The Royal Thai Navy (RTN) recently secured USD $383.4 million for the first of three S26T air-independent propulsion submarines (SSP) it intends to procure from the China Shipbuilding Industry Corporation (CSIC), the Bangkok Post reports.

As per the Bangkok Post: The funding was allocated in the national budget for 2017, which was approved by Thailand’s parliament. Upon approval from the cabinet, Thailand will order the submarine under a government-to-government deal.

As the lead ship will absorb the required logistics, maintenance, training and weapon (munition?) costs, the unit costs of the remaining two S26Ts will be less than the first.

The total cost of the S26T submarine program will be USD $1.02 billion.

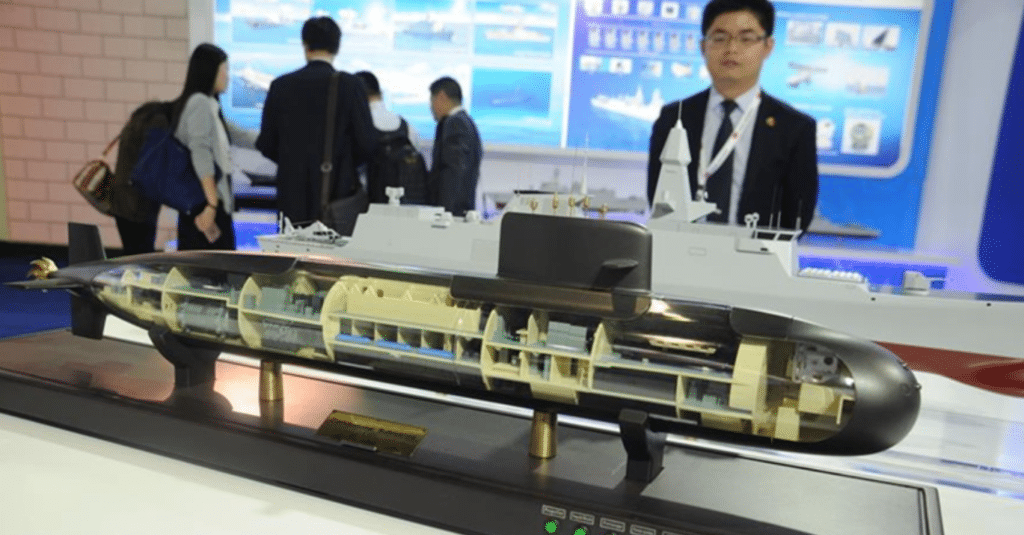

The Bangkok Post reports that the S26T “has a submerged displacement of 2,600 tons and is equipped with an air-independent propulsion [AIP] system.”

Thailand is seeking the S26Ts as part of its comprehensive naval modernization efforts, which also include the procurement of new surface warships, such as its recently launched 3,650-ton frigate.

Notes & Comments:

The S26T appears to be the AIP-equipped variant of the S20, which is the main design offered for export by CSIC. While larger than the base S20, which has a submerged displacement of 2,200 tons, the S26T is still lighter than the Type 041 Yuan-class submarine, a mainstay of the People’s Liberation Army Navy’s sub-surface fleet. It is possible, if not likely, that the Pakistan’s forthcoming Hangor-class submarines will be variants of the CSIC S26 design. As with the Hangor SSPs, it is not confirmed what type of AIP system will be in place for the S26T – Stirling or otherwise.

With Pakistan and Thailand in place, China is succeeding in the market with its submarine programs. While competitive pricing is an obvious draw, Thailand certainly had the option of pursuing Western or Western-influenced designs (e.g. from South Korea). Sufficient performance at markedly accessible pricing is a key commercial gain, and if China has indeed passed threshold, it could see considerable long-term growth in the naval market. Understandably, the developing world will be China’s principal focus.

However, ‘sufficiency and affordability’ might incur the risk of understating the nature of China’s naval offerings, even in the submarine space. For example, at the 2016 Defence Services Asia exhibition, the China Aerospace Science and Industry Corporation (CASIC) showcased a new 290 km sub-launched anti-ship missile (AShM) – the CM-708UNB. At Air Show China 2016, CASIC marketed a supersonic AShM – CM-302 – that may be an export variant of the YJ-12, which is a supersonic cruising AShM. If factored into the possibility that China could potentially be developing (or has developed) a fuel-cell based AIP system and the frequent iterative development cycle for the Yuan-class, China has a compelling submarine portfolio.