2353Views 47Comments

Discussion: Pakistan’s options for addressing India’s air warfare lead (Part 4)

This series was written to add Quwa’s perspective to the increasingly prominent question of how the Pakistan Air Force (PAF) could address India’s strong – and increasingly stronger – air warfare lead. The Indian Air Force (IAF)’s recent Rafale acquisition has added another layer of urgency for the PAF.

Part one of this series offered a summary of the operational challenges facing the PAF. Part two offers a discussion of the costs associated with procuring foreign platforms; in turn, it makes a case for the PAF to continue focusing on the JF-17 Block-III as its core defensive answer. Part three examines the challenges with the Block-III, especially in terms of how it may not smoothly coincide with the time period the IAF is expected to induct the Dassault Rafale.

In part three, it became apparent that the PAF would require an off-the-shelf platform to ‘bridge’ the gap between the probable induction period of the JF-17 Block-III and the start of the IAF’s Rafale induction process. From a defensive standpoint, the JF-17 Block-III – with its active electronically-scanned array (AESA) radar – could be a credible solution, especially if procured in substantial numbers. However, as of late 2016, the Block-II program is still ongoing, and the PAF has yet to offer an update in regards to the Block-III. It would not be unfair to suggest that the Block-III may not be a factor until 2019, at the earliest. That is when the IAF is expected to begin inducting the Rafale.

The prospect of the PAF procuring a Western solution such as the Eurofighter Typhoon or Saab Gripen NG is slim. Russian platforms, such as the Su-35 and MiG-35, can at best characterized as uncertain, though it appears that Pakistan is interested in studying its options in Moscow. With the Lockheed Martin F-16 still being a wild card of sorts, the PAF’s off-the-shelf purchase (if pursued) will likely come from China. In this respect, a late-model Chengdu Aircraft Industry Group (CAIG) J-10 – i.e. J-10B or J-10C – would be something of interest to the PAF.

Prior to 2009, the PAF was slotted as a likely launch customer for the J-10 – or FC-20 as branded by AVIC. In the defence observer community, it was widely believed that the PAF would be procuring the J-10B, which was a markedly improved variant of the fighter, though in the prototype stage. A mix of economic issues and a decision to capitalize upon the F-16C/D Block-52+ fleet, the PAF opted to walk away from the J-10. Furthermore, it did not appear as though China had even cleared the J-10B for export (as per British aviation journalist and leading PAF observer Alan Warnes).

China’s reluctance to clear the J-10B-series (which includes the J-10C) for export could be a result of its unwillingness to part with its newest subsystem work, such as the J-10B’s radar or electronic warfare (EW) and electronic countermeasures (ECM) technology.

That reluctance may still be present, but AVIC did claim that it could develop export-grade equivalents for use on the FC-31; in this sense, there may be an option for the PAF to separately fund the development of an AESA radar and accompanying ECM/EW suite for use on the J-10 and JF-17. A plausible – but very remote – alternative would be to procure the J-10 in an empty configuration (i.e. airframe and engine only), and opt for a third-party radar and ECM/EW suite.

In any case, the PAF’s objective with regards to the J-10 would be to secure the supply of an AESA radar-equipped fighter before the end of this decade. In fact, the medium-weight profile of the J-10-series, while technically redundant on paper in light of the F-16, would offer practical benefits to the PAF in light of its operational reality. For example, the PAF cannot freely configure and equip the F-16s with non-American munitions. In light of the fact that there is an increasingly large market of sound air-to-surface munitions, this limitation on the F-16 makes it an inflexible platform, and that – at the minimum – withholds the PAF from utilizing its assets to their full possible effect. In contrast, the PAF could freely configure the

In light of the fact that there is an increasingly large market of sound air-to-surface munitions, this limitation on the F-16 makes it an inflexible platform, and that – at the minimum – withholds the PAF from utilizing its assets to their full possible effect. In contrast, the PAF could freely configure the Ra’ad air-launched cruise missile, H-2 and H-4 stand-off range glide-bombs, C-802 anti-ship missile, and other munitions to the J-10.

