2395Views 24Comments

Does the JF-17’s Market Potential Matter?

Nearly 12 years after its maiden flight, the JF-17 was able to secure its first export order during the Paris Air Show in June 2015. At the time the customer was not disclosed, but at this point it is all but an open secret that the buyer was Myanmar (IHS Jane’s 360). Moving forward, Pakistan is reportedly aiming to close a sale of up to 10 JF-17s to the Sri Lankan Air Force as well as pursue possible leads in the form of Nigeria, Egypt and Morocco.

There has been some recent momentum, but it is a far cry from the expectations the fighter carried in its early development years, especially in the hopes that it could play a big part in replacing hundreds of ageing MiG-21/F-7, Mirage III/5 and F-5 Tiger IIs serving in the developing world. The fact that China, the co-development partner, did not order any JF-17s did not help with building positive perception either. With the Pakistan Air Force (PAF) as the sole user at this time, one might feel tempted to conclude that the JF-17 program did not live up to its expectations, or that it is too flawed to succeed.

Granted, the JF-17 is no paragon of fighter design nor a trendsetter for high-performance benchmarks, but it was never meant to be in the first place. Right from the onset the JF-17 was envisioned as a relatively low-cost replacement for the increasingly obsolete legacy platforms in service by the hundreds in the PAF, not to mention the many other air forces in Asia and Africa with similar or direr financial capacities. If there was a standard to broadly assess the JF-17, it ought to be on the basis of whether it actually delivers current-day air warfare benefits to an air force.

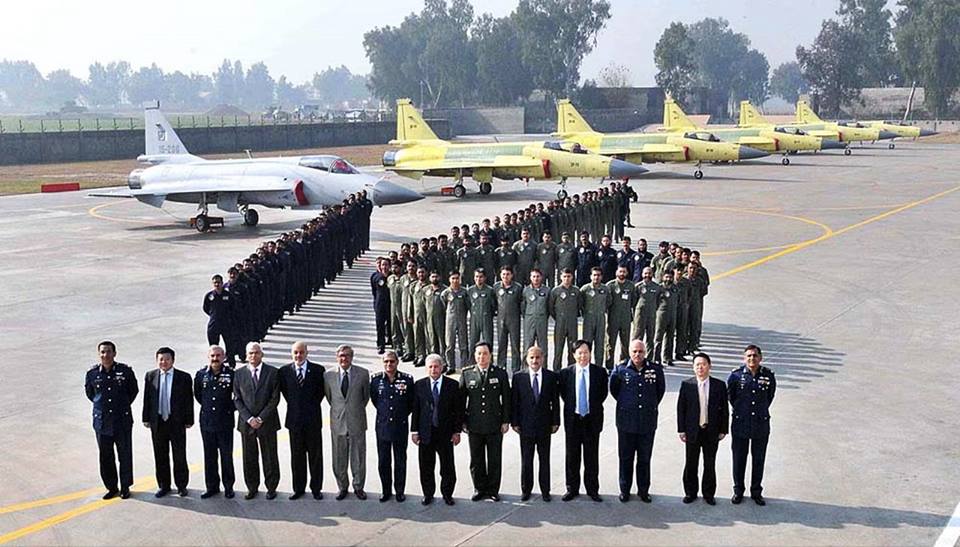

In Pakistan, the JF-17 has thus far replaced the PAF’s entire fleet of Nanchang A-5s as well as a number of its many Chengdu F-7Ps. For the most part, these platforms were limited to using the AIM-9 Sidewinder within visual-range air-to-air missile (WVRAAM) and general purpose bombs (GPB).

The JF-17 on the other hand has been greenlit to use the SD-10 active radar-guided beyond visual range air-to-air missile (BVRAAM), LT-2 laser-guided bombs (LGB) as well as LS-3/LS-6 satellite-aided precision-guided bombs (PGB), MAR-1 anti-radiation missile (ARM), H-2/H-4 stand-off weapon (SOW), as well as C-802 and CM-400AKG anti-ship missiles (AShM). For a more thorough understanding of the JF-17, be sure to read Quwa’s prior articles on the fighter.

