51Views 10Comments

Discussion: A look at Russia’s MiG-35 pitch

Foreword: This is not a news story, but a piece for discussion. The details offered in this article are not authoritative pieces of information, but rather, perspectives of the author.

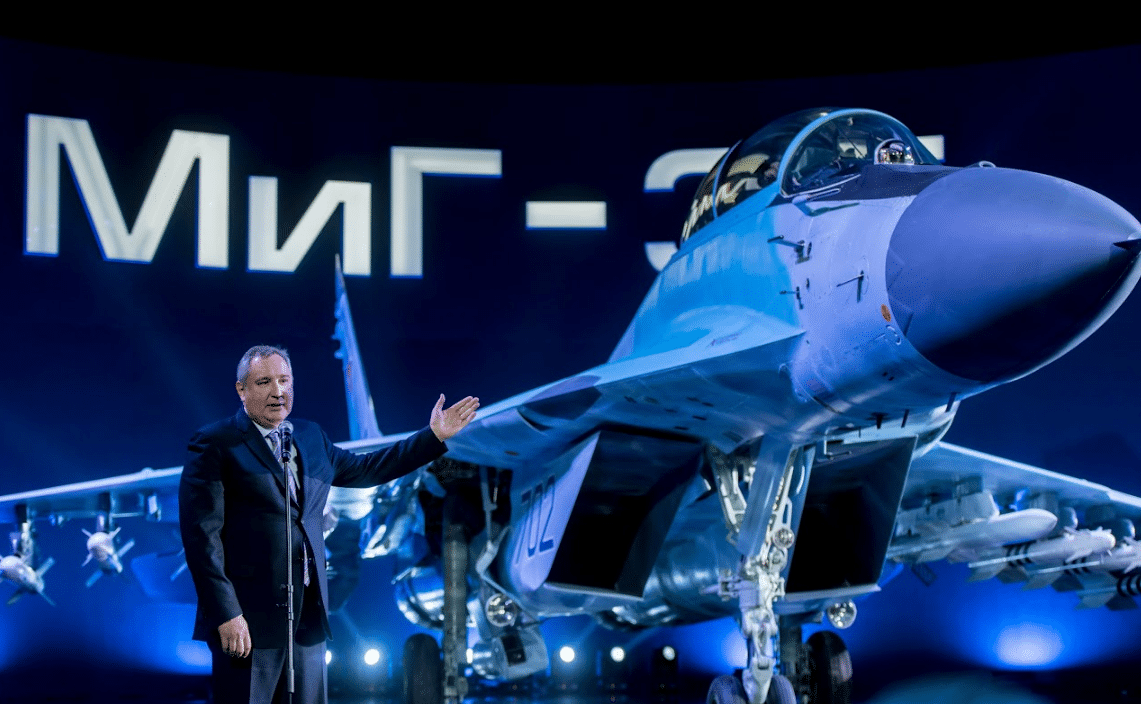

On the launch of the Mikoyan MiG-35, United Aircraft Corporation (UAC), the Russian government, and the Russian armed forces leadership delivered a vocal marketing push for the new Fulcrum variant. From citing the current MiG-29 customer base to promoting Moscow’s ongoing campaign in Syria, the MiG-35 is being presented as a low-cost but high-performance option.

The centerpieces of the MiG-35 comprise of the Zhuk-AE active electronically-scanned array (AESA) radar and RD-33MK smokeless turbofan engines with full-authority digital engine control (FADEC). When the MiG-35 was under development, Mikoyan had intended to configure it with the Thales TopOwl-F helmet-mounted display and sight (HMD/S) system and Elettronica ELT/568(v2) electronic warfare (EW) and electronic countermeasures (ECM) pod from France and Italy, respectively.

It is not clear if these systems will be offered by default on the MiG-35 considering Russia’s precarious ties with Western Europe, but it is important to note that the MiG-35 was designed to accommodate custom configuration. The use of the MIL-STD-1553 serial data bus, which will enable the MiG-35 to take on commercially off-the-shelf and industry standard munitions and sub-systems, is a clear example.

There is no doubt that Moscow and UAC have the developing world in mind, and to their credit, the prospect of an AESA radar-equipped multi-role medium-weight fighter for USD $50 million or so per unit with the logistics and maintenance package is attractive. In fact, the Russian Aerospace Forces (VKS) are apparently committing to replace their ageing MiG-29s with the MiG-35, giving the platform a domestic anchor base to build scale and help with affordability.

In his statement for the event, President Vladimir Putin noted that officials from more than 30 countries were present at the MiG-35’s launch. Besides the leading candidates, such as India or the Middle East and North Africa (MENA) clients, officials from states with emergent forces, such as Bangladesh and Peru, were also present at the MiG-35 launch event. A Bangladeshi official told Russian media that the MiG-35 was among the platforms the Bangladesh Air Force would evaluate as part of its modernization plans.

Analysts, such as Nikolai Litovkin (from Russia Beyond the Headlines), noted the Russian government’s push to position the MiG-35 and Mikoyan as relevant industry players, hoping that the attention would enable the new platform to generate overseas interest and near-term sales. However, Litovkin cautioned that Mikoyan “will be unable to organize full-scale production on its own, and significant investment will be required, both from the government and customers” to make timely MiG-35 deliveries viable.

If this is an accurate assessment, then it would be pause for concern to prospective MiG-35 customers. ‘Customer investment’ means a higher unit-cost, which risks pushing the MiG-35 into an uncompetitive cost bracket. Granted, that bracket is quite high relative to the Eurofighter Typhoon, Rafale and, to an extent, the JAS-39E/F Gripen, but many in Russia’s target market are not examining the MiG-35 against Western fighters, but other Eastern alternatives, namely Chinese ones. With China beginning to clear AESA radars for export, it may not be long before the Chengdu J-10B is also offered to the market. China is also in a better position than Russia to offer financing or credit to help propel its equipment.

Large VKS orders and domestically-driven efforts to revitalize Mikoyan will be essential to the MiG-35’s success on the market. There are very few platforms that have succeeded in the market without a domestic anchor to build scale and to guarantee production over the long-term. Unfortunately, analysts are not entirely convinced that the VKS will follow through on its intent to procure many MiG-35s.

The only alternative course is to find a large buyer, such as India or a MENA state, to instigate interest in the platform. India played an essential role in driving momentum to the Sukhoi Su-30, but with the Indian Air Force (IAF) and Indian Navy (IN) heavily tilting towards Western platforms, the MiG-35 is far from securing ground in India. MENA is plausible, especially with Egypt ordering 50 MiG-29M/M2 (or MiG-35), though the Gulf Arab states (and Morocco) have issued orders to Dassault, Leonardo, BAE Systems, Boeing and Lockheed Martin. Algeria has preferred Sukhoi.

The challenges notwithstanding, the MiG-35, technically at least, is a compelling solution. Assuming that the unit-price does not stray much further from the USD $40-45 million of the MiG-29M/M2, the platform should draw considerable interest from current MiG-29 users, which have a dearth of readily available next-generation options on the market. Translating this interest into sales is another matter however, and that will depend on Russia’s fiscal strength, Mikoyan’s reliability, and China’s responsiveness on the market.