2140Views 3Comments

Will South Africa impact Pakistan’s defence procurement plans?

On Monday March 27, Pakistan and South Africa signed a memorandum-of-understanding (MoU) to boost bilateral defence ties, specifically in procurement, training and defence industry collaboration. The MoU entails the creation of a ‘Joint Defence Committee’ that will steward collaboration, information exchanges and training of officers and soldiers. It also facilitates collaborative research and development, transfer-of-technology, co-production and joint-ventures, and armament acquisition.

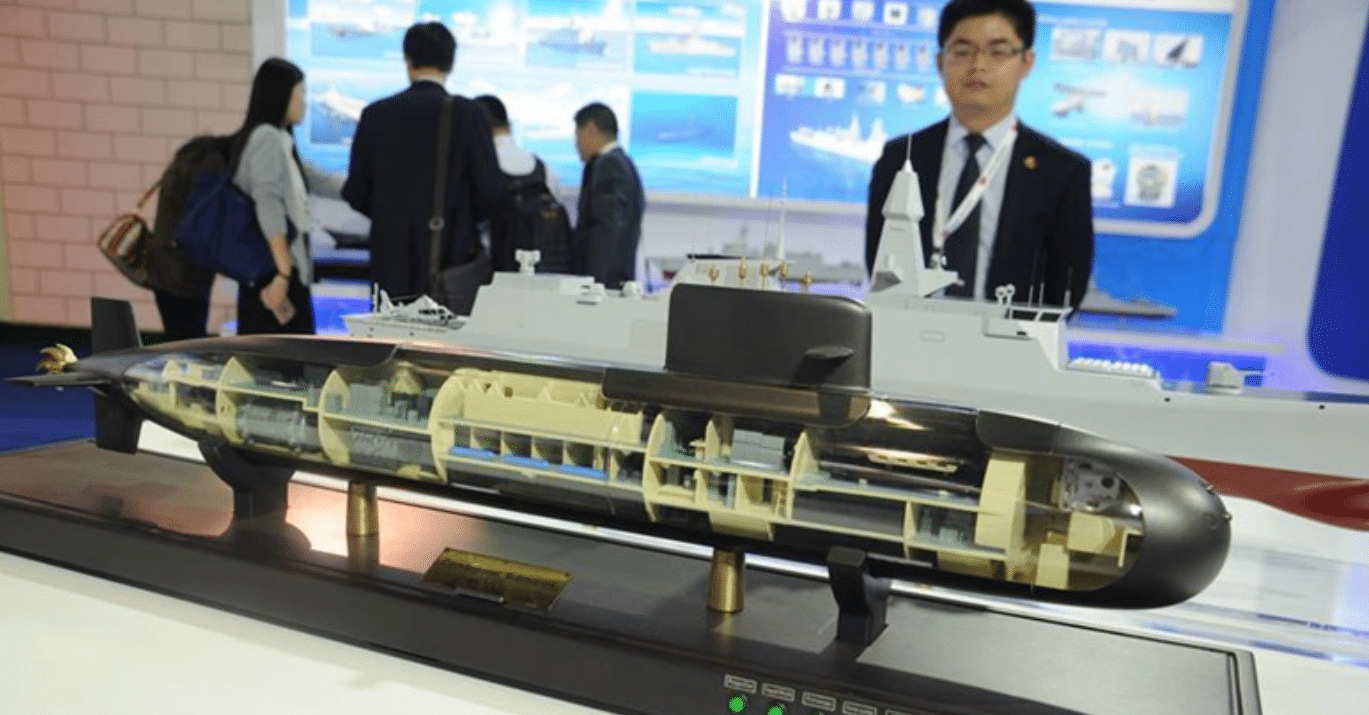

South Africa’s expertise in munitions, artillery, armoured vehicles and aviation can draw militaries in need of capable and affordable equipment, especially in technology areas not readily available – be it from cost or political and regulatory barriers – in the United States and Western Europe. However, Pakistan manages relatively well through its relationship with China, which is evident when one refers to the JF-17 Block-III multi-role fighter, Hangor-class submarine, and other mainstay platforms of the Pakistani military.

Thus, one might ask if South Africa could impact Pakistan’s defence modernization plans, especially in the near-term where it appears that Pakistan has the technology means (via existing suppliers) to bring its up and coming programs, such as the JF-17 Block-III, into fruition.

This MoU was built through bilateral efforts. It was precipitated by several high-level exchanges, such as those of the Pakistan Ministry of Defence Production (MoDP) and Ministry of Defence in the second-half of 2016. In September during the Africa Aerospace and Defence (AAD) airshow and exhibition, the MoDP Rana Tanveer Hussain met with South Africa’s Minister of Defence Nosiviwe Mapisa-Nqakula. Ms. Mapisa-Nqakula then made her office’s first ever official visit to Pakistan to sign the MoU.

Long-term collaboration is quite plausible, especially at the industry-to-industry level where one can see Pakistan Aeronautical Complex (PAC) and Heavy Industries Taxila (HIT) engage with Denel Aviation and Denel Land Systems, respectively, to build respective capacities. The Pakistani private sector, especially the likes of Integrated Dynamics and Global Industrial & Defence Solutions (GIDS), may find worthwhile and willing partners to undertake original development of systems and subsystems. For example, GIDS is interested in developing a medium-altitude long-endurance (MALE) unmanned aerial vehicle (UAV), and collaboration with Denel Aviation or Paramount Group could be an avenue for feasibly undertaking that project. GIDS is also a supplier of stand-off range munitions to the Pakistan Air Force (PAF), collaborating with Denel Dynamics might enable GIDS to broaden its product portfolio.