In absolute terms, this would not be a low-cost initiative, but at this stage, Beijing appears to be the only party willing to extend flexible financing and credit to Pakistan for defence purchases. One can simply point towards the recent submarine order as evidence for this point. However, in light of the alternatives, especially in Western Europe, a purchase of a J-10B-derived fighter would be prudent on its own terms. China has a strategic interest in having a militarily strong Pakistan to help hamper India, which the U.S. is increasingly counting on to help contain China. In this respect, the issue of pre and post-conflict supplies and platform access (to configure the fighter at will) would not be an obstacle.

47 Comments

by AMAN

BILAL !!!!!!!!!

TIME HAS COME TO ANALYZE ONLY TWO OPTIONS

EITHER F-16 OR SU-35

IN EVERY ASPECT SU-35 IS SUPERIOR TO F-16 AND COSTS LESS THAN F-16.

MAIN POINTS-

1= DON’T WORRY RUSSIA WILL SELL SU-35 TO PAKISTAN BECAUSE INDIA IS NO

MORE BUYING RUSSIAN JETS .

2= INDIA WILL BLOCK EVERY DEAL THAT YOU WANT TO MAKE WITH USA OR EU.

JUST LIKE PREVIOUS ONCE THE EIGHT F-16.

3= J-10 IS NOT GOOD ENOUGH AS RAFAEL AND BUYING WEAPONS ONLY FROM

CHINA WILL LOOK LIKE PAKISTAN HAS ONLY ONE ALLY .

PAF WILL HAVE TO BUY SU-35 TO COUNTER RAFAEL I MEAN HAVE TO!!!!!!!

BECAUSE SU -35 IS MOST ADVANCE 4.5 GENERATION FIGHTER IN THE WORLD.

SU-35 CAN DOWN EVEN F-22 RAPTOR. https://uploads.disquscdn.com/images/9f4cde1e45d4ab013c87c506e4f405d9e2b5d4eb737b7e72b56d8e4e71349b0f.jpg

PLEASE REPLY BILAL & ABDUL RASHID I WANT BOTH OF YOU TO COMMENT ON MY OPINION .

AND YES PLEASE NEXT ARTICLE ON

“WHICH ONE SHOULD PAKISTAN CHOOSE AS ALLY SAUDI ARABIA OR IRAN”.

by Abdullah Aman

i too also think J-10B or C are only viable option for PAF with it combustibility it would be better platform and cheaper one too if we get different long range air to air weapons that plane is the best choice as for SU-35 could be an option if Russia agrees as for as india censor on this matter both country know India is not going any for long time with 200+ SU-30 and investment in Sukhoi PAK FA but that plane is expensive

by Khalid Rahim

Moscow has shown keen interest in developing close Defense Relations and we should avail the opportunity to bring Russia into Sino-Pak fold. PAF probably has already shown keen interest in SU 35. Let’s keep our fingers crossed.

by Manju

Is it me or someone else noticed that some parts of articles are missing? Anyways the articles still resembles 1970s, when there was very less parity between India and Pakistan,things are completely changed now. And Yes, J10 seems to be the only option for Pakistan because those who are calling for the purchase of Su35. Well it’s not going to happen because of Indian Investments in Russian Defence(more than 20 billion annually). Some of them might be as described below.

1.India is upgrading all its 200+ Su30mki to “Super Sukhoi” standards which will make it equivalent to Su35.

2.India is Purchasing S400 triumpf missile defence system this year.

3.India has heavily invested in Sukhoi-PAK FA(5th gen) and also expecting it’s prototype for India by next year.

3.India is planning to acquire another nuclear attack submarine from Russia and jointly working on Aircraft Super carrier “Shtorm”.

4.The deal of producing Kamov ka226 will be finalised this year.

Russia has many defence and nuclear projects here in India and almost half of India’s defence budget goes to Russian defence purchases annually.

