192Views 0Comments

Understanding India’s Entry into the Wassenaar Arrangement

Introduction

On December 07, the then 41-member Wassenaar Arrangement (WA) unanimously approved of India’s entry into the WA. Like the Missile Technology Control Regime (MTCR), which India joined in June 2016 as its 35th member, the WA is a multilateral body designed to control the transfer of certain technology. India’s membership will be formally announced in December 2018 during the WA’s next plenary meeting in Vienna, Austria. For India, entry into the WA is a positive on several fronts, from foreign relations – with most of the world’s leading powers accrediting India for having sufficient export controls (i.e. reputation) – to further linking the Indian defence industry to key suppliers and buyers of critical technologies.

On the other hand, India’s entry into the WA poses challenges for Pakistan in terms of serving as a clear indictment of where it stands vis-à-vis India (e.g. India is in the WA and MTCR while Pakistan is not) and further easing India’s ability (an already well-established reality) to develop next-generation weapon systems. In the long-term, as Indian suppliers, buyers and funding permeates across companies engaged in the WA and MTCR, that entry will also serve as a probable block on Pakistan’s access to technology and support for its own defence programs. With the U.S. as a factor in the WA and MTCR, it is unlikely that Pakistan will enter either, even in an optimistic future scenario of effective foreign relations engagement and fiscal strength (China possesses both as well, but it too is not a member of the WA or MTCR).

What is the Wassenaar Arrangement?

The WA’s purpose is to push for “transparency and greater responsibility in transfers of conventional arms and dual-use goods and technologies, thus preventing destabilising accumulations.” While WA members “seek” to prevent using the technologies guided under the WA for bolstering military capabilities, the goal of the WA is to control transfers from WA members to non-WA members and entities. The WA works to prevent terrorists and malicious non-state actors from accessing conventional weapons and dual-use technology. The WA also requires its members to report to the WA on its sale of arms and technology to non-WA members on a semi-annually basis, if not more frequently. Besides the U.S., U.K. and Russia, most of the WA’s members are NATO (including Turkey) and close U.S. allies, such as Japan and now India.

India’s Foreign Relations Gain

On the surface, India’s entry into the WA serves as accreditation of India’s standing in the international political stage. Like the MTCR, the WA emphasizes its role in mitigating the illicit transfer of weapons and technology to malicious actors and recalcitrant states. Functionally, there are two components to gaining WA membership: First, aligning one’s own export control policies to those of the WA, which will see one refrain from selling to questionable parties. In this respect, expectations can vary, from blocking the sale of certain dual-use technology (e.g. diesel engines that can power commercial ships and naval ships alike) to a specific country. It can also be as stringent as refraining from dealing small arms to a certain market out of concern that those small arms could reach non-state actors. Second, WA membership requires that every existing WA member – which includes the U.S., U.K. and Russia – approve of the new entrant.

In reality, the second requirement to WA membership is the important one. Like it had in the MTCR, the U.S. is explicitly backing India’s stature in these key multilateral bodies. India has not been able to secure membership in the Nuclear Suppliers Group (NSG) due to China (the NSG also requires the consensus of its members for new entrants). However, India will try leveraging its memberships in the WA and MTCR in a bid to convince China to change its stance on the NSG. Interestingly, that might not be that sound of a strategy considering that China’s entry in the MTCR and WA is actually contingent on the U.S. and, to a lesser extent, Western Europe. However, with the U.S. and China at odds in the Pacific Ocean, it would be grossly erroneous to suggest that the U.S. would approve of China’s membership in the MTCR and WA, at least without finding other ways to first restrict China’s access to research and development (R&D), dual-use technology and new technology partners – i.e. rendering the MTCR and WA meaningless to China.

New Avenues for India’s Critical Technology Development

The WA does not directly facilitate the transfer of sensitive technology, goods and expertise between its members. Rather, it serves as accreditation that reduces the regulatory roadblocks between countries so that such trade is easier – like the MTCR, a WA member is assumed to be a party of good standing. Such an instrument assumes that the risk of illicit third-party transfers (from the recipient WA member to some questionable non-WA member) is a non-factor. Trade between WA (and MTCR) members thus preserves the respective stature of each member by ensuring that trade is done between ‘good’ parties. While the WA states that its goal is to prevent the transfer of critical technologies for defence purposes, it is obvious that the rule does not apply to trade between WA members (evident in the scores of such programs in Japan, South Korea, the U.S., Turkey and now India). Furthermore, as new programs get tied into ventures or partnerships between WA members – especially leading ones such as the U.S. and U.K. – it is plausible that trade between WA members and non-WA parties will be discouraged in those sensitive areas – e.g. space rocket technology for satellite launch vehicles (SLV).