However, the South African defence industry may have a plausible shot at securing near-term contracts, especially with the JF-17 Block-III and the needs of the Pakistan Navy. The forthcoming JF-17 Block-III will be configured with an active electronically-scanned array (AESA) radar, updated avionics and integrated electronic warfare (EW) and electronic countermeasures (ECM) suite, and, as originally planned, high off-boresight (HOBS) air-to-air missiles (AAM) integrated with a helmet-mounted display and sight (HMD/S) system. While the Block-III’s AESA radar options – and by extension, EW/ECM and avionics – are known, there HMD/S route is not clear.

At Air Show China 2016, the Aviation Industry Corporation of China (AVIC) showcased concepts of next-generation subsystems, which included an HMD/S system with design similarities to the BAE Systems Striker II. But this was not a marketable product (i.e. with a label and actual specifications). With that avenue not yet in place, the PAF’s remaining HMD/S options would comprise of the BAE Systems Striker and Thales TopOwl-F. The most ubiquitous non-Eastern HMD/S design belongs to Israel’s Elbit, which is a non-starter for the PAF (notwithstanding third-party access via the U.S.).

South Africa is home to Airbus Defence & Space (DS) Optronics, which belongs to Hensoldt, a sensor and electronics subsystems company located in Germany. The Pakistan Navy is a Hensoldt customer through its selection of the SERO 250 periscope and OMS 200 optronic mast for its Agosta 90B submarines. With Denel Dynamics already offering a HOBS AAM in the form of the A-Darter, it would be interesting if Airbus DS/Hensoldt in South Africa could be counted upon to develop a HMD/S system. For Hensoldt, an HMD/S solution need not be focused on just the JF-17, but it can be a welcome competitor in a sparse market.

It has been more than a decade since South Africa marketed an HMD/S, but the presence of research and development facilities and leadership by a company aiming to grow in the sensor market should provide sufficient grounding to produce a solution. If successful, the HMD/S and A-Darter could provide the South African defence industry with a direct entry into the JF-17 Block-III.

Another near-term opportunity may be with the Pakistan Navy. In June 2016, South Africa’s Navy reported that the Pakistan Navy requested information about the Denel Dynamics Umkhonto surface-to-air missile (SAM) system. It is not known where that interest stands at the moment, but the forthcoming Umkhonto EIR – with a 30-35 km range – could be a plausible SAM solution for the Pakistan Navy’s current and future surface warships. In comparison to analogous Western solutions, such as the MBDA Sea Ceptor or Aster-15, the Umkhonto EIR could be more affordable. Denel Dynamics’ partnership with Saab to integrate the Umkhonto-series to Saab’s Giraffe AMB radar could be a contributing aspect considering that Saab is one of Pakistan’s (albeit potentially fleeting) defence electronics suppliers.

The Pakistan Army was slotted the Denel Land Systems T5-52 as a competitor for its 155 mm/52-calibre wheeled self-propelled howitzer (SPH) requirement. In the final quarter of 2016, Denel sent a T5-52 SPH to Pakistan for testing. It appears that the T5-52 and YugoImport-SDPR’s NORA B-52 are the leading SPH candidates. If Serbian media reports regarding the potential scale of the Pakistani SPH requirement (which purportedly stands in the 500-range) are accurate, Denel might secure a significant sale. Competitive cost, quality and access to key technology, such as the 54-km range Rheinmetall Denel Munition (RDM) M2005 Velocity Enhanced Artillery Projectile (VLAP), could bolster the T5-52’s prospects.

The Pakistan Army also has a recurring need for mine-resistant ambush-protected (MRAP) vehicles, which it is importing from the U.S. at a cost of $875,000 a vehicle. Denel OMC and Paramount Group should see opportunity in this space. There is also a need for an 8×8 wheeled armoured fighting vehicle. Denel OMC or Paramount Group could partner with Pakistan’s public or private sector to fulfill that need.

In general, the entry-point for the South African defence industry would be to provide capable solutions at a competitive price in areas where Pakistan has yet to secure a supplier. However, this would be a near-term opportunity as Pakistan’s long-term objective is to build supply-side independence, ensuring that its defence hardware is mostly built and, if possible, developed domestically. There are opportunities in this respect as well, especially since Denel Group and Paramount Group have a reputation for providing strong transfer-of-technology and co-production benefits.

3 Comments

by Zain YG

Every cooperation, with friendly nations that are fairly neutral with our national conflicts and inrestes, is a good thing. That’s obvious

SA, definitely has something to gain, financially and technology wise, therefore this is a mutual impact if it’s serious and committed enough endeavor.

Also, having in mind corporate greed which influences the policies which are driven by geopolitical ambitions it’s very unpredictable how a non Chinese and muslim country will have a military cooperation with Pakistan, and how Pakistan will deal with it and to what extent.

we all have seen how that goes with ziomurikkkstan.

by Shakeel

I eagerly anticpate the enhance of defence relationship between SA-Pak. Our govt must utilise SA scientific & engineering prowess in the most optimal way.

Excellent news.

by Sami Shahid

The paramount group of South Africa is producing Helmet Mounted Display system, Electro Optical sighting system , Armored Personnel Carriers and MRAP vehicles. Pakistan can get all this at a much lower cost and South Africa might even transfer the technology. South Africa might also agree to help Pakistan in developing an attack helicopter.