2285Views 2Comments

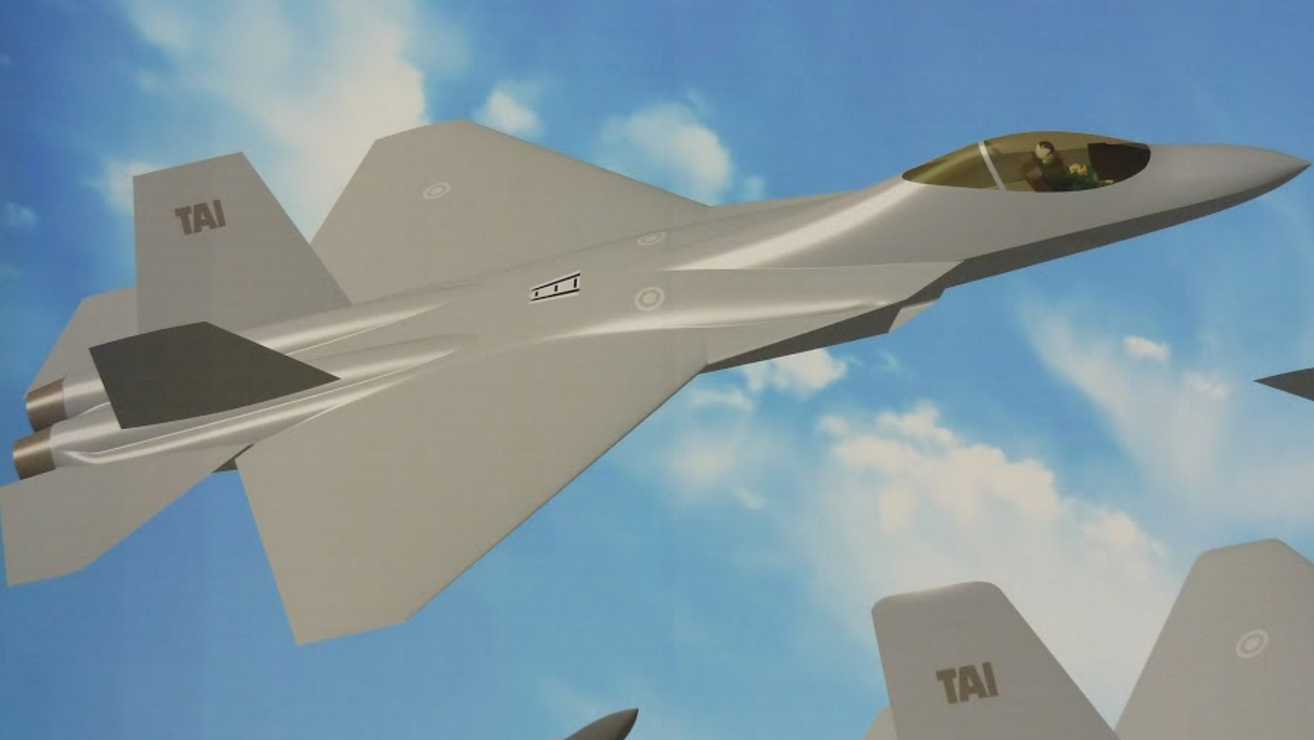

Turkey still aiming for TFX maiden flight in 2023

In his speech to the İstanbul Düşünce Vakfı (Istanbul Thought Foundation), Turkish Aerospace Industries’ (TAI) General Manager, Temil Kotil, stated that the company was still aiming to fly the TFX, Turkey’s next-generation fighter platform, in 2023 (i.e. to commemorate the establishment of the Turkish Republic).

As per Kokpit Aero, Kotil also elaborated on TAI’s recent GBP £100 million-plus deal with BAE Systems, stating that BAE will provide “400 man/years” of engineering consulting and support work to TAI.

The current contract is centered on designing the TFX, it is expected to conclude in four years, after which another four-year contract could be awarded to undertake TFX development.

In addition, the TFX will eventually benefit from a domestically designed and produced turbofan engine, which Kotil claims should be ready in 10 years. However, initial TFX units will be equipped with a foreign turbofan engine, potentially a Rolls-Royce system.

Kotil reiterated that Turkey’s goal of exporting the TFX to other markets.

Notes & Comments:

TAI is evidently ambitious and optimistic about the TFX. To its credit, the program is being driven by local requirements (i.e. to gradually supplant the Turkish Air Force’s F-16s) and a concerted drive to position Turkey into a major defence and aerospace exporter. The Turkish Undersecretariat for Defence Industries (SSM) and TAI have been in touch with prospective third-parties, such as Pakistan, regarding the TFX.

The statements and early engagement indicate that Turkey is seeking support in building scale for the TFX. It is possible that upon the conclusion of the initial design phase, Turkey may invite third-parties to co-invest in TFX development, which will help distribute the research and development overhead.

However, Turkey current industry markets – e.g. Saudi Arabia, Pakistan and Kazakhstan (among others) – are generally cost-sensitive. Granted, Saudi Arabia and Kazakhstan have more spending power, but liberal expenditure may be a thing of the past considering the mounting austerity pressures, at least on Riyadh (and the Arab Gulf market in general).

Some analysts anticipate that the cumulative cost of the TFX program – i.e. design, development and production – could amount to USD $70 billion in work. This (based on 250 aircraft) would put the TFX’s all-inclusive (flyaway plus long-term maintenance) cost at $280 million a unit, which is plausible for a next-generation Western technology-based fighter platform.

Additional TFX orders may help lower the unit price, but the biggest cost savings would likely occur with the Turkish industry scaling the development overhead of subsystems (e.g. radars) across many domestic and export applications, such as legacy fighter upgrades. Aselsan is developing new electronics suites – including an active electronically-scanned array (AESA) radar and next-generation electronic warfare (EW) kit – for the Turkish Air Force’s F-16s. Scaling the research and development work for transceiver modules (TRM) across radars for F-16s, surface warship radars, land-based air defence radars, and export solutions would help bring a relatively affordable electronics suite for the TFX.

While contingent on the technical ability of co-purchasing partners, partial airframe and subsystem production in partner states may help reduce the costs further (with cheaper currency and labour). For example, TAI had contracted Anka drone-related work to Pakistan Aeronautical Complex (PAC) in 2013 and it had spoken to the Pakistani Ministry of Defence Production about TFX-related activities in 2016.

Overall, the TFX would still be a costly fighter, but it may be a relatively manageable one. Granted, this will depend on Turkey’s ability to manage costs, especially during development (which is prone to cost overruns and technical complications). Fortunately, the dearth of directly analogous Western platforms should provide the TFX an addressable market. Turkey’s efforts to cultivate defence industry ties in places such as Saudi Arabia will also help in guiding interest towards the TFX, especially if Ankara leverages investment and offsets in those countries.

2 Comments

by nob hamid gul

Pakistan should seriously grab this opportunity and contribute to TFX program in order to develop first prototype by 2023.

by MT

if British cant fly their 5th Gen indigenous fighter by 2023 then its not that difficult to judge turkish capability. They are yet to make a 3/4th gen working doppler radar,flight control system & design their own plane. No country have ever made 5th gen fighter without knowing bits and pieces of 3/4th gen fighter plane development, project management