Ukraine is a good example of a beneficiary of WA membership. Having seen Kiev reduce expenditure in defence procurement through the 1990s and 2000s, the Ukrainian high-technology sector had relied on exports to sustain operations and propel new programs. Unfortunately, success did not occur in all areas, but Ukraine did benefit to an extent in space development thanks to being in both the WA and MTCR. For example, it is a regular exporter of SLV services, having recently launched Angola’s first communications satellite using its Zenit SLV platform from Kazakhstan.[1] The European Vega SLV’s fourth stage rocket – i.e. the Avum – is in fact the Ukrainian RD-843 engine, which was developed by the Yuzhnoye Design Bureau and produced by Yuzhmash.[2] Being able to supply a critical component to a marquee Western program assumes Western Europe’s trust in Ukraine, be it for quality or for security (Ukraine will have had access to the Vega). The WA and MTCR help remove key barriers. In effect, one finds that WA/MTCR membership allows for acquiring critical technology as well as readily selling it, the latter being important for Ukraine as it has linked itself as both a commercial services and critical technology supplier.

India will seek to emulate Ukraine’s successes and likely expand upon them both in terms of boosting its commercial gains and in acquiring technology and expertise for its own programs. Through the 1990s and 2000s, India’s major defence programs – especially those with inherently complex inputs such as the Tejas (e.g. its fly-by-wire flight control system) – had suffered delays and cost overruns. These occurred due to New Delhi choosing to confer the R&D work to its Defence Public Sector Undertakings (DPSU) – i.e. state-owned entities – such as the Defence Research and Development Organization (DRDO). In order to pursue those programs, these DPSUs also had to build human capital and infrastructure, but also undergo failure due to inexperience. These issues will not be as much of a factor thanks to the MTCR and WA, which will see India directly approach outside parties with experience to provide it development support whilst also maintaining its goals for indigenous development and production.

Turkey is a good example of how WA/MTCR membership enables for overseas contribution to one’s own programs. As part of its next-generation fighter program, the TFX, Turkey also requested proposals for the TFX’s turbofan engine platform, which is to be designed, developed and manufactured in Turkey. Among the two competitors is the U.K. propulsion giant Rolls-Royce, which partnered with the private Turkish company Kale Group to form TAEC Uçak Motor Sanayi AS. Rolls-Royce apparently has enough regulatory approval from the U.K. to bring valuable intellectual property and expertise to Turkey in order to develop the TAEC turbofan engine. Likewise, TAEC’s competition is coming from TUSAŞ Motor Sanayii A.Ş. (TEI), which is co-owned by General Electric (GE). Granted, the participation of foreign entities in national programs alters what is meant by “indigenous”, but the impact is what counts – i.e. the one providing the funds will own valuable IP along with a domestically sourced engine. It is a two-way relationship as TAEC and TEI’s equity structures enable Rolls-Royce and GE to profit, respectively.

Through its prior offset-driven agreements, many of the same overseas suppliers are already in India using the Indian industry as part of their respective supply channels. However, with the WA/MTCR in place, New Delhi can connect with these companies to develop original solutions within India for the Indian military (i.e. analogous to Turkey), which will serve as an accelerative agent for India’s next-generation programs, such as its fifth-generation fighter program, among others. Short-term, one should expect suppliers in the WA/MTCR states to support India with its BrahMos and Nirbhay cruise missile development, be it in terms of perfecting the Nirbhay’s miniature turbofan engine or further reducing the weight and physical size of the BrahMos so that it can be deployed from a wider set of platforms. Long-term, India could leverage its work in scramjet (supersonic-combusting ramjet) engine technology[3] to attract large and smaller players, the latter in Brazil, South Africa and Ukraine. This is a new technology area with limited work outside of the WA and MTCR, and it could form the basis of next-generation munitions. Tying-up partners in these countries would result in blocking of Pakistan’s access for its own development efforts.

