9635Views

IDEX 2025 Recap: Emirati Defence Industry Accelerates Momentum and Aims for Global Presence Quwa Premium

The UAE defense industry emerged as a surging force at the 2025 International Defence Exhibition and Conference (IDEX 2025), using the exhibition in Abu Dhabi to showcase advanced indigenous solutions, secure multibillion-dollar contracts, and forge strategic partnerships in leading Western European and East Asian defence markets.

EDGE Group spearheaded this effort with record-breaking sales, while emerging original equipment manufacturers (OEM) like Calidus and collaborations with large foreign vendors demonstrated UAE’s growing role as a defence systems integrator and subcontractor.

EDGE Group Dominates with $2.9 billion USD in Sales

EDGE concluded IDEX 2025 with $2.9 billion in new sales with 16 major contracts and 32 international agreements, cementing its position as the Middle East’s premier defense technology exporter. In fact, it used a 9,000 m2 pavilion to showcase 218 systems – more than double its portfolio in 2023 – spanning a wide range of autonomous platforms, smart weapons, and novel cybersecurity solutions.

Key contracts included:

- $1.18 billion USD in aerial munitions sales to the UAE Armed Forces

- $61.8 million USD for GPS PROTECT anti-jamming systems to the UAE Ministry of Defence

- €500 million deal with Fincantieri to support the UAE Navy’s (UAEN) fleet

When it was established, exports made about 2% of EDGE Group’s sales. In 2024, exports made up 35% of EDGE Group’s business. EDGE Group Chairman Faisal al Bannai said, “if we do close some of the deals we’re expecting to close this year, it could go to 50% or beyond 50% of our orders.”

Thus far, sales have largely been in the Middle East, Asia, Europe, and Latin America. The U.S. is the only largely untapped market for EDGE Group, currently at least.

One of the factors helping EDGE Group grow its exports is international growth, especially through a burgeoning network of subsidiaries. It currently has 35 subsidiaries – up from 20 in 2023 – via strategic acquisitions, like a 50% stake in Brazil’s SIATT or a majority stake in Estonia-based Milrem Robotics.

Elevating Sensor Fusion

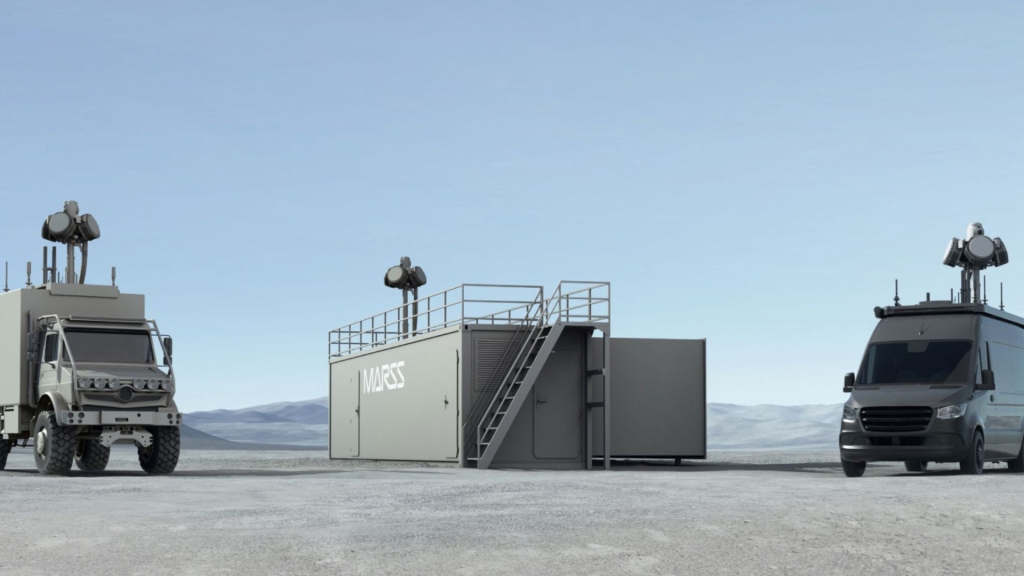

One of EDGE Group’s strategic partners, MARSS, unveiled its latest iteration of the NiDAR 4D system, a cutting-edge command, control, communications, and computing (C4) platform designed to provide multi-domain protection across air, surface, and underwater environments.

