2373Views 54Comments

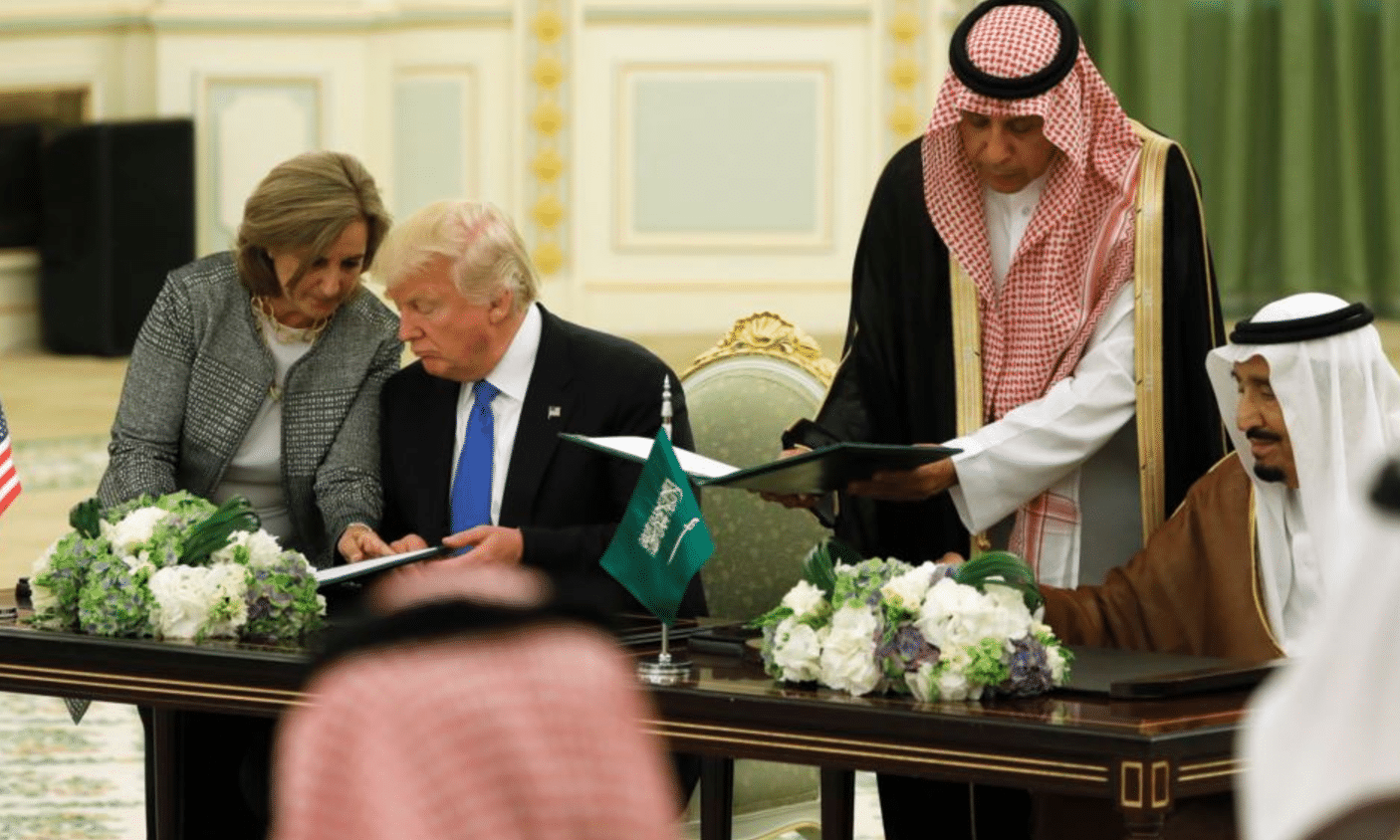

Saudi Arabia and America ink $110 billion arms deal

Saudi Arabia and the U.S. inked a $110 billion U.S. arms deal involving the sale of helicopters, air defence systems, guided munitions and other systems to Riyadh.

The landmark agreement was signed on President Donald Trump’s inaugural foreign visit since becoming the 45th President of the United States. This will be followed by $350 billion in sales over the next 10 years.