The difference in munitions alone demonstrates how much of a leap the JF-17 is in comparison to the hundreds of legacy platforms still in service around the world. However, if this is apparent, then it begs the question, “Why is the JF-17 having difficulty in garnering sales?”

The answer can be traced to two issues: First, the apparent bifurcation of the combat aircraft market, i.e. the pull towards two extremes between aircraft that are expensive high-performance fighters such as the Rafale on one end of the spectrum, and very low-cost light attack aircraft such as the A-29 Super Tucano on the other end. Second, the reality that arms acquisitions are not purely commercial transactions.

A number of air forces that in an earlier age would have made for prospective JF-17 buyers may today be inclined towards light close air support (CAS) aircraft such as the A-29 Super Tucano or the in-development Textron AirLand Scorpion. The rationale (in those specific countries) would stem from the idea that there are no aerial or state-level threats warranting a full-fledged fighter; A-29-like aircraft would be sufficient for defending one’s territorial integrity from low-capacity threats (such as smugglers or war lords).

On the other end of the spectrum are air forces content with acquiring comparatively small numbers of expensive high-performance fighters such as the Dassault Rafale or Eurofighter Typhoon. For a country upholding key security interests necessitating a fighter fleet, an air force may emphasize a smaller number of potent force-multipliers ahead of a larger number of less capable platforms. In the end, it may seem more efficient and worthwhile for certain countries to acquire two squadrons of Typhoons over four or five JF-17 squadrons.

In effect, the JF-17 has to compete in an increasingly compressed space in the middle, which in turn is increasingly saturated with very similar platforms: FA-50, Tejas, second-hand Gripens and surplus early-model F-16s. However, there is also the angle of international relations. For example, countries aspiring to join NATO (such as those in the Balkans) will probably look to surplus F-16s for replacing their MiGs, not just out of concern for cost, but the fact that it is a mature platform of choice within the organization. Others, such as Sweden and South Korea, may offer some countries a favourable line-of-credit or financing terms should a country choose their respective fighters; Pakistan is in no position to offer such support.

To be frank, it is unlikely that any of today’s lightweight platforms, such as the JF-17, will make massive in-roads (to the tune of the F-16 and MiG-21 of old) in the global fighter market. Acquisition dynamics have changed since the Cold War and there are few air forces in the world today in need of affordable platforms to serve in numbers. The market should not be the central concern for Pakistan; rather, it should focus on ensuring the JF-17 receives the developmental support to quickly reach its next big milestone.

24 Comments

by jigsaww

I think it would be pretty unfair to equate JF-17 in sales to Mig-21 or F-16. These fighters came at pretty much the best time for fighter jets era. It’s a very saturated market today and other weapon systems like cruise missiles, air defence/standoff weapons etc, are to large extent compensating for fighter jets. Not even Rafale or Eurofighter or for that matter possibly F-35 could ever pull the sales achieved by F-16, not even 50% of that. JF-17 will have sale difficulties, no doubt, but on that front every 4th gen fighter is going thru that phase. Gripen, Rafale, Eurofighter all have their sales problems.

The biggest push comes from political influence of a country and this is why both soviet union and US were able to market their dog fighters in thousands, giving a political package to buyers.

Pakistan should remain optimistic about Egypt for a very large order of 100+ JF-17s.

by Guest

Is the current JF17 block 2 capable of night strike?

and why is it not a good replacement of PAF Mirrages?! I have read this on different blogs including yours that the Mirrages will stay for a little longer and better be replaced by Su35s or J31s. Why is it so?

by Guest

Will it be a good idea to let Egypt or some other country produce JF17 locally. Will that mean more profit for Pakistan? Or will it be a loss in he long term? How does this work?

