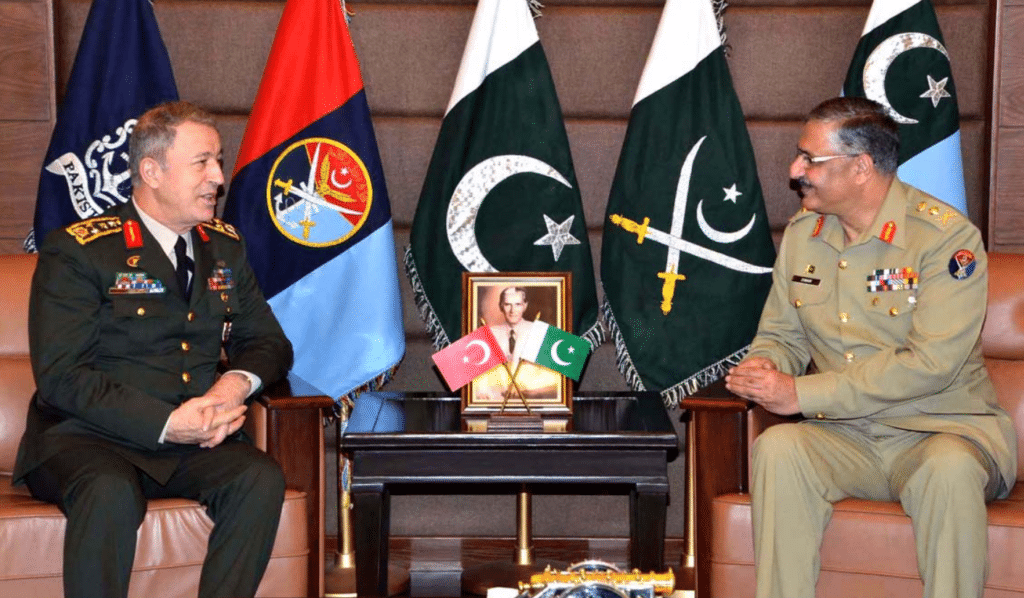

On 01 March 2017, the Turkish Armed Forces’ (TSK) Chief of General Staff – General Hulusi Akar – made an official visit to Pakistan. Gen. Akar met with Chairman of the Joint Chiefs of Staff Committee Gen. Zubair Mahmood Hayat, Chief of Army Staff Gen. Qamar Javed Bajwa, Chief of Air Staff Air Chief Marshal Sohail Aman, and Chief of Naval Staff Admiral Muhammad Zakaullah. During the visit, Gen. Bajwa called upon Turkey and Pakistan to further bilateral defence ties.

As per the Haber Turk, “negotiations were held to increase sharing of knowledge and experience in the fields of defence industry development, joint production, counter-terrorism and military education.”

Notes & Comments:

In 2016, Turkey emerged as one of Pakistan’s leading defence hardware and services suppliers, namely by securing a contract to upgrade the Pakistan Navy’s Agosta 90B submarines and selling advanced targeting pods to the Pakistan Air Force. These were follow-ups to earlier sales of software defined radios (SDR), a naval fleet tanker, fast attack crafts, towed howitzers and F-16 upgrade work from the early 2010s.

Turkish Aerospace Industries (TAI) and Savunma Teknolojileri Mühendislik ve Ticaret A.Ş. (STM) are also eager to secure sales for T-129 attack helicopters and MILGEM corvettes, respectively. If these programs come into fruition, Turkish defence hardware sales to Pakistan could reach U.S. $1 billion.

During the 2016 International Defence Exhibition and Seminar (IDEAS), which took place in Karachi in November, the Turkish Undersecretariat for Defence Industries (SSM) said (to MSI Turkish Defence Review) it had extended a financing plan to Pakistan to help with the MILGEM program.

Besides big-ticket items, the Turkish industry – especially Aselsan and Roketsan – have sought to broaden their business activities in Pakistan through supplying subsystems for current programs, such as the Heavy Industries Taxila (HIT) al-Khalid main battle tank (MBT) program, among others.

In parallel, the Turkish industry has also sought to engage with the Pakistani defence industry. At IDEAS in November, the SSM inked a purchase of 52 Super Mushshak basic flight trainers from Pakistan Aeronautical Complex (PAC). This is Pakistan’s largest single Super Mushshak order. Earlier, the SSM had also contracted Anka unmanned aerial vehicle (UAV) parts manufacturing to PAC.

It would be natural if offsets, co-production and/or workshare are also factors in proposed Turkish sales to Pakistan. In fact, while funding will generally be a precarious element to dealings with Pakistan, offsets may be a method to build competitiveness in the price-sensitive market.

However, progress in this area will depend on Pakistan’s willingness to open defence industry activity to its domestic private sector. For example, Aselsan’s offset agreements in Saudi Arabia and Kazakhstan involve – at the minimum – companies co-owned by the local government, Aselsan and the SSM. In general, offsets are serve as investments for the vendor, which incentivizes them to engage with the native private sector, namely through partnerships, subsidiaries and buyouts.

Thus far, the Turkish industry has preferred to engage in partnerships, such as with Taqnia and Military Industries Corporation (MIC) in Saudi Arabia. These partnerships will produce equipment such as SDRs, electronic warfare suites, electro-optical sensors and potentially even radars for local use and third-party export. Despite Pakistan’s depth of defence and security needs (especially in the civilian sector), it has not seen as much activity in this space, which indicates under-utilized defence industry potential.