The maximum Pakistan can afford is below 30 fighters that too expecting a credit from Russia which I don’t think is going to happen anytime soon (Present state of Russian economy).Even if Russia agrees the deal with Pakistan(that’s a big IF), it might delay the delivery(after 2020) to such a time so that India will already have operational squadrons of PAK FA(5th gen).

by junkie

We need to look at the procurement of another fighter in light of its need, as Bilal has already stated in one of the articles. The country’s philosophy can be structured around offensive or defensive. If we agree to a defensive philosophy, then having a bullet proof anti-aircraft system is a very good option. But this will have to be really bullet proof. It would need to cater for well-known deficiencies in radar systems (e.g., the Americans destroyed Iraqi radars using low flying stealth helicopters during the first war, the Americans were able to penetrate our radar defenses with impunity in the OBL raid, HARM missiles actively identify and destroy sources of EM radiation, etc.) If a country such as Russia is willing to help us with electronic warfare, then buying an air defence system and starting a parallel program for creating our own air defense system based on existing models and investing money into it makes perfect sense. Such a system is needed regardless whether we have a 5th Gen fighter or not.

if this approach can be adopted, the PAF can sit back and rethink Block III as an advanced air superiority platform. But again, there are a lot of variables here and my best wishes are with our Air Force. May Allah the Almightly help them make the best decisions for Pakistan and the Muslim Ummah.

I just want to add that acquiring new fighters is NOT a trivial undertaking and spending scarce resources down that blackhole would be highly inadvisable. A compromise is to get a country like Turkey/Saudi Arabia to create an airbase in Pakistan and station its advanced fighters here. That would send a totally different kind of message and would reduce any chances of ‘misadventurism’. Again, I agree this is really ‘out there’, but no harm in discussing all possibilities.

by junkie

Pakistan must also avoid falling into a ‘Tejas like trap’. Instead of trying to bring out a full featured Block III in a decade, it is better to limit the scope of Block III to include the two-seater version and whatever enhancements are possible by end of this year/mid next year. The two-seater version will pay off immediately by fulfilling the requirement of foreign airforces for a trainer version of JF-17. There can then be a Block 3.5 that has the airframe structural changes and the engine capacity that will enable future workloads of AESA radars etc. In all other respects the 3.5 can remain the same. This means we will gear up the production line for the modified airframe, get expertise in maintenance/overhaul of the new engine, and start mass producing early. The later modifications of AESA etc. can be simply upgrades for Block 3.5.

by SP

Pakistan has traditionally bought systems from the West when it got them at subsidised rates due to being allied with the West whilst India was allied to the Soviet (opposite camp) howevee it still managed to procure systems from.Europe.

Since the collapse of the Soviet Union Pakistan has suffered as it is unable to procure systems from the West due to high prices and Western interest to safeguard their interests from a rising China which mean’t warming of relations with India. The except was when Pakistan rented itself out to the US to fight its wars, however what Pakistan gained in one hand was taken away from it by the West from the other hand. For example Pakistan gained support from US to help it in Afghanistan but it lost due to wear and tear of its infrastructure, the rise of US and Indian supported terrorism in Pakistan, installation of client government in Islamabad (PPP) and the loss to the economy of Pakistan.

Now if Pakistan were to buy Western systems for Chinese aircrafts, it would not be getting cutting edge technology but mature technology at inflated priced with considerable delay so by the time of being operation it would be outdated. Then India would try to create hurdles as it has more of a hold on western countries than Pakistan. India has an aggressive policy towards Pakistan which aims to deny Pakistan any oxygen.

As far a Chinese systems are concerned, chinese technology has grown by great leaps. Quality Chinese systems are exported to the West and Chinese companies have subsidiaries in the West. Chinese companies are worldclass now with further progress in the future. The cost benefit analysis does not justify getting western systems for chinese aircrafts. Better option would be work with the chinese and get the systems customised to PAF needs. China is furthermore not going to be swayed by Indian protests. Russia is also a more reliable ally than the US will ever be and it will send a strong message to the West to stop fighting a proxy war against Pakistan in order to sandwich it between hostile India and hostile Afghanistan. Furthermore the US wants to be allied to Iran but its attempts are being rebuffed by Iran. The US wants a safety guarantee from Iran for Israel, once Iran agrees that US will improve relations with Iran and also get Iran to also create problems for Pakistan. The US policy seems to be aimed at not only containing China or Russia but also Pakistan.