Central to NiDAR 4D’s capabilities is its proprietary Hybrid Intelligence technology, which combines traditional algorithms with artificial intelligence (AI) and human intelligence to enhance real-time situational awareness and decision-making.

The system integrates data from a wide range of sensors—including radar, electro-optical/infrared (EO/IR) cameras, sonar, and radio-frequency (RF) detectors—into a unified operational interface.

Currently, the NiDAR 4D integrates the following sensors:

- Radars: NiDAR 4D incorporates radar technologies from providers like Terma and Leonardo DRS RADA Technologies for wide-area surface detection and counter-UAS capabilities. These radars enable the system to detect aerial and surface threats, including drones and fast-moving craft, at extended ranges.

- Sonar Arrays: Sonardyne sonar systems are used for underwater threat detection, such as identifying divers, mini-submarines, and other subsurface threats. This integration ensures robust maritime domain awareness.

- EO/IR Sensors: High-definition EO/IR cameras from providers like L3 Harris provide day-and-night imaging capabilities. These cameras are gyro-stabilized and equipped with cooled mid-wave infrared (MWIR) technology for precise target tracking and classification under various environmental conditions

- Radio Frequency (RF) Direction: RF detection systems, such as those from BlueHalo, are integrated to monitor drone communications and identify potential aerial threats through their signal emissions.

- Passive RF Sensors: Systems like Aaronia passive RF sensors can also be utilized for detecting radio frequency emissions from drones or other electronic devices in the vicinity.

This approach eliminates the need for multiple disjointed systems and reduces cognitive burden on operators by automating detection, classification, and response recommendations.

MARSS announced at IDEX 2025 that it had successfully deployed NiDAR 4D-powered defense systems at two major naval bases within the Gulf Cooperation Council (GCC).

These installations are among the region’s largest naval facilities and are now safeguarded by NiDAR’s multi-layered security network. The projects were completed in early 2025 under a contract valued at over $50 million.

A Growing Portfolio of Innovative Defence Solutions

At IDEX 2025, EDGE Group unveiled a comprehensive portfolio of 46 new weapon systems and solutions across air, land, sea, cyber, and space domains. These systems highlight EDGE’s focus on innovation and its growing role as a global leader in the defense industry.

Air Domain

Jeniah UCAV: Revealed at IDEX 2023 and developed by EDGE Group’s ADASI, is the UAE’s first jet-powered unmanned combat aerial vehicle (UCAV), designed for high-speed, low-observable (LO) operations across land and maritime domains.

With a maximum takeoff weight (MTOW) of over 4,000 kg, it features an internal weapons bay with a payload capacity of 480 kg, and a top speed exceeding 1,000 km/h.

The Jeniah successfully completed its first autonomous test flight on March 15, 2024, demonstrating its advanced capabilities for offensive strikes and reconnaissance in contested environments.

Hunter Series Loitering Munitions: Developed by EDGE Group’s Halcon subsidiary, the Hunter represents a versatile family of fixed-wing and rotary-wing smart munitions designed for intelligence, surveillance, reconnaissance (ISR), and precision strike missions.

Key platforms include the Hunter 2-S, a tube-launched swarming drone with a 50 km range, 45-minute endurance, and 2 kg payload capacity, optimized for coordinated swarm attacks. The Hunter 10, with a range of 100 km and extended loitering capabilities, is tailored for long-range precision strikes in contested environments.

The series also features specialized variants like the Hunter 2-SJ, designed to detect and neutralize enemy electronic warfare systems, and the Hunter-N, optimized for naval operations with rapid deployment from vessels and a 500-gram warhead for tactical strikes

NASEF-20 and NASEF-125 Cruise Missiles: The NASEF series, developed by EDGE Group’s Halcon subsidiary, was first revealed at the Dubai Airshow in November 2023 and represents a new class of subsonic cruise missiles designed for precision strikes against land and naval targets.

The NASEF-20 is a low-cost cruise missile (LCCM) optimized for soft target engagement, guided by GNSS with an optional Semi-Active Laser (SAL) seeker for enhanced accuracy.