Personally I would never like this to happen, instead they should only be exported.

by saqrkh

The JF-17 is a capable strike platform and the WMD-7 pod should enable it to engage in nighttime strikes. But the rationale behind replacing the Mirages with FC-31 (in addition to JF-17) is to force a bigger jump in the PAF’s strike capabilities. JF-17 is newer than the Mirage and offers improvements in the way of being a multi-role fighter, but the FC-31 goes a step further by being a low-observability platform with potentially more range and payload. It’s about getting a huge improvement, not just replacing the older platform.

by saqrkh

Egypt will probably prefer to license manufacture the JF-17 at home. PAC doesn’t lose anything except a few years of work, it’ll get the money anyways.

by saqrkh

Yep in the end, the JF-17 meets the PAF’s needs. The Block-I/II are solid improvements over the A-5 and F-7P, and the Block-III will carry the change further by edging into Gripen NG territory (AESA, HMD/S, HOBS AAM). I prefer the PAF not worry about exports at this stage, just get to Block-III.

by Guest

Thanks, makes sense.

by Guest

Is it more profitable to let customers license manufacture at home or export Jets? Is it like a license is issued for an amount and then the country can manufacture as many units as they want or can they only manufacture a limited number of units?

How I see it is that if the country can manufacture any amount of units and then probably even export them, then it is a loss for the original manufacturer in the long run.

I am curious about how this works? For eg Pakistan I suppose manufactures M113s under license and even wants to export them (or APCs derived from M113) so does Pakistan pay for every unit produced to the original manufacture?

by Abdul Rashid

Great set of articles on the JF-17. Keep up the good work please. First time we are getting some detailed information the on going development on the project.

by saqrkh

So pretend that buying JF-17 off the shelf directly from Pakistan costs $15mn, and $1mn goes in profit to PAC. If Egypt chooses to license manufacture, then each JF-17 would cost them $20mn ($15mn for the plane plus $5mn for setting up facilities). In the end, PAC will still make its $1mn per plane profit.

by Mohsin E.

I was recently at PAF airbase Sargodah, and got a chance to examine and sit in the cockpit of a Block 1 of the CCS. The 3 large MFDs (non-touchscreens for now, but will be touchscreen for Block3s) gave a very modern feel to the Thunder’s cockpit. The engineer said that PAF pilots reserve the right to keep making suggestions to the design and ergonomics etc. which then contribute to the development of future blocks. This is a huge plus when you have a share in development. Also, I’m happy to report that (according to the same engineer) the Block 3 will receive improvements to the RD93 engine, that will make those damn black smoke trails go away, finally!

The old Viper’s cockpit (block 15 ex Jordanian, pre MLU) looked like a dinosaur by comparison, but the 360 visibility from the Viper was phenomenal. I had wished we were able to make/afford a bubble canopy design for the Thunder, but that Viper setup is too exceptional, even by Western standards. Even the seat is much higher up, so vertical visibility is much better in the Viper. I think only the Raptor might beat it in that department.

By the way, I couldnt get anywhere near the Block 52s or the MLUs, because their hangars are heavily guarded, and there is also a considerable American presence on the airbase because of them… Very disconcerting, considering the sensitive nature of Mushaf Airbase… It really reminds you why we need to get over our Viper addiction…

Getting to the point though, exports aren’t really a major concern at this early stage, I think. Even the first Grippen iteration had a lot of difficulties. But prospects for exports keep improving as the platform matures. The Thunder has now seen combat, and the technology on it is battle-tested. This will help it in the future, and of course as its avionics package improves, that will boost its chances. Priority should remain in making it customized for the PAF’s needs for now, and that will, I think, (ironically) help in selling it offshores anyway, as the PAF’s threat environment is exceedingly demanding, much more so then many of its potential customers.

by Mohsin E.

p.s. tried to upload some pics I took, but upload failed due to size restriction =/

by saqrkh

Nice info, thanks for sharing!

Bubble cannopy is tough, but some improvements can be made to cockpit visibility; it’s possible, just see the MiG-29 to MiG-35 transition. Granted, such a change may require some sacrifice in drag reduction, but with HMD/S apparently on the way, it might be worth it in the end.