by KM

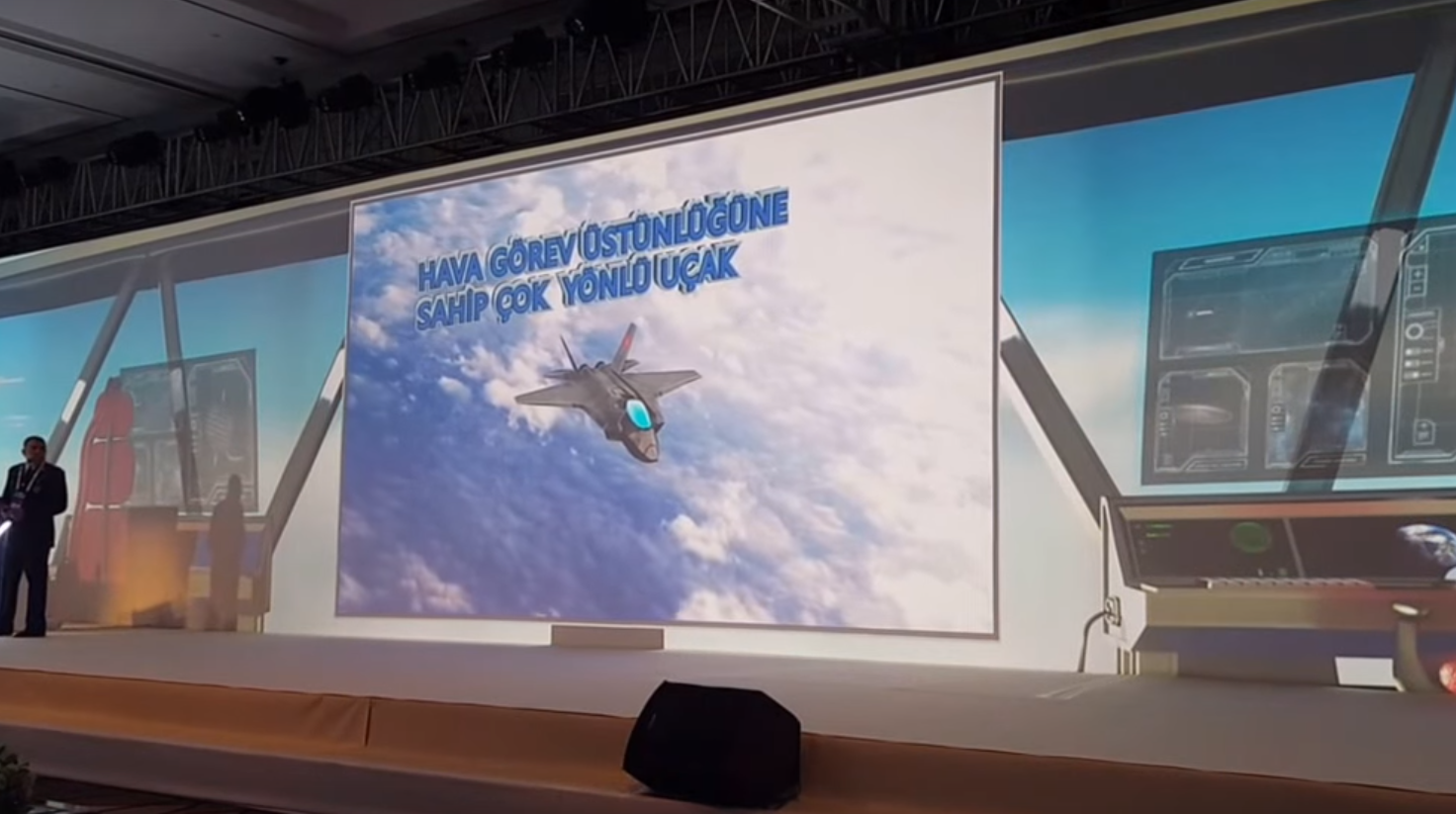

There has been lot of discussion over Medium Weight profile to counter Rafael but I am thinking instead of reactive approach why shouldn’t we act pro-actively and start thinking seriously about next gen fighter. It is time for Pakistan to seriously think of TAI TFX as by the time we manage to induct JF-17 Block 3 or buy off the shelf medium weight aircraft, we will already be lagging behind India.

by Qasim57

We have a history of taking Chinese airframes and integrating more-advanced European radars and avionics (F-7PGs, etc).

Biggest question is if we can get European AESA radars, and pair Meteor missiles with the JF-17. I’d expect fervent lobbying from India, but Europeans can be more reasonable than Americans.