Meanwhile, the NASEF-125 is a more advanced subsonic cruise missile with dual capabilities for anti-ship and ground attack missions, featuring Imaging Infrared (IIR) and active radar homing seekers, as well as advanced sea-skimming capabilities to evade detection.

At IDEX 2025, EDGE showcased the NASEF as part of its expanding portfolio of precision-guided munitions, emphasizing their modular design and adaptability for integration with UAVs and naval platforms.

Desert Sting Family: At IDEX 2025, the Desert Sting munitions were prominently showcased on platforms like the Jeer UAV, demonstrating their compatibility with advanced unmanned systems.

Designed for deployment from UAVs, fighter aircraft, and other aerial platforms, the Desert Sting series includes lightweight guided-glide weapons such as the DS-16 and the larger DS-25.

Both offer precision targeting through GNSS-assisted INS guidance and optional semi-active laser-homing (SALH) seekers. The DS-16, currently in production, boasts a range of up to 18 km when launched from high altitudes, while the DS-25, entering production in Q3 2025, features a 14-km range and a 40-meter lethal radius with its 25-kg warhead.

Land Domain

NIMR RCV: The NIMR Robotic Combat Vehicle (RCV), developed under EDGE Group’s NIMR division, was first revealed at IDEX 2023 and showcased again at IDEX 2025.

This 8×8 unmanned ground vehicle (UGV) is designed to enhance battlefield mobility and survivability by providing overmatching firepower while maintaining standoff distance from enemy threats.

Modular in design, the NIMR RCV integrates advanced autonomous capabilities, including Milrem Robotics’ Intelligent Functions Kit (MIFIK), which enables autonomous navigation, multi-asset coordination, and real-time command-and-control integration.

At IDEX 2025, EDGE emphasized the NIMR RCV’s adaptability for multi-role missions, ranging from reconnaissance and logistics support to direct combat operations.

The NIMR RCV leverages hybrid-electric propulsion for near-silent operation, advanced off-road performance, and compatibility with a variety of weapon systems, including remote weapon stations and loitering munitions.

With its focus on reducing risks to personnel while maintaining tactical superiority, the NIMR RCV is positioned as a key enabler for modern mechanized forces.

Milrem Havoc 8×8 RCV: Estonian defense firm Milrem Robotics unveiled its cutting-edge Havoc 8×8 Robotic Combat Vehicle (RCV) at IDEX 2025.

The Havoc, weighing 12 tonnes without payload and measuring 6.5 meters in length, features a hybrid-electric drivetrain that enables near-silent movement, an operational range of 600 km, and a top road speed of 110 km/h.

This advanced propulsion system not only enhances stealth but also provides instantaneous torque for superior off-road performance, making the vehicle adept at navigating rugged terrains, urban environments, and high-altitude passes.

he Havoc’s modular design allows it to carry up to five tonnes of mission-specific payloads, including a turreted 30 mm cannon, anti-tank missile launchers, counter-UAV systems, and surveillance radars.

This adaptability is further supported by its integration into Milrem’s unified autonomy ecosystem, which ensures compatibility with other unmanned platforms while reducing development and maintenance costs.

Designed as a force multiplier for smaller or dispersed forces, the Havoc can operate autonomously over extended distances using satellite communications like Starlink, enabling it to serve as a forward-deployed asset for reconnaissance or direct engagement ahead of manned units

Sea Domain

MANSUP-ER Anti-Ship Missile: The MANSUP-ER, an extended-range variant of the Brazilian Navy’s National Anti-Ship Missile (MANSUP), was co-developed by EDGE Group and SIATT and officially revealed at the Dubai Airshow in November 2023.

Designed for precision engagement of naval and coastal targets, the MANSUP-ER boasts a range of 200 kilometers, a speed of 950 km/h, and a 150-kg explosive payload.

It integrates inertial navigation with GNSS assistance and includes active radar homing for enhanced accuracy in contested environments.

At IDEX 2025, EDGE and SIATT showcased the MANSUP-ER as part of their growing collaboration, emphasizing its adaptability for air, land, and sea platforms. The missile is slated for integration onto Brazil’s Tamandaré-class frigates and UAE naval vessels.