Lockheed Martin

In its press release, Lockheed Martin says the deal comprises of agreements and contracts outlining the sale of “integrated error and missile defence systems, multi-mission surface combatant ships (MMSC), radar systems, surveillance systems, tactical aircraft and rotary wing programs” to Saudi Arabia.

The MMSC is a development of the Littoral Combat Ship (LCS). In 2015, Lockheed Martin had proposed the MMSC to Riyadh for the latter’s corvette requirement. The original deal envisioned the sale of four MMSC for $11.25 billion. In early 2016, Riyadh balked at the deal and approached Spain’s Navantia for five Avante 2200 corvettes. Bloomberg reports that the new MMSC contract is worth $6 billion U.S.

Lockheed Martin signed a letter-of-intent with Taqnia to “form a joint venture to support final assembly and completion” of 150 Sikorsky S-70 Black Hawk utility helicopters. Lockheed Martin and Taqnia had held talks for the S-70i in 2016.

Lockheed Martin will also sell the Terminal High Altitude Area Defence (THAAD) system. The New York Times reports that Trump’s senior adviser (and son-in-law) Jared Kushner contacted Lockheed Martin CEO Marillyn Hewson by phone to request a price reduction in the THAAD for Saudi Arabia. Lockheed Martin will also sell additional PAC-3 Patriot surface-to-air missile (SAM) systems.

Lockheed Martin also signed a memorandum-of-understanding with the newly established Saudi Arabian Military Industries (SAMI) to “provide for localization efforts associated with [MMSCs] and Aerostats.”

Through these agreements, Lockheed Martin states that it is playing a major role in Saudi Arabia’s Vision 2030 aim, which projects Saudi Arabia sourcing at least 50% of its defence hardware and services locally. Seeing the scope of the agreements, it is apparent that Vision 2030 is being pursued through commercial offsets, co-production and local maintenance, repair and overhaul (MRO). In bringing these programs to fruition, Lockheed Martin expects the creation of “thousands of jobs” in Saudi Arabia over 30 years.

Boeing

The U.S. and Saudi Arabia will also sign an agreement for a $3.5 billion sale of 48 Boeing CH-47F Chinook transport helicopters. The Chinook program will join ongoing Boeing contracts in Saudi Arabia, such as the F-15SA, which Riyadh ordered in 2010 under a $29 billion purchase for 84 new-built and 70 upgraded jets.

Raytheon

In its press release, Raytheon states that it has signed a memorandum-of-understanding with SAMI. The company aims to engage in “Air Defense Systems, Smart Munitions, C4I Systems and Cyber Security of Defense Systems and Platforms.”

Raytheon’s business will also comprise of sales of surface-to-air and air-to-surface munitions for Saudi Arabia’s new surface warships (i.e. MMSC) and aircraft, respectively. For example, the MMSCs will be armed with Raytheon’s Evolved Sea Sparrow (ESSM) system. The sale of 16,000 Paveway laser-guided bomb kits is also expected to proceed, though these are not part of this recent umbrella agreement.

Like Lockheed Martin and Boeing, Raytheon intends to support Riyadh’s Vision 2030 plan by contributing to the creation of a “localized defence ecosystem with regional expert capabilities.” As part of this effort, Raytheon is establishing Raytheon Arabia, which will be a Saudi business wholly owned by Raytheon. Based in Riyadh, Raytheon Arabia will provide “in-country program management, supply and sourcing capabilities, improved customer access and centralized accountability.”

General Dynamics

Riyadh will also ink a deal for 115 M1A2 main battle tanks (MBT). Like Boeing, Raytheon and Lockheed Martin, General Dynamics announced that it would “localize design, engineering, manufacturing, and support of armoured combat vehicles” in Saudi Arabia.

Notes & Comments:

In terms of the hardware and services, the scope is comprehensive. Although analysts have noted the lack of an offensive element – i.e. multi-role fighter – it is worth noting that Saudi Arabia’s primary vendor for such systems is Boeing (i.e. F-15) and BAE Systems (i.e. Typhoon). Analysts believe that the sale of F-35 Lightning IIs would have jeopardized Israel’s qualitative edge in the region. Otherwise, the sale of the THAAD and PAC-3 outlines Riyadh’s intent to fortify its air defence coverage for defensibility against ballistic missiles (one of Iran’s mainstay offensive capabilities).