Pakistan’s Avenues

Theoretically, even if Pakistan could earn the trust of the MTCR and WA members, the U.S. will serve as a block, more so than India (which can be swayed to choose otherwise provided Pakistan has U.S. support). The U.S. is positioning India as a key asset for containing China, but it also appears that for India to assume that role, Pakistan cannot be allowed to have similar access and support from the U.S. or its allies. From a foreign relations standpoint, Pakistan will need acknowledge this isolation and, instead of coming off as desperate for a change-of-mood in Washington, proactively work to achieve its own national interests as an ‘isolated power’ (emphasis on the term “power”).

Regardless of it having WA/MTCR membership or not, Pakistan is still a country with 200 million people. It is also geo-strategically positioned between three major regions – i.e. South Asia, Central Asia and the Middle East (with linkages to the Arabian Sea and Gulf of Eden). Pakistan must learn to actively leverage this position, if not with the U.S. then with Western Europe, South Africa, Latin America and Central Asia. Moreover, Islamabad must learn to substantiate words with action – instead of pleading to the U.S. for understanding its sacrifices and exposure to instability from supporting the U.S.’ very tenuous hand in Afghanistan, then it must learn to withdraw to protect its interests. If Pakistan is unable to secure MTCR or WA membership (and also receive less in the way of aid) otherwise, then what is the loss?

From a technology development standpoint, Pakistan has and will continue to have difficulty accessing a high level of support from WA and MTCR members. This is especially the case in miniature propulsion and other technology critical to long-range munitions. Investment in human capital development and R&D is essential, if not to independently build alternatives, then to at least reach a point where Pakistan can be a viable partner for China, which is aggressively developing technology analogous to that in the U.S. et. al.

