2807Views 4Comments

Pakistan’s KSEW inks contract with TTS Group for Syncrolift ship lift-and-transfer system

Pakistan’s Karachi Shipyards & Engineering Works (KSEW) took a step in implementing its infrastructure modernization plans by inking a $29.8 million U.S. deal for the Syncrolift ship lift-and-transfer system from Norwegian ship design and building firm TTS Group.

In its official press release TTS Group states that design and development work will be done in Norway, with manufacturing planned in China and Europe. KSEW will receive the system in the “first half of 2019.”

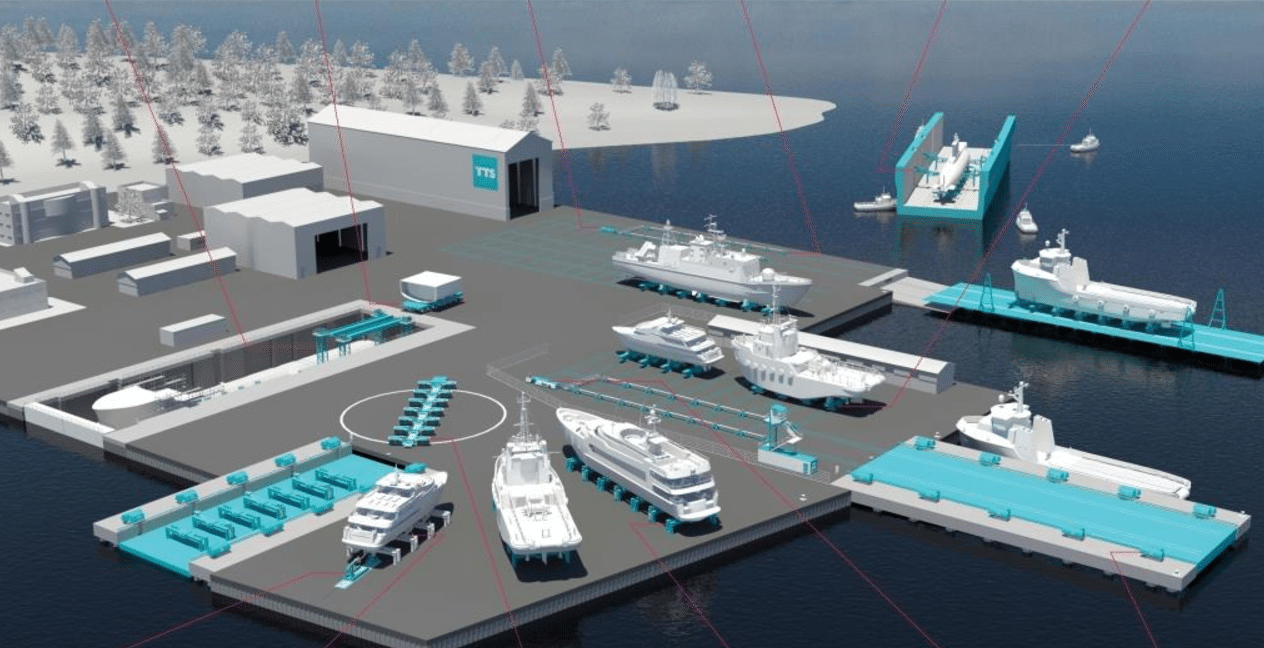

The Syncrolift enables shipbuilders to lift ships from sea-level to land-level, where TTS Group’s system of “advanced hydraulic transfer trollies” move ships to and from production or repair sites on land.

In contrast to drydocks, the Syncrolift-enabled site can handle as many as 10 ships, providing “volume and efficiency advantage[s] compared to … shipyards using drydocks.”

KSEW’s Syncrolift ship-lift system will handle ships of up to 9000 tons.

Notes & Comments:

The Pakistan Ministry of Defence Production (MoDP) set the acquisition of a ship lift-and-transfer system – i.e. the TTS Group Syncrolift – as a priority for KSEW in 2017.

According to the specifications detailed in the MoDP’s annual yearbook for 2015-2016, the ship lift-and-transfer system would have to lift vessels of up to 8,000 tons. In turn, the lift-system will be connected to an ‘elaborate’ rail-linked system that would, using 30 winches (i.e. motorized trollies), place the ship to one of 13 “custom-built” workstations on land. The acquisition will involve a transfer-of-technology element whereby after-sale maintenance of the system will be managed locally.

The Syncrolift is being bought to lift ships from sea to land, but unlike a drydock system – which is fixed – 30 trollies would physically move the hull to one of 13 sites in-land. Conversely, the rail-transfer system will move ships from the in-land station to the ship-lift system, where it will then be laid for launch at sea.

TTS Group’s website shows that the Syncrolift is a complete system comprising of a ship elevator as well as rail-transfer system. Based on TTL Group’s press release and the MoDP’s description, it appears that KSEW is procuring elevator, rail-transfer system and trollies.

The MoDP states that the acquisition will “increase business capacity and efficiency of ship turnover by three times.” It adds that the system will offer KSEW better commercial growth prospects, especially in the ship repair market, and allow it to fully support “all present and future national maritime and defence objectives.” The MoDP also claims that the system will enable the domestic construction and launching of submarines “for the first time.”

The Syncrolift acquisition speaks to KSEW’s efforts to modernize its infrastructure and enable it to assemble ships (e.g. the MILGEM corvette) more quickly and, eventually, undertake a greater share of production tasks. This will support the Pakistan Navy by accelerating its fleet modernization efforts and allow it to confer more tasks to the local industry. The latter will enable the Pakistan Navy to reduce costs by relying on Pakistan’s currency as well as local labour and material costs.

It appears that the Pakistan Navy’s next-generation submarine program – i.e. the Hangor-class submarine – is the launching point for this endeavour. KSEW will manage four of the eight submarines. The MoDP states that the steel-cutting of the first Hangor-class submarine (to built at KSEW) is scheduled for October 2020. The four KSEW ships are expected to be in the hands of the Pakistan Navy by 2028.

While KSEW will take on more construction work, the requisite steel, propulsion and other critical components of the Hangor-class will still be imported. However, enhancing KSEW’s construction capacity may incentivize entities such as Maritime Technologies Complex (MTC) to explore in-house ship design and development. Like many other ship design entities overseas, MTC could develop original designs and then acquire the requisite materials and subsystems directly from manufacturers. MTC would basically assume the role of a main contractor like that of STM and CSOC in Turkey and China, respectively.

Alternatively, incumbent naval contractors already dealing with Pakistan – such as STM, CSOC and the Netherlands’ Damen Shipyards – could see KSEW’s modernization as an opportunity to pitch custom solutions to the Pakistan Navy. While key materials and systems would still be imported, KSEW’s competency in construction would remove the need to pre-fabricate hulls, which will help control costs and provide more flexibility to these companies in their offerings.

4 Comments

by Mohsin Ali

Good to know that Pakistan is doing some upgrade for PN.

by Ali Afzal

This is great

by Nayyar Azam Saifi

This is a great news. This will enhance KSEW shipbuilding and maintenance capacity. Pakistan now should move to push MTC to work on good FFGs design with displacement of 6k to 7k tons with good arsenal. CM 302 Export variant of YJ-12 ASM can be a wonderful addition to navy surface combatants

by Kazmi

This undoubtedly, is a great step towards Indigenization, capacity and capability building of KSEW and will surely boost the modernization efforts of Pakistan Navy and PMSA in future.