The MMSC is likely to be a first step towards a wider naval modernization effort. The MMSC is a multi-mission ship capable of anti-air warfare (AAW), anti-ship warfare (AShW) and anti-submarine warfare (ASW). The MMSC is an enlarged variant of the Lockheed Martin Freedom-class Littoral Combat Ship (LCS), which was designed to provide the U.S. Navy with a surface combatant for littoral waters.

Besides three al Riyadh-class frigates (i.e. variant of the DCNS La Fayette-class), Saudi Arabia’s fleet is comprised of frigates and corvettes built in the 1980s. These larger legacy combatants amount to eight ships, which in turn are supported by nine 495-ton al Sadiq-class patrol boats. The al Sadiq-class may necessitate a need for fast-attack crafts. In 2015-2016 Saudi Arabia intended to expand with an Eastern Fleet, which was to originally take on the MMSC. It is not known if Saudi Arabia will acquire additional MMSC (or LCS) ships or if it will pursue lower-cost ships from Spain and/or Turkey in tandem.

Each of these defence agreements has a commercial offset and local partnership element. Given the scope of Riyadh’s projected expenditure, it does not seem that original development, even in partnership with overseas vendors, is not currently a priority. Rather, the bulk of expenditure – even for Vision 2030’s sake – is being tilted towards off-the-shelf procurement with local industry workshare.

However, Saudi Arabia’s nascent industry will largely benefit from assembly, maintenance, integration and testing more so than native manufacturing and fabrication. This could potentially grow in the future (through the $350 billion in follow-on sales), but the current framework is geared to issue the balance of manufacturing work to the U.S. Lockheed Martin’s comparison of jobs creation in the U.S. (18,000) in comparison to that of Saudi Arabia (“thousands”) reflects that reality.

54 Comments

by Shaheer Anjum

It seems like Saudi Arabia is being bolstered and geared up as the head of a Sunni alliance with 34000 reserve troops from the so called “muslim nato” at the behest of the US to potentially fight the terrorists supported by Iran by proxy in Iraq and Syria with Raheel Sharif at its head.

As necessary as it is to curb the khawarij every where, I can’t help but dread the looming open military confrontation between Shia Iran and their allies and the KSA led Sunni nato we as a Muslim ummah are hurtling towards inextricably.

by Aaif khan

I would suggest KSA to spent few millions dollar more and hire some experienced foreign policy and security adviser. There are plenty in Britain America France Italy and Russia.

by ali amanat

Brother you are quite right, its just a confrontation between iran and ksa,

But not against terrorism, and to save israel.

by Aawish

for $110 bn and $350bn in future, KSA is getting peanuts. USA will never provide full TOT to KSA, even they did, they will transfer it very slowly till they develop some new war toys and KSA will be forced to buy them.

by umar rana

so you are saying that IRAN is an angel who never touch any other country sovereignty.iran is the biggest sectarian viloator. An evil

by Chanakya

The question every Pakistani should ask is what Saudi has done for Pakistan apart from giving free petrol and minuscule aid. If 100 billion dollar had been pumped into Pakistan infrastructure as CPEC is doing then Saudi would have been a true friend of Pak.

by Mazhar J

Correct, KSA is doing all this due to Iran factor, rest of the Gulf states are also on board. But spending this much + $350 Billion in follow up sales and without any F35 in it, seems to be waste of money in a colossal way. I have not seen any serious ToT agreements despite of this gigantic deal.

by Mazhar J

I seriously doubt IKs political acumen, he had made wrong decisions on wrong times. He will make big mess if given a chance, and it’s due to his lack of political experience. Nawaz is no different, he is also a dumb PM, I don’t know why people call him smart, you can judge his intelligence when he talks, spends more time thinking while talking.

