2547Views 5Comments

Aselsan eager to expand activities in Pakistan

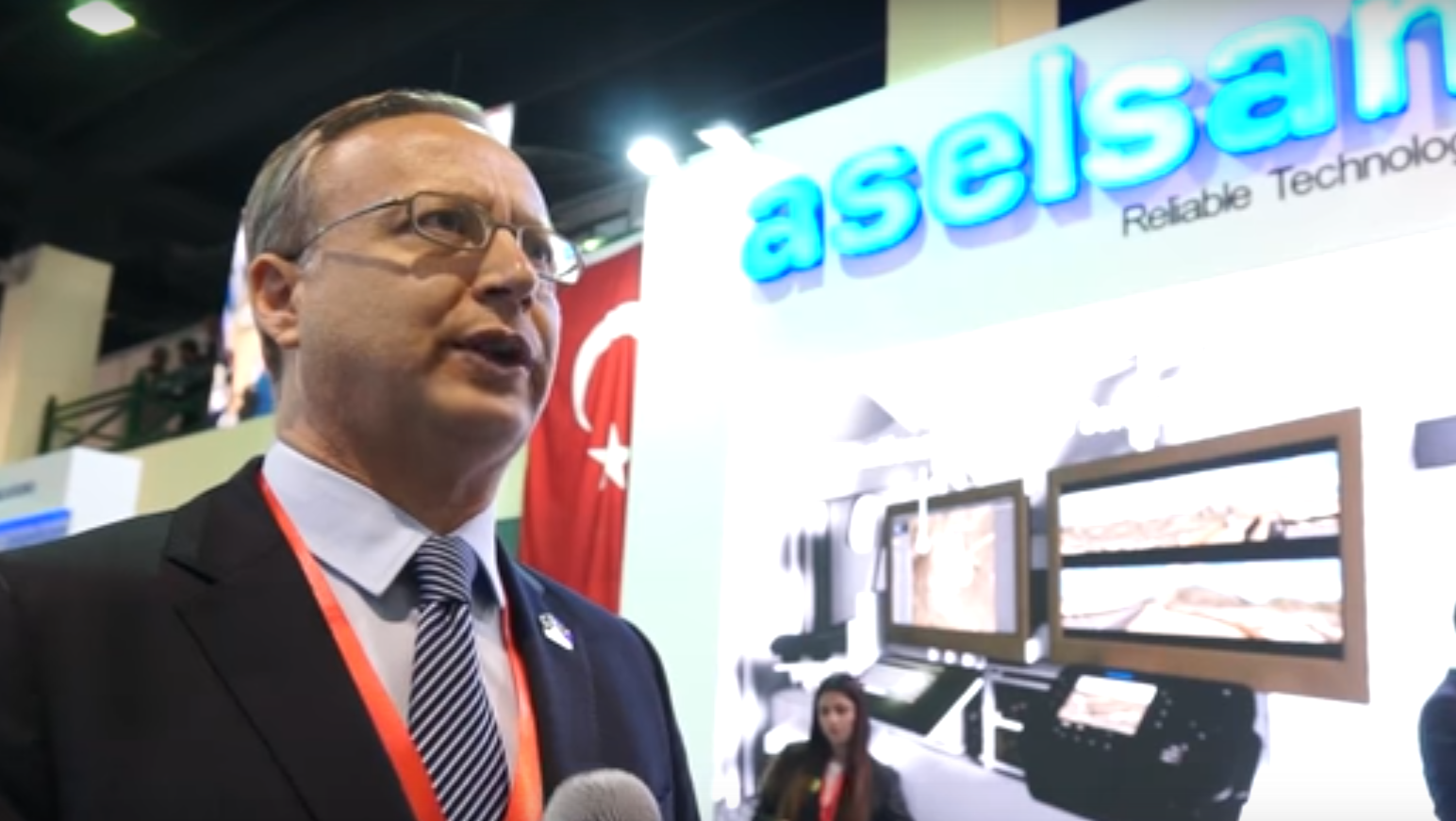

Speaking to Army Recognition, Aselsan’s Regional Business Development Manager for the Middle East and Africa Oğuz Yemişçiler outlined Aselsan’s interest in expanding its activities in Pakistan, describing it “a very important” market.

Aselsan has already secured several contracts from the Pakistani military.

Yemişçiler confirmed that the company sold ASELPOD advanced targeting pods to the PAF for use on the latter’s JF-17 Thunder lightweight multi-role fighter. In fact, the ASELPOD will join the PAF’s inventory by the end of this year. In June, Aselsan was awarded a $25 million deal by the PAF to supply 16 ASELPODs. Mr. Yemişçiler also noted that in regards to the ASELPOD, the PAF will be using a build identical to that in use by the Turkish Air Force, thus benefiting from the latest of Aselsan’s technology catalogue.

Yemişçiler also stated that Aselsan is “actively working” in the al-Khalid main battle tank (MBT) program and has been doing so for over 10 years. In tandem with outlining Aselsan’s expertise in upgrading MBTs, Aselsan is actively promoting its onboard electronics suite comprising of fire control, electro-optical, and communications systems for use on the al-Khalid II MBT, the first major iterative update of the al-Khalid.

Aselsan is also among several subsystems vendors supporting the Pakistan Navy’s Agosta 90B submarine upgrade program. Earlier this month, the company told IHS Jane’s that its ARES-2SC/NS electronic support measures (ESM) system was selected for the program (which is being led by another Turkish vendor, Savunma Teknolojileri Mühendislik A.Ş. or STM).

Notes & Comments:

Chinese and Turkish companies were the leading exhibitors at the 2016 International Defence Exhibition and Seminar (IDEAS), showcasing their collective prominence in the Pakistani defence market. Through the 1990s and 2000s, China emerged as Pakistan’s leading armaments and armament technology supplier, but the U.S. was Pakistan’s leading supplier of qualitative drivers.

However, transactions of that nature between Washington and Islamabad have slowed in recent years, pushing Pakistan to seek such drivers from other sources, including China. However, Ankara has opted to step in as a prospective alternative source for such technology, and in some areas, it has succeeded. But Turkey is eager to expand its subsystem sales to the sale of complete solutions, most notably the Turkish Aerospace Industries (TAI) T-129 attack helicopter and STM MILGEM corvette.

The sale of these big-ticket platforms would enable multiple Turkish companies, among them Aselsan, to secure a strong and long-term presence in Pakistan. For Aselsan specifically, T-129 and/or MILGEM sales would have it supply Pakistan with a range of onboard subsystems, such as sensors, for example. But in parallel, Aselsan is also making clear moves towards becoming a core supplier of subsystems on Pakistan’s existing platforms, such as the al-Khalid MBT and JF-17, or its forthcoming programs, most notably the Navy’s next-generation submarine program. With each slated as mainstay platforms in their respective service arms, the potential scale involved would amount to valuable long-term business lines for Aselsan.

5 Comments

by John John Slade

Well, at least Pakistan got high quality stuff from Turkey rather than China. Beside, more high quality stuff the lesser flaw are.

by bill

The only drawback of Turkey is unavailability of credit line like China which is hindering many big ticket deals with Pak.

by Sami Shahid

Well if Pakistan starts producing Advanced Targeting Pods then it will be a great step !

by Syed

The good thing about partnership with Turkey is that we can develop indigenous resource,not too many countries produce everything,it’s a collective effort

by Saptarshi Dasgupta

With Sniper and Aselpod Pakistan matches our LITENING G3/4/5 and Talios (with Rafale). PAF is surely coming back to its old glory.