2575Views 12Comments

Hensoldt: Europe’s new but also experienced defence electronics vendor

The newly formed German defence electronics vendor Hensoldt is on the verge of acquiring British radar company Kelvin Hughes from ECI Partners, Kelvin Hughes’ parent firm. Subject to London’s anti-trust and regulatory approval, Hensoldt aims to close the acquisition by Q3 2017.

Known for supplying maritime radars to the Royal Navy and overseas customers, Kelvin Hughes comprises of 200 employees and maintains annual revenues of $34 million U.S.

If successful, this would be Hensoldt’s second corporate acquisition since its emergence in March. In May, Hensoldt acquired Euroavionics GmbH, a supplier of avionics for civilian aircraft applications.

Hensoldt is the result of private equity group KKR buying spun-off two Airbus Defence and Space (DS) divisions: Electronics and Border Security GmbH and Airbus DS Optronics GmbH. Consequently, Hensoldt inherited Airbus DS’ strong defence electronics portfolio, which comprised of radars, communications equipment, electronic warfare (EW) systems and electro-optical and infrared tracking (EO/IR) equipment, among other assets.

Organizationally, Hensoldt is two business clusters: Hensoldt Sensors GmbH, which will market Airbus DS’ sensor and EW systems, and Hensoldt Optronics GmbH, which will continue selling Airbus DS’ EO systems, such as optronic masts and EO/IR turrets. Hensoldt has 4,000 employees based in Europe, South Africa and, potentially, the United Kingdom, with annual revenue potential of over $1 billion.

Hensoldt’s acquisition behaviour to-date highlights the company’s drive to become a new major sensor and defence electronics supplier. Today, Thales is the incumbent supplier of radars to both NATO and non-NATO markets, with Saab and Leonardo as strong competitors.

Despite its expansiveness, Airbus DS did not emerge as a markedly notable contender in the electronics space. In fact, its former acquisition from South Africa – i.e. Airbus DS Optronics – did not add to the space of helmet mounted display and sight (HMD/S) systems, an area South Africa had helped pioneer.

In contrast, Hensoldt is a specialist electronics vendor; thus, its growth is contingent on its ability to sell and develop electronics. Hensoldt Optronics South Africa (HOSA) will undertake the mainstay of optronics work for the Hensoldt, which includes HMD/S solutions, EO/IR turrets (such as the Argos II and Goshawk II), laser rangefinders and thermal imagers. HOSA is also the source of optronic masts and periscopes for submarines, a key business area for the company.

In radars and EW, Hensoldt will seek to cast a dent to Thales’ near and long-term big-ticket prospects, but it will cast a broad net and address smaller markets. In his statement regarding the purchase of Kelvin Hughes, Hensoldt CEO Thomas Müller stated: “The Kelvin Hughes product portfolio will allow us to enter more price-sensitive markets and … bring us one step closer towards our strategic objective to develop our Sensor House into a Sensor Solutions provider.”

Granted, “price-sensitive markets” can also include NATO markets, but with many militaries in Asia, the Middle East and North Africa seeking to modernize their naval and land-based air defence environments, Hensoldt has considerable opportunity for near-term big-ticket sales.

How is Hensoldt relevant to Pakistan?

Through its acquisition, Hensoldt is both inheriting and consolidating business with Pakistan. In October, Pakistan, via Turkey’s STM, contracted Airbus DS Optronics to supply a SERO 250 periscope and OMS 200 optronic mast for the lead Khalid-class Agosta 90B submarine (of three) slotted for a mid-life upgrade. In February, Pakistan selected Kelvin Hughes’ SharpEye I-band pulse-Doppler radar for the Agosta 90B. The Pakistan Navy also selected the Kelvin Hughes’ SharpEye radar for its 17,000-ton Navy Fleet Tanker.

If the Kelvin Hughes acquisition succeeds, Hensoldt would acquire the combined share (in value) of Airbus DS Optronics and Kelvin Hughes’ inputs in the Agosta 90B. The SERO 250, OMS 200 and SharpEye would essentially become a Hensoldt package, which Hensoldt can potentially extend to other programs.

For Hensoldt, the Pakistani naval market would have at least three major business opportunities: the next-generation – i.e. Hangor-class – submarine program, the multipurpose offshore patrol vessel (MOPV), and the MILGEM corvette program. While Hensoldt’s main incentive is to expand its business activities in pakistan, the Pakistan Navy could continue pursuing Hensoldt with the aim of standardizing its equipment.