by Shaheer Anjum

The terrorists supported by Iran include the khawarij groups (Hizbullah, militias supporting Asad) fighting the khawariji ISIL/Alqaeda, and their ilk. This proxy war between Iran and KSA is heading towards a worse form of confrontation and every muslim country in the region is being caught up in the march towards open hostility between the ummah. Yes Iran is preparing in its own way for the confrontation, and what is sad is that you’re missing the critical point that in the end it’s muslim vs muslim with muslim blood being spilled. As far as Imran Khan is concerned I have the same amount of confidence in his abilities as I have in our current or previous corrupt political “leaders”.

by Aaif khan

Hello Chanakya, I own a book of Chanakya written by samita bandopadhyay in Bengali language.

would you name your property that you built for yourself by hard efforts after your friends? If NOt? Than you’re not their True friends.

by Salman

Lemme scratch all over my head and think, what does that make you? A sectarian puffed by JI and other molvis against people with the same culture and ethnicity as us isnt it? We dont know what really happens on the ground, and every side is doing their own kamal in the region

by John Rue

Saudis are buying arms like they buy cars. There is no strategy and no real negotiation. no Transfer of Technology. Just buy all shinny stuff and it will fit in together to make a working solution. They should try to stay close to Turkey. If they ever get hit by sanctions, that will be the only country that can help keep their planes air worthy.

by Max Pane

waste of money without any strategy

by umar rana

Then what does your remarks on the first hand make you AND we have to see and comment on both sides.i am not accusing or supporting any other side.

by Paul Baggio

Massive waste of monies! what Saudi got? licence to build anything? did Saudi produced their own combat rifles? how much TOT Saudi got?

…Saudi merely act as ‘cow milk’ to US defense industries! pathetic!!

…surely Saudi can put aside ‘some billions’ to invest in military industries in some Muslim countries such as Pakistan, Turkey. Indonesia, to name a few!

by ali amanat

Brother the , the stage has been set and the game has commenced , and America and Israel are doing all because of muslim factor , the horizon is looking very radish disastrous, and more challenges ahead of pakistan because middle east situation.

by SP

The Saudis through dollar hegmony and selling oil in us dollars worldwide has made the US a military and economic superpower. This is the real strength of the US and so long as oil remains a global commodity and is sold the world over in dollars then US will remain a superpower and continue to exploit the world.

by ahmria

This is how you know how stupid the Saudis and their negotiators are. A potential 350 billion dollar deal and no F35s included in it. When the F35 nears the end of their service liives then the Americans will sell them to the Saudis for stupid money and the Saudis will lap it up even as the Americans provide Israel with the F35 successor. Duplicitous Americans .

by Paul Baggio

Saudi MUST learn from Iran experience who during Shah regimes almost totally dependent on US made weapons! They buy US weapons like mad but end up almost useless due to sanction as Iran (during Shah) hardly include TOT as part of purchase agreement!

by Aman

Friends What friends man ?

Sauds are our master not friends .

Remember !!!! Their friends are USA and Israel not Pakistan !!!!!

by Aman

Sauds are doing all they can to Protect Israel !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

by Aman

This is the reality that Only China And Turkey are real friend or ally not Sauds

They only Use us wherever they want.

Only we help them wherever they say but they don’t come to assist us.

It’s not called friendship man it’s called Slavery.

by Quraishi

The fact is no one really like beggars, had Pakistan had something to sell and to bring to table it would have sure done deals.

This deal has real substance then just some friendly help, don’t be so narrow focused.

Where was the friendly help when saudis wanted to fight the terrorists in Yemen.

Y do u even seek help when Pakistan is inclined to heavy economic restrictive measures such as heavy tax.

People respect and like respectable nations not one looking for help.

Saudi has some serious threats and desperately needs new hardware .

U think of Chinese as good friends, they r the biggest ripoff ever just wait and see, did you read the whole depth of cpec agreement, it’s stripping Pakistan of its resources at commodity value and all the value addition will be done in china.

by Quraishi

This is trade and has nothing to do with friendship, all the years Pakistanis want to side with terrorists Iran even after all their stupidity then this is what Pakistan deserves.

by Quraishi

These r just emotional talk, if u see them as your true friend then u must be happy for ur friends success.

by Quraishi

Can u even define what’s strategy?

by Quraishi

Iran deserve a hard lesson or they will never understand, how do u guys ignore Iranian terrorism in Pakistan so easily, ur not even doing justice to Pakistan and urself let alone to anyone else.

by Quraishi

For who do you think Iran built its military for?

by Quraishi

If money is that stupid how about u go get some.

by Quraishi

This is all the rubbish Pakistani media says, reality is far opposite.

