2511Views 7Comments

Saudi Arabia aims to local-source 50% of future arms acquisitions

By Bilal Khan

Under the “Vision 2030” program, aiming to re-orient the Saudi economy for a post-oil world, Saudi Arabia is seeking to source at least 50% of its defence acquisitions from its domestic industry by 2030.

According to the Stockholm International Peace Research Institute (SIPRI), Saudi Arabia is the world’s fourth largest defence spender at $87.2 billion U.S. a year. Although it has overtaken Russia, the majority of its acquisitions are imported, mainly from the U.S. and Britain.

In a televised interview with Al Arabiya, Mohammed ibn Salman, the Defence Minister and Deputy Crown Prince, stated, “Does it make sense that we are the world’s fourth latest military spender in 2014 and third in 2015 and we do not even have a local military industry?”

Prior to the Vision 2030 announcement, Saudi Arabia was in the process of sourcing a proportion of its arms using domestic channels. For example, a new munitions production factory was recently opened in Al-Kharj. Built with the contracted assistance of South Africa’s Rheinmetall Denel Munition, the Al-Kharj facility will supply the Saudi military with a range of artillery shells and general purpose bombs.

Vision 2030 will likely accelerate these efforts. At this stage, one should expect to see Riyadh to attach offset and technology transfer clauses to its future acquisitions. Having seen Boeing and Lockheed Martin push their respective fighter platforms for India’s “Make in India” campaign, it will be interesting to see how American vendors respond to Saudi Arabia’s stipulations.

In Riyadh’s case, one would need to heavily invest in the requisite talent and infrastructure necessary to absorb advanced technology, and there will be a lead time before complete solutions begin rolling out. Of course, the 50% target is being set for 2030, hence is being envisaged as a gradual process.

In addition to resulting in sizably deep technology transfers, it could also result in the rise of numerous private sector defence players in Saudi Arabia. Whether this weighs on the rise of foreign subsidiaries or an abundance of Saudi firms, that remains to be seen.