They could be made to see the value of deterrence between Pakistan and India, to prevent a conflict between nuclear-powers.

by MT

1. Italy may sell radar to pakistan but Why would MMDA france sell Meteor missile to pakistan given MBDA is own by french major company

2. There is no parity between india and pak via economy, science+technology,innovation index .

by MT

TAI TFX is not even on detailed design phase.

The fighter is atleast 20-25 in future if Turks can get those funds which as of now looks bleak with their F35purchases & junk Debt rating

by MT

It depends upon the orders of Su35. Russian will not sacrifice their relations with future economic giant,3rd largest oil+gas consumer & 8 bill$ defence deals of Su30MKI upgrades to Super Sukhoi over 1-2 bill$ money from pakistan

by Muhammad Khurram Bhatti

I agree with Naim on the foreign policy matters and his last comment provokes the thought, “Why did Pakistan walk away from the F-16s?” There must be a rationale behind not using our own funds for F-16s. With a man like Sohail Aman at the helm, there gotta be a valid reason behind that. I think we shall see a few agreements in the next month that will explain this rationale. What we need is an air superiority strategy that can counter both Rafael and PAK-FA. We can’t start running for one fighter to match Rafael today and then be back on the road in 2021.

by Abdul Rashid

AMAN!!!!!

I’m just your average, seedha-saadha, site moderator to help promote friendly discussion. It is best if Bilal makes the detailed analysis your input calls for!

BTW, The F-16 option is still there at a cost should PAF decide to pursue it. But why should they when……………”When what?”, I hear you ask. When…. are your ready for it, Aman? Both of us together in one voice… 1….2….3…… When Su-35 is BEST!!!!!!!!!

by Qasim57

The Meteor is *not* a French missile, nor is MBDA “owned by a french major company”. It is an European conglomerate.

MBDA was formed by a merger of Italian Alenia Marconi systems, British Matra BAE Dynamics, and French Aerospatiale-Matra.

To have a substantive discussion — and not an interminable “fanboy” propagandistic exchange it is important to get the facts right.

by middleway1

India is obsessed with parity against China. Pakistan is not similarly obsessed with parity as such, because it has no offensive designs against India. It is only interested in minimum effective deterrence.

by middleway1

I agree. I think the US would like to see Pakistan broken up into smaller, more “manageable” pieces. That’s the game being played out right now. Thus it is imperative for Pakistan to become strong economically, not just militarily.

by middleway1

Made me laugh! Good sense of humor!

by Sami Shahid

When only China is investing in our country than we should buy fighter aircrafts from China not USA ! J-10 is a good alternate for F-16 and Pakistan should get it.

by bill

I am quite agreed with u up to some extent as per AESA radar and also EW suit of EU origin probably Italy however we may chose SA path for supply of next gen Marlin BVR and HOBS Wvr missiles for use on large scale with entire fleet with only exception of F16s.

by bill

The only path to counter IAF/India is to achieve self reliance which can be made possible in short term by JVs in case of next gen BVR and WVR missiles with SA on other hand in medium term we may go for JV with Italy as done in the past.

by bill

To be honest with lighter air frame perhaps you may make JF17 more stealthy and lighter by using composites along with use of RD33 variant having smokeless/ IR suppression system, resulting in more agile and fast jet i.e up to Mach 2 or some increase in service ceiling but due to air frame/power limitations only an AESA with some what medium range can be installed and it’s better version for expected Jet of medium class.

PAF has another path for induction of additional platform i.e EU fighter trench 1 may be available in numbers cheaply from Italy and UK. Later on can be equipped with tailor made AESA with relatively longer range and lighter version for JF17.

by MT

But India China parity is more plausible as they both are big players by economic size,ranking of their companies,r& d investment,patents/papers published.

Pak doesn’t rank in top30:in any of those categories

by Kanishk

Aman there are few things you are forgetting is that india is not buying su35s because it has figter with similar capabilities su30mki and the performance capabilities differences are going to significantly reduced after the super sukhoi project that russia and india are working on.

Next thing india is buying 200 helicopters from russia the deal will be made official probably in October or November.