Do you forget the Iranian attacks on Makkah many decades ago, their ambitions has been there for decades yet you fail to see the reality.

by Quraishi

Do u even know about Iranian proxies in Pakistan ?

What have u done to defend your country.

by Quraishi

Few mistakes happen doesn’t change the principle of the situation, such is normal when one is taking many decisions.

by Aaif khan

Not a saudi supporter but Iran is doing every possible thing to strengthen Israel.

by Aman

Well Strategy is nothing But a well planned Policy To Achieve your Goals

With least chance of Failure .

by Aman

Could you name some of them ?

by Aman

I am a historian and i know there was noting like that

You are Selling Your own Propaganda !!!!!!!!!!!!!!!!!!!!

by Aman

No , You are a Saudi Supporter !!!!!!!!!!!!!!!!!!! Sorry brother hahahahahha

“but Iran is doing every possible thing to strengthen Israel.”

any example ——-

by Aman

I have warned , You don’t Sell Your own Propaganda !!!!!!!!!!!!!!

by Chanakya

Your statements are contradictory. Why China wants to invest 100 Billion USD in Pakistan which has so much security issues? Yes China is not doing for charity but their thought process is that if Pakistan is lifted up economically the unemployed Pak people will have something better to do. Why could Saudi have not done this? The answer is simple. The Arabs dont think non-Arab Muslims at their level and like to use Pakistan as a tissue paper like fight their wars and pay the price in blood.

by Quraishi

Which of my statements are contradicting?

How can you be so naive, China isnt investing 100B in Pakistan coz of friendship, its doing so coz its going to give china huge value creation, and vastly optimize its supply chain, greatly improving efficiency and reduce costs, u seriously dont know?

How do you expect saudi to do this when saudis dont have a supply route directly affecting their trade, and if you see more carefully, China is stripping pakistan of its resources, this isnt true friendship, if you sell what you have in your house in other words resources, and get money doesnt really mean you have gained alot, they were always there for that value.

Ur conclusion is just emotional, has people in pakisan looked upon many of its minorities equally, including Bangladeshis? balochies etc..

y do u demand from others what u cant even do in your own country.

Do you think China is any better then using people like tissue paper, and when have u seen Iran even provide anything to Pakistan, any employment etc.. If you dont know they dont even allow Pakistan to explore oil next to its border region.

Y do u want to be at the same level when all the behaviour and actions of Pakistan as a nation are much lower then that of arabic middle eastern nation :s

by Quraishi

Im not selling any propaganda, someone you are part of iranian propaganda big time.

by Quraishi

Sure, large portions of MQM are Iranian proxy,

many of the fighters in balochistan have full backing from Iran

many of the solders killed in syria fighting with bashars army were pakistanis

Many of the assisinations in Pakistan of great fighers were done by terrorists trained in pakistan

have some respect and read this

https://tribune.com.pk/story/1190515/iran-fires-mortar-shells-pakistan/

how friendly is this now?

https://www.youtube.com/watch?v=R_RQ8iMWVaI

and you blame saudis? calling urself a historian

PAKISTANI RECRUITS soruce : http://www.washingtoninstitute.org/policy-analysis/view/irans-afghan-and-pakistani-proxies-in-syria-and-beyond

Formed two-and-a-half years ago and trained by the Qods Force in the Shiite holy city of Mashhad in northeastern Iran, the Zainabiyoun Brigade is another volunteer outfit fighting in Syria. The IRGC-affiliated Fars News Agency described the unit as an elite assault force with over 5,000 young Pakistani Shiite fighters, though Reuters and other Western outlets cite no more than a thousand. Many originally lived in Parachinar and its surrounding villages in northwestern Pakistan, then migrated to Iran or the United Arab Emirates. While demand to fill Zainabiyoun’s ranks reportedly increased when the UAE expelled some 12,000 Pakistani Shiite workers in recent years, the brigade’s core members came from al-Mustafa International University, a religious institution that is based in Qom but has branches in Islamabad and Beirut as well as numerous affiliate organizations elsewhere (e.g., the Islamic College of London, Indonesia Islamic College, the Islamic University College of Ghana).