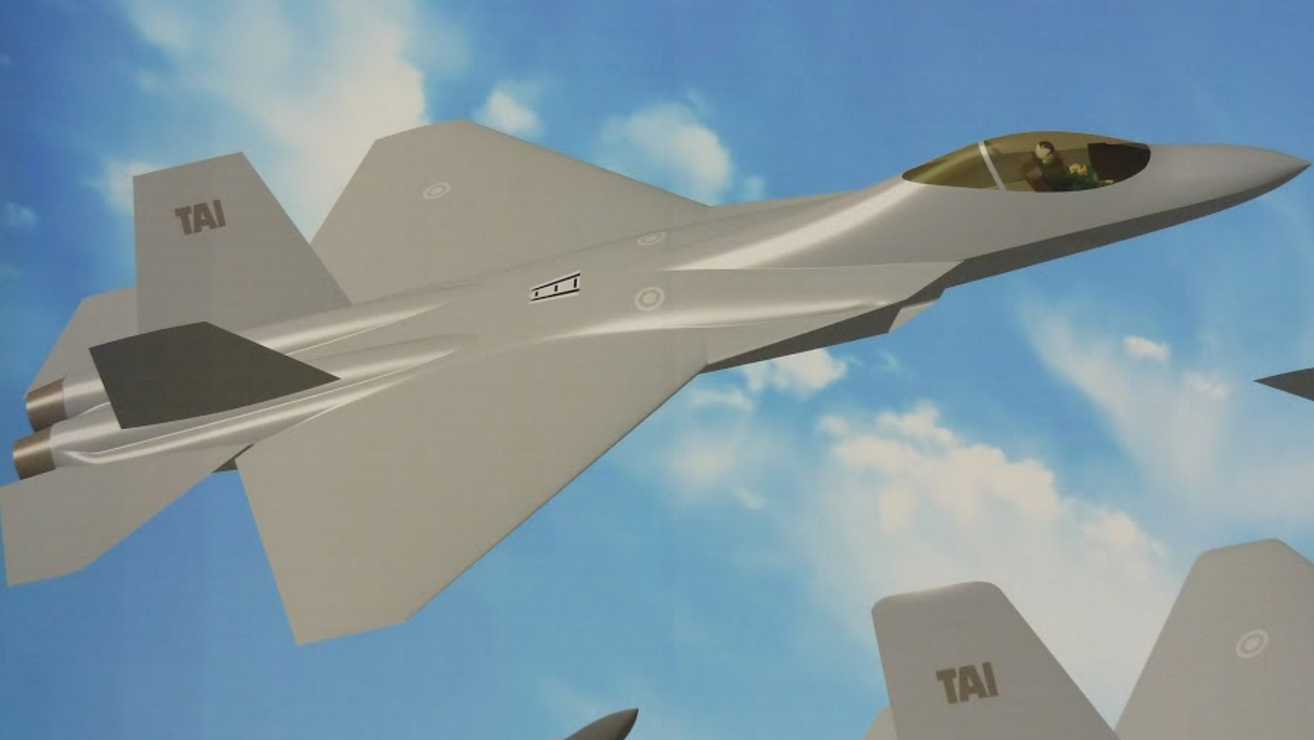

While Western firms will continue being front and center of Saudi Arabia’s arms acquisitions, it will be interesting to see if Saudi Arabia invests in Turkish, South African and Ukrainian goods as well. Saudi funding in programs such as the Otokar Altay and An-188 would provide these systems a massive financial shot in the arm, thus cementing their presence and enabling the vendors to more easily market their goods to other countries (by actually being able to offer the goods in a cost-competitive manner).

The development of a Saudi arms industry will definitely be worth watching over the coming years.

7 Comments

by Javed

It will be a dream come true if it ever happens, but there are some serious obstacles in the way, even 15 years from now things may not change as much.

Saudi misplaced confidence comes from the money, too much money because they think they accomplish such feat when they have pretty much no human asset today or let’d say in 15 years. If they start investing heavily in advanced and specialized engineering education (15 years) is time is blink of an eye. This is probably the most challenging and difficult task to train skilled manpower of ctrical mass. It took Pakistan decades in nuclear field and as we know it was not the money only but the holy grail was the specialized and highly trained manpower in sufficient numbers across the spectrum of nuclear technology . Aerospace is no different

by jigsaww

Reality dawning on the Saudis.

They had all the resources to do this 50 years ago but they slept over it gathering world class weapons with one of the worst militaries in middle east.

The yanks are in the process of ditching the saudis anyway, so i don’t see considerable help coming to the saudis.

A better plan for saudis would be to start up with partnerships and start building own competence down the line. We are looking at a 30 year plan provided the saudi state survives the horrors it has created for itself with that little boy effectively ruling the kingdom.

It’s going to be a messy ride.

by Heavy Weight Fankaar

Maybe if Muslim countries had better ties, this would have worked, especially Iran and KSA. Otherwise, I don’t see this working out. Sure, they could get help from Pakistan or maybe even some European country but who do they plan on selling their stuff to? Europeans aren’t going to buy it. Nor are the South Americans. What’s left is either the pro Saudi Muslim Squad or the Irani League. The Irani League is out of the question. Talking about the pro Saudi Squad, well most of them operate either Russian or US Tech. If they plan on going into Africa, I don’t think countries could afford such expensive toys(mind you this stuff by the Saudis is bound to be expensive). Even if by then it is affordable, if the JF-17 makes it’s inroads into Africa which it will InshAllah, they’re pretty much screwed. It’s like this, the West hates KSA for it’s shenanigans, Russia hates KSA for it’s shenanigans. Iran and it’s allies hate KSA for it’s shenanigans. The ones left are mostly pro SAUDI countries that have other plans.

by Ashi Sidhu

Saudi prince certainty knows his problems they are world’s largest arms importers and third largest defence budget but not in top 20 military powers according to the prince

Unfortunately they have wrong allies Americans always keep asking about human rights records and are very sensitive to technology transfer issues

whereas Russia help india in making nuclear submarine license manufacture of tanks jets and ships with almost no restrictions on reverse engineering

Hope that madrassa graduates now focus on something else than wahabi militant ideology

by javed

Granthi trained can only assemble and produce under license.These licensed produced hardware has only 5% technical value and 95% prestige for murakh “googled educated” like you. If reverse engineering was India’s forte then show us the proof?

by nob

50 years ago the Saudi neither had any money nor they had the population.

by jigsaww

But they had the resources and oil that the world was ready to buy on 200 USD barrel too.