced and equipped MPAs to the Swordfish. By the 2020s, the market could become flush with several options, each seeking launch-users to bring designs from paper to reality, and in turn, gain a competitive edge.

1 Comment

by Mir Mohammad Ali Khan

Nice to read it ! thanks for sharing !

Regards

Mir Mohammad Ali Khan