The SharpEye radar platform could be integrated onboard Pakistan’s submarines, warships, patrol ships and auxiliary support ships. The SharpEye is a comparatively low-cost system that has already been cleared for sale to Pakistan, where it is to see use aboard on the Khalid-class submarine and Pakistan Navy Fleet Tanker. It would not be surprising if is extended to the MOPV, MILGEM corvette and other ships.

In terms of submarines, the main draw for Pakistan to extend the Khalid-class’ coming subsystems to the Hangor-class would be commonality, which helps scale its training and maintenance infrastructure. For Hensoldt, this would mean sales for the SERO 250, OMS 200 and SharpEye.

For the MILGEM corvettes, Hensoldt could offer the SharpEye along with the TRS-3D and TRS-4D radars, which provide 200 km and 250 km in range, respectively. However, Pakistan’s radar selection will depend on the extent of the MILGEM’s anti-air warfare (AAW) capabilities. If the corvettes lack space for vertical launch system (VLS) cells for medium-range surface-to-air missile (SAM) systems, then the Navy has little utility for long-range radars. Lower-cost radars, such as the Saab Giraffe AMB, may be sought instead.

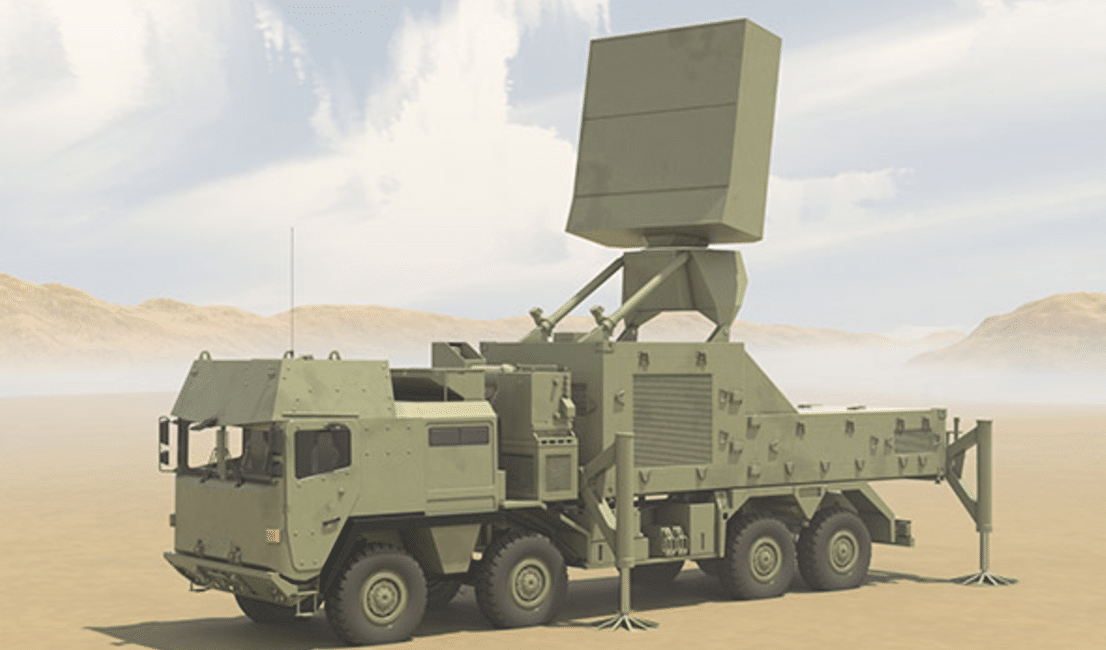

However, Hensoldt’s land-based radars – i.e. TRML-3D/32 and TRML-4D – may interest the Pakistan Air Force (PAF) as potential successors for its Siemens Mobile Pulse-Doppler Radars (MPDR). The MPDRs are the PAF’s mainstay low-level air surveillance radars, but in light of modern EW threats such as digital radio frequency memory (DRFM)-based jamming, the MPDRs are diminishing utility. The TRML-4D is a gallium nitride (GaN)-based active electronically-scanned array (AESA) C-Band radar with an instrumented range of 250 km. It can be used as an air surveillance or target acquisition radar. Hensoldt’s competition on the market include the Saab Giraffe 4A, Leonardo Kronos Land and Thales Ground Master 200.