And then again india is investing 4.3 billion in fgfa project which is fifth generation fighter with Russia which india wants to buy 150 jets.

See this from business point of view do you thing just because russia does not like usa it will sell PAF su35s fighters that to in small number 30 at the most and upset india. And i haven’t even mentioned other small arms deal like s400 air defence system,etc.

Hope this answers your answer.

by nob hamid gul

I don’t think Pakistan will go for j10. Instead pakistan should try to Make jf17 a 4++ by configuring it with western aesa irst ECM/EWsuite and Rd33mk engine by redesigning airframe with more composite. And replace mirage and f7pg with those jf17. Procure atleast 250 unit.

Get mig35 to replace f16s as it also has rd33mk. And there are chances that Russia may agree to sell this ignored aircraft. Maintenance of engine will be no burden as jf17 will also have this. Procure 5 squadron

ANd then laid the foundation of fifth gen aircraft. Go for TFX.

Admin please write about Pakistan Army’s Artillery and armoured brigade

by nob hamid gul

I don’t think Pakistan will go for j10. Instead pakistan should try to Make jf17 a 4++ by configuring it with western aesa irst ECM/EWsuite and Rd33mk engine by redesigning airframe with more composite. And replace mirage and f7pg with those jf17. Procure atleast 250 unit.

Get advance air to surface stand off missles/munitions

Get advance air to air missile like meteor.

Get mig35 as it also has rd33mk. And there are chances that Russia may agree to sell this ignored aircraft. Maintenance of engine will be no burden as jf17 will also have this.

Pakistan need heavyweight jet for it’s navy.

MIG 35 is low cost and with the capabity to check India’s sukhoi 30mkisuper.

Procure 5 squadron.

F16 should continue to serve and should be replace by mig 35 only when the fifth gen start to be inducting.

Finally invest a little more in ground air defence System.

laid the foundation of fifth gen aircraft. Go for TFX.

Admin please write about Pakistan Army’s Artillery and armoured brigade

by AMAN

I agree with you MT but what goes in a try?

i mean Pakistan should try at least .

by AMAN

reply=

1. It’s only thought no deal has been signed yet its you media hoax

2. No S-400 deal has been signed yet even the price of the deal not finalized yet and i

guarantee you Russia won’t sell S-400 to India just like France.

3. your stealth program with Russia is delay delay and delay because India doesn’t want

to spend money on that project .

3. I know next aircraft carrier won’t come from Russia it will be purchase from USA.

4. And 4th Ka-226 is light utility helicopter it is no big thing.

Russia also understand the situation and it has started first ever joint military exercise with Pakistan. Russia knows that India is going closer to U.S.A and Israel.

by AMAN

Yes I agree with your opinion No – F-16 if we have a better and less costly option.

by AMAN

wait for right time and we should convince Russians for Su-35 of at least 3-4 billion dollar.

From next budget and upcoming budgets we should spend more on air force.

and if they won’t accept deal we should purchase J-10 from china.

by AMAN

Yes Su-35 is the best!!!!!

by Mazhar

Don’t forget our previous wiasted $600 m in refused F-16s. I think we never got our full money back but some wheat. If Americans did it in the past, what’s the guarantee they will not do it again. It’s better to stay away from F-16 and try something else. I am very confident of our PAF experts, they will come up with some viable solution.

by SS_IND

The following options-

1.Su 35 (not going to happen simply because of cost and maintenance, and Russia doesn’t give discounts at the cost of billions from India)

2. J10 (depends on China-India relations, but wont be cheap)

3.JF-17 Block-III(the only option but is never going to be better than Rafale or Su30 (to be Super Sukhois) maybe will become comparable to Tejas)

4.Eurofighter (Expensive like Rafale but not better than Rafale.)