by Quraishi

https://www.youtube.com/watch?v=R_RQ8iMWVaI

if u continue on like this, soon u will be history urself, let alone being a historian,

btw whats ur qualification as a historian?

by ahmria

Pakistan are trying to be neutral with iran and not agitate them to much as Pakistan has a sizeable Shia population and if Pakistan upset Iran then Iran would interfere in Pakistan by agitating the Shia population against the government and military.

by ahmria

You obviously don’t understand what I’m trying to say. The Saudi regime are stupid for paying over the odds for weapons that are inferior in quality to what the US gives Israel. The Americans actually have it enshrined in their law that American must help and ensure that Israel always has a qualitative edge over the Arab neighbours. Why else do you think that israel gets the F35 and The Saudis are given the F15SA? Don’t get me wrong the F15SA and the Eurofighters are fantastic jets but they are still a generation behind the F35. The Saudis are paying way over the odds on most of their military hardware yet Israel is allowed to get approximately 4billion dollars a year of free military aid by the Americans on the proviso that they spend most of the aid buying american military hardware. If I was the Saudi defence minister I would have an issue with this inequality.

by Quraishi

So did u ask anyone if saudi has a strategy or r u just assuming stuff,

Waste of money based on what?

When Pakistan spends on arms all r happy, when any other country spends it’s a waste of money, y such difference

by Quraishi

I do understand what ur saying, but what u r saying is coz u r looking at things from the very narrow fixed perspective of urs.

Saudi doesnt really have any conflict with Israel, nor is israel attacking countries next to it or starting proxy wars.

These weapons are purchased to counter the threat from Iran, who has massacred muslims in millions all around the region.

Perhaps its u who is what u called the saudi gov for not being able to see the reality.

So we all know this fact that American will always keep Israelis at an edge, what about it :s if this is the case then y should pakistan be buying any f 16s now?

there is no saudi israel conflict in sight, I dont see a point y u bring israel into it.

And the sum is so huge coz saudi is buying lots of technologies to locally manufacture and export equipment, its not all solely for arms.

by Aman

Learn something From us

How to talk

We don’t fight each other all the time !!!!!!!!!!

by Aman

I don’t believe in Documentaries They are made to propagate the history.

BTW I am 16 YO !!!!!!!!!!!!!!!!!!!!!

by Max Pane

strategy in my opinion is use our resources to get maximum interest with less rely on foreign countries . what saudi got nothing . they have beautiful toys but they need u s crew for maintenance . i saw a comment of american who said that when we were trained them they waste their all time in smoking and other things and for american it is goog so we can easily earn 50 k usd easily for working in royal air force

by Chanakya

The economy has to be kick started and for this you need investment. China is not stupid to alienate Pakistan by sucking its economy through loans. Saudi like any other arabs treat non-arabs muslims like tissue paper i.e. use and throw. Gwadar is primarily opposed by UAE as its JAFZA port will be hit. Look at the bigger picture and you will understand that CPEC is best thing to happen.

by Chanakya

The people of Pakistan are stupid i.e. they cannot differentiate between a friend and an enemy. The mullahs paid in riyals are propaganda piece of Saudis. They need to be tackled first if the country has to progress.

by Quraishi

U have wrong understanding of strategy,

When talking of strategy in perfessional context it has a specific meaning, which maybe broad but it doesn’t mean it’s this open to personal interpretation.

U r talking of simple operations calling it strategy, I see nothing to do with strategy in what u wrote, and it’s just emotions.

by Quraishi

U r 16

I think u should become present first before becoming a historian lol

How do u validate a news if all documentaries are fake.

Btw this was international news, quiet surprised u as a historian don’t know about it.

Just know without qualification u can call urself what ever, in the sight of precessional community u will be a layman