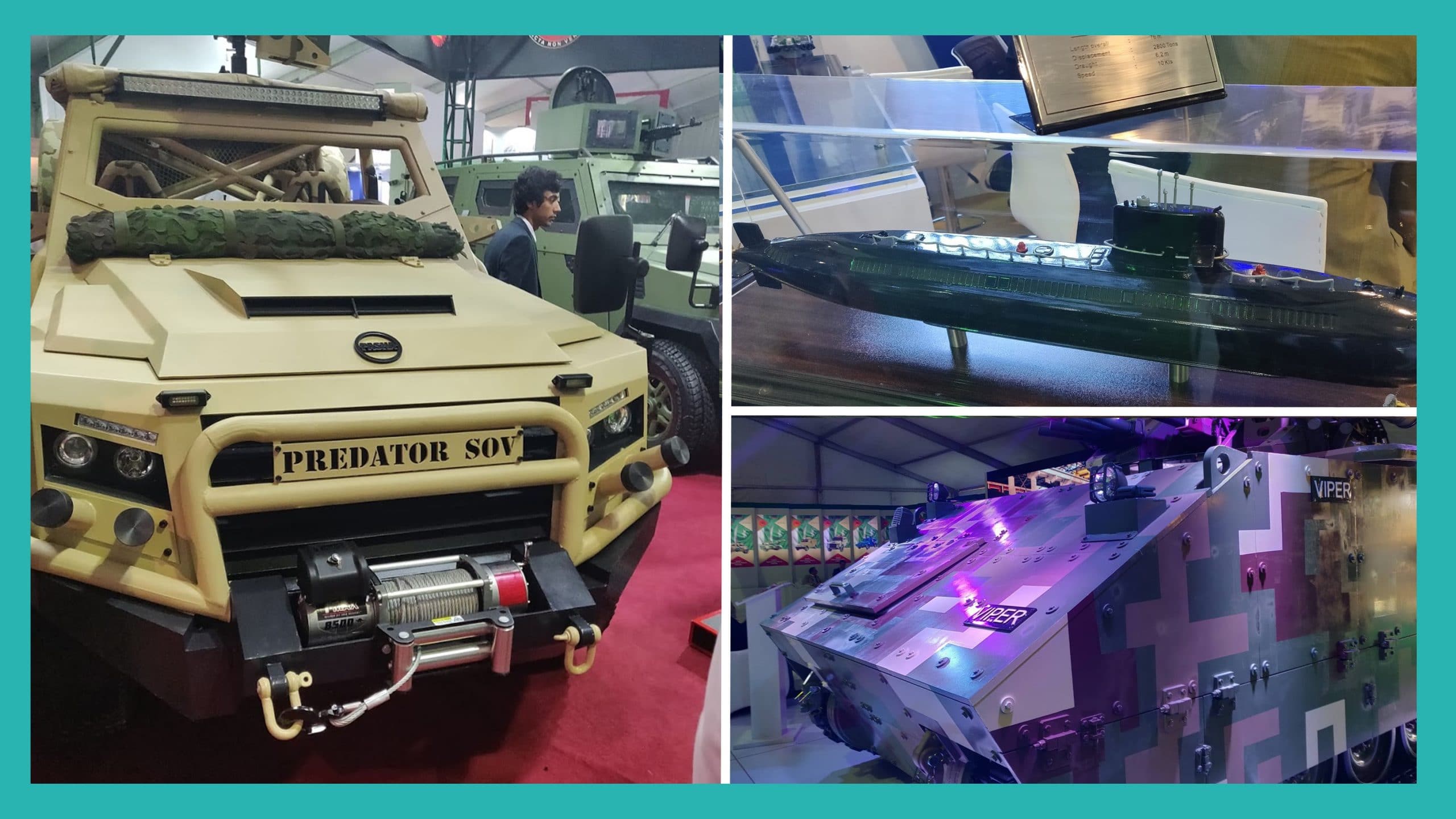

To Pakistan’s credit, it appears efforts are underway in Pakistan to build human capital and R&D functions. The avenue to watch is the Pakistan Air Force’s (PAF) Project Azm, under which the PAF is having Pakistan Aeronautical Complex (PAC) develop and produce a medium-altitude long-endurance (MALE) unmanned aerial vehicle (UAV) and a fifth-generation fighter. The PAF Chief of Air Staff (CAS) envisioned a complete chain for human capital development, with Air University’s campus in Kamra playing a role in developing engineers and scientists for PAC and its Aviation Design Institute (AvDI). While modest in the beginning, consistent investment can yield sizable results over the long-term, making Pakistan a factor.

Elevating domestic R&D capacity can make Pakistan an attractive R&D partner for WA/MTCR members. While WA/MTCR membership is not possible, building sufficient incentive in terms of savings and earnings for certain WA/MTCR members (e.g. South Africa, Turkey and Ukraine) can result in strong bilateral R&D agreements. For example, South Africa might find that its companies will do better engaging in Pakistan than India or another WA/MTCR member. In turn, it can (and seemingly appears to be) engage Pakistan’s programs by offering its expertise and capacity while also exploring cost-saving opportunities in Pakistan (by sourcing work to Pakistani suppliers). This will not entirely compensate for the gains in actual membership nor will it assure support in sensitive areas (e.g. propulsion), but it can support work in other complex inputs, e.g. shorter-range rockets for air-to-air missiles. Likewise, other smaller players – such as Brazil, Ukraine, the Czech Republic and Poland – could see Pakistan in this light over the long-term.

Conclusion

Pakistan’s absence in the MTCR and WA stem from a combination of not having a strong foreign relations record as well as relatively limited fiscal strength for prospective suppliers and R&D capacity to entice WA and MTCR members to push for Pakistan’s inclusion. For Pakistan, its only available avenue for success is to forge a path of independence and pursuit of strength through strong bilateral relations. This is not an easy avenue, and the results may not be realized in the near-term, but it is better than non-action or half-action based on the hope that the U.S. will one-day support Pakistan. Fortunately, at least some quarters of Pakistan’s security leadership are of this view, most notably Air Chief Marshal (ACM) Sohail Aman, who has stewarded the founding of Kamra Aviation City under the explicit call for achieving independence from overseas suppliers, at least in the realm of securing modern combat aircraft. This must permeate across all other areas, especially with those in charge of foreign relations.

[1] “Angola’s first satellite to enter orbit on Dec. 26.” Xinhua. 21 December 2017. URL: http://www.xinhuanet.com/english/2017-12/21/c_136843113.htm (Accessed: 24 December 2017).

[2] William Graham. “Arianespace Vega rocket launches Mohammed VI-A.” NASA Space Flight. 07 November 2017. URL: https://www.nasaspaceflight.com/2017/11/arianespace-vega-mohammed-vi-a-launch/ (Accessed: 20 December 2017).

[3] “ISRO’s Scramjet Engine Technology Demonstrator Successfully Flight Tested” Indian Space Research Organisation (ISRO). URL: https://www.isro.gov.in/launchers/isro%E2%80%99s-scramjet-engine-technology-demonstrator-successfully-flight-tested (Accessed: 21 December 2017).