5.F-16 (good option as infrastructure already exists in use to buy without discounts)

But i think the bigger problem is not to counter India’s Rafale which most likely are going to be more than 36..but replacing the 190 old jets as the Pak ACM said in his interview.

by Zain Rizvi

Is there any option to get s300vm4 and S350 from Russia to kill intruding jets and missiles, most likely carrying nuclear warheads. Thsee would be the most useful means to defend our airspace, critical infrastructure, and population incase of a nuclear attack. Investing in JF17 block 3, R&D on a future generation platform preferred to be a hypersonic UAV capable of delivering nukes would be sufficient to defend our nation. Furthermore I believe that Pakistan needs to as many nuclear warheads as possible. An a super electromagnetic weapon as the last option to stop devastating war.

by MT

why won’t russia sell s400 to india??

pak fa is delayed bcoz its not up to mark

by SP

PAF leadership, pilots and engineers need to get out of their comfort zone in order to grow. They need to overcome inertia and to stop procrastinating. The mentality of buying more f-16 just because youp are familiar with it is the same insane and lazy mentality that keeps the Pakistani public flocking to buy Suzuki Mehrans as maintenance is cheap.

Pakistan operates mirages and is probably the last country to still be operating them and is probably maintaining it by cannibalising mirage aircrafts, it is operating f-16 which it first acquired over 30 years ago, and it is operating jf-17 which is a new and good aircraft but based on mig-21.

Its about time that PAF became adventurous and acquired something like SU-35 or failing that J-16 with Russian engine or failing that J-11 with Russian engine.

by AMAN

Because S-400 will be threat to china .

china won’t let that happen.

Russia refused to sell S-400 to India during Manohar parrikar’s visit to Russia. And now India trying to convince Russia for S-400.

by MT

You have no clue about Indo russia china relations-

Russians r not fool who will sit in lap of china. They like to balance relationship. for the same reason, russian selling latest kilo class submarine to Vietnam & allowing india to sell Brahmos to vietnam

Russia have infact asked India to move forward on Pak-Fa so Pak-Fa is the only deal thats affecting S-400 battery sales

by jamshed_kharian_pak

World of Islam Ksa Arabia, Ir Iran has Natural Religious Great influence in the Islamic world, as Islamic country Ir Pakistan we must not use satanic divide and rule policy, we must care for both of them, in the great interest of Ir Pakistan and Islamic world at large.

by noman

I think US soon offer to sell F16 to Pakistan, to keep away Pakistan from Russian block…

by noman.anis.kh

but we are not familiar with j10, we can fly f16 any version,also f16 crash ratio is very minor as compared chinisie varient planes like jf 17 recently crashed in arabian sea and f7pg lost twice in last 8 months….remembet US woud offer to F16 soon InshAllah..by induction of US tech in our PAF we can be able put pshycological pressure to india as well as other countries of the region…US needs us…we do not have any need of US if you see history since 1947…

by SS_IND

https://in.rbth.com/economics/defence/2016/10/10/india-to-acquire-russian-s-400-system-that-makes-f-35s-stealth-useless_637411

by M. Naim Shaikh

China has never invested a penny in Pakistan. It has made tremendous amount of money from Pakistan. In fact, there has been a reverse flow of knowledge and technology from Pakistan to China. For example, China was still separating Uranium U235 isotopes from U238 through a labor intensive electro-magnetic system when Khan Labs and Pakistan offered the most advanced Centrefugal Uranium separation technology on a platter. The latest Chinese attack helicopter is based on pieces and photographs of the most secret US helicopter destroyed in Abotabad! Ironic isn’t it. The list goes on and on. Finally, do not forget what is happening at Saindik and Riqodiq gold and copper mines (mind my spellings of these places).

by MT

India just signed the deal with Russia for S-400

Source: Reuter

by SS_IND

India has bought the S400 missile defence !!

by yassir

Does Pakistan have anti satellite weapons program. India has plenty of satellites while Pakistan has just a few putting India at a disadvantage in case both possess such weapons and use them in war. Just like Iran, Pakistan needs to invest heavily in missile technology which is far less complicated and less expensive to develop then aircraft related technologies. The gap between Pakistani and Indian air force capabilities is going to widen with each passing year in favor of India. Pakistan cannot afford an air force race with India but a missile race, yes it can.

The air superiority of Indian air force can be effectively balanced by a Pakistani edge in missile force. Missiles are difficult to locate and to stop in air, while aircrafts are easy to be located , easy to be stoped in air and even easy to prevent their take off by disabling the runways.

by Rnegade

Eight f16 Pakistan could have bought if they were not looking for subsidy.

You are right if Pakistan can spend hard cash they will be able to get SU 35 as Russia is in need of hard cash for its defence sector.