BTW Mohsin, if you’d like, you could do a guest post with the photos, and I’ll post it on the main news site under your name plus author details and contact info.

by jigsaww

I know there’s some resistance as to why JF-17 is being pushed for sales so hardly or early but i think this will all go a long way in establishing pakistan as a good defence exporter. let’s not forget, pakistan after turkey is pretty much THE only defence equipment maker. We need more countries in middle east to set up defence manufacturing and R&D, muslim countries.

Egypt has already done K-8 local production in large numbers. All they need is to set up a similar setup for JF-17 since egypt definitely needs a plane of jf-17 type. you can never be sure of sales, but rafale and mig-35 will simply not be enough and do not fit at light fighter level. i’m personally all for egypt going for jf-17, but give it time until block 3 arrives and yes, pakistan should definitely NOT shy away from pitching jf-17 to middle eastern and other countries. after all, pakistan army has a good model and exports going on. at the end of the day, all this adds up to your national exports and wins pakistan political influence in region. It is MUST for pakistan to establish itself as a defence supplier in long run to win leverage in region and parallel offerings to PAF and abroad will not harm, only benefit.

direct sales or under license production, both bring you money anyway.

by Muhammad Shahid

Any idea In what time frame JF17 Block III will be ready to induct in PAF inventory?

by Mohsin E.

Thanks, I’d be delighted to write detailed post of the experience on the base, there are some insights I’d like to share, and not just regarding the JF-17 and the Vipers, but also the morale/environment, as well as the units and the personnel (including foreign contractors)… Although, before I can write a more detailed post, due to OPSEC, I’ll have to clear what I can publish with the officer on whose invitation I was invited in. I was there in the capacity of a ‘guest’ and not a ‘journalist’ after all. Let me get to work on getting clearance, and in the meantime, how do I get contact you to keep you posted on the progress? I tried looking on your Discus profile but couldn’t find contact information. I can post one of my email addresses here if that’s needed.

by saqrkh

No worries, take your time. You can send what you have to me at bilal@quwa.org

by saqrkh

Not clear as of yet, but the design was finalized in January 2015. Depending on the scale of changes, for example if it includes more composites and a larger airframe, it may be a couple of years before we even see the prototype.

by Guest

Is there a limit on the number of units they can manufacture? Or can they manufacture any number of units and just pay us a $1mn per unit (as per your eg).

I think if exporting gives PAC $1mn profit then letting a customer licensed manufacture should give PAC more profit (like 1.5mn/unit) as the customer gets a privilege of manufacturing it at home and then probably the license itself is sold?

Is License Manufacturing and TOT same?

by Muhammad Shahid

Just heard on TV that Pak finalized sale of 8 JF17 to Sri Lanka. Its a great success for Pak for which, all the JF17 team deserve great appreciation. After reading/analyzing above article and and current world situation, I think JF17 Platform will grow further.

by saqrkh

New article is on the way; with two orders, it’d be worth checking out what’s next for PAC in terms of fulfilling, servicing, etc.

by saqrkh

It depends on how PAC prices the goods. For example, it could exact a larger profit for agreeing to transfer technology, or it could sell Egypt knocked down kits for local assembly, thereby controlling supply.

ToT just means transferring technology, but that could refer to many different things. For example, PAC was able to co-produce Falco UAVs, but the Spada 2000 Plus SAM deal resulted in the transfer of overhaul and testing equipment. Both are examples of ToT, license manufacturing is another example.

by Mohsin E.

sounds good, thnx

by truth101

I am not sure where the PAF leadership stand today on acquisition of 5th gen fighters, but 1 thing is for sure that PAF is really concerned about attrition it’s strike elements are likely to face. So the investment is on integrating indigenous SOW in JF 17s like the H2 an H4s, enhancing their precision day and night strike capability and also investing on conventional version of RAAD cruise missile, which is in near completion now.