Falcon AUV: The Falcon AUV, developed by EDGE Group in collaboration with Portugal’s OceanScan, was showcased at IDEX 2025 as part of the UAE’s “Ghost Fleet” initiative to deploy 50+ unmanned surface and undersea vehicles by 2030.

Designed for mine countermeasures (MCM) and ISR missions, the Falcon AUV features a modular payload bay, synthetic aperture sonar (SAS) for mine detection, and 48-hour endurance at 5 knots.

EDGE highlighted its successful Red Sea trials and integration into the UAE Navy’s autonomous fleet, emphasizing its role in enhancing maritime security while reducing risks to personnel in contested environments.

170 Detector USV: The EDGE Group 170 Detector USV, first unveiled at IDEX 2023, is a versatile 17-meter unmanned surface vessel designed for maritime ISR and underwater mine detection.

Configurable for manned or unmanned operations, it features silent electric propulsion (4 hours at 5 knots) and high-speed diesel mode (40 knots), with retractable 3D sonars, a 360-degree camera, and a payload capacity of up to 1,000 kg for missions including surface warfare and seabed mapping.

Space Domain

EYE-SAT EO Satellite: The EYE-SAT EO Satellite, unveiled by EDGE Group’s FADA (Falcon Advanced Dynamics Arabia) in collaboration with Space42 at IDEX 2025, is a high-resolution electro-optical satellite designed for ISR missions.

With a 0.5-meter resolution imaging capability, the 150kg satellite supports dual-use applications, including environmental monitoring and urban planning, and is part of the broader QUAZAR LEO constellation to ensure secure, quantum-resistant communications.

Slated for a Q4 2025 launch aboard a SpaceX Falcon 9 rocket, EYE-SAT underscores the UAE’s push to bolster sovereign space capabilities through advanced AI-driven analytics and partnerships.

Calidus Expands Armoured Vehicle Ecosystem

Wahash IFV: $642M Deal and Production Ramp-Up

The UAE’s Tawazun Council awarded Calidus Land Systems a AED2.36 billion ($642.5 million) contract for its Wahash 8×8 infantry fighting vehicle (IFV) during IDEX 2025, signaling a major boost for the Emirati defense industry.

Unveiled at IDEX 2019, the Wahash is a modular armored platform designed to integrate the BMP-3 turret—already in service with UAE forces—providing a 100mm main gun, 30mm coaxial cannon, and Kornet anti-tank guided missiles (ATGMs).

The IFV features a combat weight of 32.5 tonnes, amphibious capabilities, and capacity for three crew members plus eight dismounts, leveraging a 724 hp engine and independent hydropneumatic suspension for enhanced mobility in desert terrain.

The $642.5 million contract likely pertains to the original BMP-3-armed Wahash, mirroring the UAE’s 2017 procurement of 400 Otokar Rabdan IFVs. The Wahash’s adaptability was further shown through integration with Aselsan’s KORKUT 35mm air defense turret, enhancing its role in counter-UAS and short-range air defense missions.

Light Infantry Fighting Vehicle (LIFV) Debut

At IDEX 2025, Calidus also showcased a light infantry fighting vehicle (LIFV) variant, shedding amphibious systems to prioritize air transportability and lower costs.

The LIFV retains the Wahash’s powertrain but pairs it with Aselsan’s Nefer unmanned turret, armed with a 30mm 2A42 cannon and 7.62mm machine gun.

With a combat weight of 27 tonnes (up to 34 tonnes gross vehicle weight), the LIFV is equipped with Turkish company Aselsan’s Nefer unmanned turret, armed with a 30mm 2A42 autocannon, a coaxial 12.7mm or 7.62mm machine gun, and optional anti-tank guided missiles. The turret also features a roof-mounted remote weapon station (RWS) with a 7.62mm machine gun, providing versatile firepower for urban and conventional battlefield operations.

Designed to accommodate a crew of three and up to ten soldiers, the vehicle prioritizes internal space by using an unmanned turret configuration. The LIFV can reach speeds of up to 130 km/h with a range of 700 km, making it highly mobile across diverse terrains.