It is not known how Pakistan will supplant the MPDR, but for Hensoldt and the industry, it could be a high-value and long-term avenue. The Saab 2000 Erieye airborne early warning and control (AEW&C) program is an example of the PAF’s executing cornerstone requirements over the long-term (in May it announced that it will add three new Erieye AEW&C to its existing fleet, which it ordered in 2007). Low-level radars are essential for plugging gaps in high-level coverage, which expose vulnerabilities to low-flying aircraft, unmanned aerial vehicles and stand-off range munitions. Readily mobile low-level radars fill these gaps and provide an added dimension of flexibility to the PAF, which can adjust its air defence coverage to the situation by re-deploying its radars.

HOSA’s optronics could also be a factor for the PAF provided HOSA develops a fighter-use HMD/S system for the JF-17 Thunder multi-role fighter. While it had disclosed a general overview of the JF-17 Block-III’s subsystems, the PAF has not provided few details into the specific suppliers it will rely upon to support the Block-III. However, the HMD/S market has few competitors, with Elbit dominating the space on most platforms, leaving Thales and BAE Systems to fulfill the rest. Likewise, HOSA’s EO/IR turrets could interest to the PAF for use on small manned and unmanned aircraft.

Hensoldt’s emergence presents Pakistan with a new potential supplier for its sensor and electronics requirements. The usual fiscal constraints will shape the outcome of deliberations, but there are key, yet untouched, opportunities Hensoldt can pursue within the Pakistani market (e.g. HMD/S). In other realms, such as radars, Hensoldt would broaden the competitive pool, providing Pakistan with additional quality options.

12 Comments

by Asif Khan_47

Nice report but don’t you think you are assuming and reading a lot with relationship to Pakistan?

by Bilal Khan

Overall, I see it as another potential supplier. Via the OMS, SERO and SharpEye – which the PN selected – it’s already dealing with Pakistan. In fact, even some of the late stage support for the Siemens MPDR is now run via Hensoldt.

by Steve

Very knowledgeable article. Congratulations Bilal. I agree the Pakistani armed forces are slowly but surely building up critical infrastructure with electronics and radars paramount to its defence strategy. GaN based AESA radars should be what we aim for on land, sea, and air. Local manufacturing with collaboration will reduce cost which is always a problem. HMD/S for Block III looks very interesting!

by Asif Khan_47

Siemens MPDR are in service with Pak Army Installation defence system since 1979. Rather these MPDR are getting replaced with FM-90 SAM and the radars. Go to places like Mangala and Terbala you will see that Siemens MPDR are no longer there. If you can see this years PAF parade at Risalpur you will see Siemens MPDR displayed as a relic. Thanks!

by Bilal Khan

The MPDR is also the serving low-level sensor of the PAF, still in place.

by Asif Khan_47

No, both Pak Army and PAF have replaced them. PAF replaced it with SPADA it has RAC-3D radar. Some months ago when I was leaving Nur Khan AB, I saw a battery of SPADA, in the past R-440 Crotale along with MPDR with Oerlikon guns were installed. The Oerlikon guns are still there.

by Bilal Khan

Interesting. I was told flatly by a retired, but still engaged, PAF officer that the PAF was still looking. He added that the PAF won’t replace the MPDRs with fire control radars (e.g. RAC-3D), but specifically mobile low-level sensors for surveillance, i.e. with instrumented ranges of 180+ km. Also, the MoDP reports for 2010-2011, 2012-2013 and 2013-2014 show that MPDRs were being overhauled in those years.

by kaster

Bilal there were recently some reports that Raytheon is developing a cyber attack warning system for pilots will you please shed some light on it and also should Pakistan air force try to get a system like that because cyber attacks on flying planes can be a big threat. A few days ago I red an article which stated that the last indian SU-30 crash near china border was also due to a cyber attack.

by Asif Khan_47

MPDRs belong to Pak Army Air Defence command and it is shared with PAF for its FOB. The reason MPDR are placed at AB is that it works parallel with Oerlikon guns and Skyguard system. Oerlikon guns belong to Pak Army and not PAF. So in the past to defend the AB PAk Army AD units are based at with Oerlikon guns.

by Bilal Khan

hmm… I think we’ll need to wait for more official documentation. In the 2017 March 23rd Parade the PAF was showcasing an MPDR, suggesting that the PAF is still using the MPDR. https://youtu.be/5m8KMCZ7BM8?t=1h1m39s

by Asif Khan_47

An advice don’t try going with what they display at parades and MoDP. They lie so much that they forget what they said earlier and rather they start to contradict themselves. They displayed SPADA first time this year but it has been operational since 2014-15.

by Hamza

Asif Sb your information is totally incorrect about MPDRs ownership please recheck. whereas about Oerlikon and Skyguard you are correct