Calidus confirmed that the LIFV has entered production for the UAE Armed Forces in multiple configurations, underscoring the UAE’s growing defense manufacturing capabilities and its commitment to self-reliance in military technology. With its modular design and competitive specifications, the LIFV is expected to attract interest from regional and international buyer

Naval Expansion: Localization and Autonomous Systems

MAESTRAL Joint Venture and Fleet Modernization

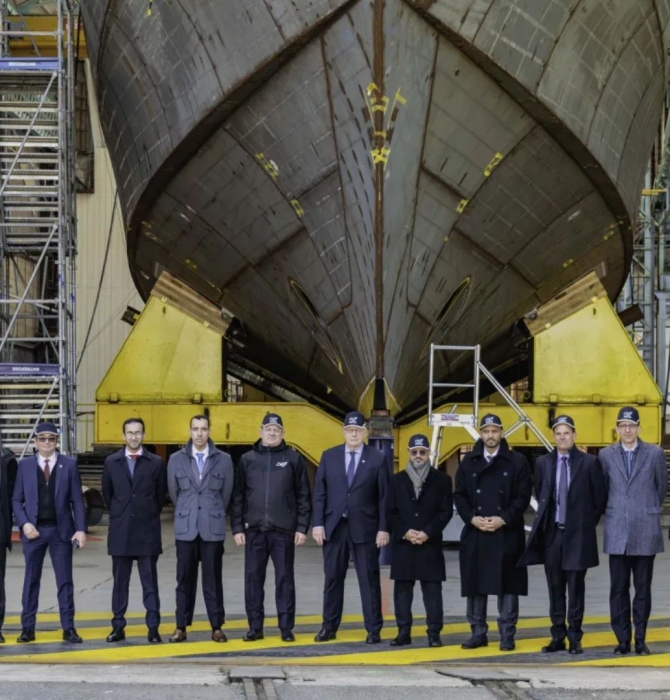

At IDEX/NAVDEX 2025, the MAESTRAL joint venture, a collaboration between EDGE Group and Fincantieri, secured a €500 million ($524 million) contract to provide comprehensive In-Service Support (ISS) for the UAE Navy over the next five years.

Awarded by the UAE’s Tawazun Council, the contract designates MAESTRAL as the Industrial Strategic Partner responsible for fleet-wide maintenance management, lifecycle support, and logistical services. This effort will cover the UAE Navy’s diverse fleet of 82 vessels, including Abu Dhabi-class corvettes, Falaj-class patrol vessels, Ghannatha boats, minehunters, and landing craft.

The partnership aims to enhance fleet readiness while supporting the UAE Navy’s transformation into a more agile and capable force capable of addressing evolving maritime threats.

The ISS program will leverage both local expertise from Abu Dhabi Shipbuilding (ADSB) and Fincantieri’s global shipbuilding capabilities to deliver advanced maintenance solutions.

Hamad Al Marar, EDGE Group CEO, emphasized that this contract reflects “the trust placed in MAESTRAL’s advanced capabilities” and its ability to deliver turnkey maritime solutions.

Pierroberto Folgiero, Fincantieri CEO, described the deal as a “pivotal step” in expanding Fincantieri’s regional footprint while reinforcing its commitment to industrial partnerships.

By combining UAE national resources with international expertise, MAESTRAL is poised to deliver cutting-edge maintenance services that ensure operational excellence for the UAE Navy while fostering local defense industry growth.

Strategic Partnerships: Localizing Technologies

GM Defense Collaboration

At IDEX 2025, GM Defense, a subsidiary of General Motors, and EDGE Group announced a strategic partnership to jointly explore opportunities in the development of advanced light tactical vehicles for military customers in the Middle East, Africa, and Asia.

The collaboration, formalized through a Memorandum of Understanding (MoU), focuses on leveraging GM Defense’s technical expertise in vehicle engineering and EDGE’s regional infrastructure and operational capabilities.

A key highlight of the partnership is the Next Generation Tactical Vehicle-Hybrid (NGTV-H), which was showcased at IDEX with EDGE’s Hunter SP loitering munition launcher mounted on its rear. The NGTV-H features hybrid propulsion for enhanced range and stealth, making it suitable for a variety of tactical missions.

This agreement also includes the potential local production of GM Defense’s Infantry Squad Vehicle (ISV) in the UAE, aligning with EDGE’s focus on fostering indigenous manufacturing capabilities.

Steve duMont, President of GM Defense, stated: “The MoU is not just to bring [the NGTV] to the UAE as a product, but to bring it there as a vehicle to be produced in the region for the region’s needs, using an Emirati and regional supply chain to help us reduce the amount of transportation, bring jobs into the region, bring technology into the region.”

Turkish Synergies

EDGE Group deepened its collaboration with Turkish defense companies at IDEX 2025, securing agreements that enhance technological synergies and expand regional defense capabilities.

Korkut Air Defense on Wahash 8×8: EDGE subsidiary Calidus and ASELSAN announced the integration of the Korkut 35mm self-propelled air defense system onto the Wahash 8×8 armored vehicle. The Korkut, originally designed for tracked platforms, now features:

- Twin 35mm autocannons firing 1,100 rounds per minute

- Integration of ATOM 35mm programmable airburst ammunition to counter drones and missiles

- Stabilized turret with radar and electro-optical tracking for mobile engagements.

This adaptation marks a significant upgrade for the Wahash, which already serves as a cornerstone of UAE mechanized forces. The collaboration includes joint production plans, with ASELSAN providing technical support to localize critical subsystems.

Potential Hürkuş Production: Turkish Aerospace Industries (TAI) and Calidus signed an agreement to explore co-producing the Hürkuş trainer.

Cyber/Electronic Warfare (EW): Preparing for New Warfare Environments

GPS PROTECT and Sovereign Communications

EDGE Group secured a AED 227 million (USD 61.8 million) contract with the UAE Ministry of Defence to supply its GPS-PROTECT anti-jamming systems, reinforcing the Emirates’ focus on securing critical navigation capabilities in electronic warfare environments.

Unveiled during the event, the compact system is designed to protect global navigation satellite system (GNSS) receivers from jamming and interference, ensuring uninterrupted command, control, and navigation for air, land, and maritime platforms.

Developed by EDGE subsidiary SIGN4L, the GPS-PROTECT integrates advanced signal processing to mitigate spoofing and jamming threats, addressing a critical vulnerability for modern militaries reliant on satellite-guided operations.

Analysis: Market Implications and Future Direction

The UAE’s defence industrial strategy seems to reveal a deliberate shift toward becoming a global leader in asymmetric warfare technologies. By prioritizing drones, smart munitions, and EW systems, i.e., areas with high export potential and lower barriers to entry compared to traditional platforms, the UAE is positioning itself as a nimble, cost-competitive supplier in an evolving market.

It seems that the EDGE Group wants its solutions to cater to the demand for affordable and modular solutions, particularly in regions Africa, Asia, and the Middle East, where budgets are constrained but threats from drones and EW are escalating.

This export-centric strategy is not merely transactional but part of a broader economic vision to diversify the UAE’s economy beyond hydrocarbons. Defense exports, which surged from $1.2 billion in 2020 to $4.8 billion in 2024, are a pillar of the UAE’s goal to reach $20 billion annually by 2030.

Ultimately, the UAE’s defense strategy is a calculated response to global trends: the proliferation of drone warfare, the centrality of EW in modern conflict, and the rise of cost-conscious procurement.

By avoiding direct competition in large-platform markets (e.g., fighter jets, main battle tanks,etc.) and instead entering niche sectors where agility and innovation yield outsized returns, the UAE is carving a unique niche.

While geo-political realities are a factor, it is possible that the UAE’s more concerted focus on niche spaces is affecting its interest in pursuing fighter and other platforms. That said, should EDGE and other Emirati players grow into bigger defence contractors by commanding niche spaces, they may explore investments in big-ticket platforms. Indeed, Emirati officials have reportedly signalled some interest in Turkish programs like the KAAN next-generation fighter. This interest may be a long-term play meant to prepare the Emirati industry to eventually engage in large platforms.

Finally, the Emirati defence sector has emerged as a strategic enabler for British and European defence firms seeking to expand their global footprint, particularly in markets where geopolitical sensitivities or export restrictions might otherwise limit direct access.

Through joint ventures, technology transfer agreements, and localized production initiatives, the UAE’s defence ecosystem – spearheaded by EDGE Group and Tawazun Council – has become a critical intermediary for Western defence technologies.